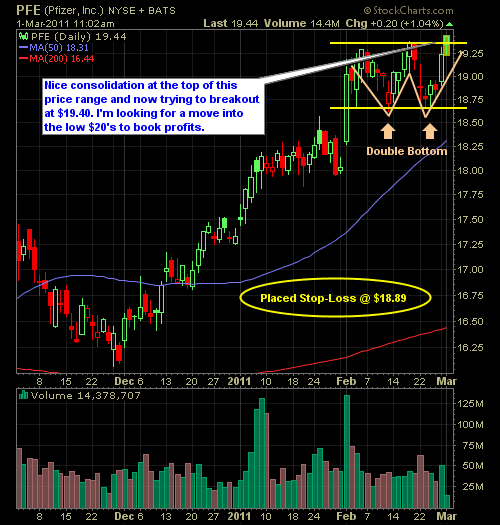

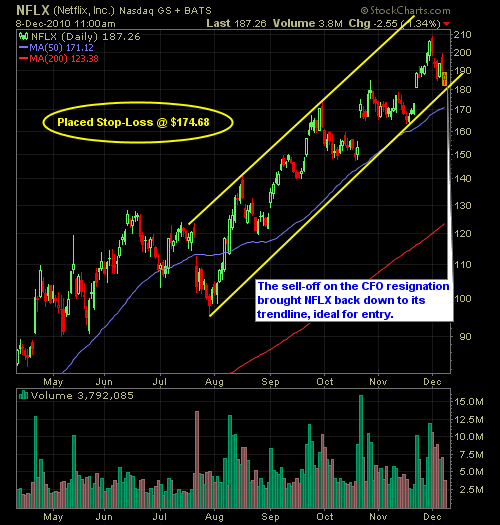

Only one trade so far, and I took it in Pfizer (PFE). But I am looking at a few others that are very intriguing – Netflix (NFLX) is one of them, with it currently testing the 50-day moving average, it could see a sizable bounce. Here’s the chart analysis and setup on PFE.

Current Long Positions (stop-losses in parentheses): BGCP (8.69), NFLX (205.35), SRZ (8.73), TSL (28.55) Current Short Positions (stop-losses in parentheses): None BIAS: 100% Cash Economic Reports Due Out (Times are EST): Personal Income and Outlays (8:30am), Chicago PMI (9:45am), Pending Home Sales Index (10am), Farm Prices (3pm) My Observations and What to Expect:

Current Long Positions (stop-losses in parentheses): BGCP (8.69), NFLX (205.35), SRZ (8.73), TSL (28.55) Current Short Positions (stop-losses in parentheses): None BIAS: 25% Long Economic Reports Due Out (Times are EST): GDP (8:30am), Consumer Sentiment (9:55am) My Observations and What to Expect: Futures are up very strong ahead of the market open. Asian

Every year millions of people are making New Years resolutions and most of them are not even kept beyond the first week. For traders, resolutions are very important, or at least the establishing of new goals and expectations of one’s self in lieu of the trading year ahead This vastly important to the improvement and

Current Long Positions (stop-losses in parentheses): VMW (84.50), APOG (12.18), BIDU (105.80), ESV (48.75), CX (9.56), NFLX (179.67) Current Short Positions (stop-losses in parentheses): DTV (40.50) BIAS: 21% Long Economic Reports Due Out (Times are EST): International Trade (8:30am), Import and Export Prices (8:30am), Consumer Sentiment (9:55am), Treasury Budget (2pm) My Observations

Current Long Positions (stop-losses in parentheses): VMW (84.50), APOG (12.18), BIDU (105.80), ESV (48.75), CX (9.56), NFLX (179.67) Current Short Positions (stop-losses in parentheses): DTV (40.50) BIAS: 36% Long Economic Reports Due Out (Times are EST): Jobless Claims (8:30am), Wholesale Trade (10am), EIA Natural Gas Report (10:30am) My Observations and What to

Current Long Positions (stop-losses in parentheses): TICC (10.28), NFLX (172.58), MCD (77.74), BIDU (111.99), SPY (119.90), CTXS (64.13), MENT (11.08), MON (61.20), GS (160.40), HRS (44.99), HTZ (11.78), KR (22.36) Current Short Positions (stop-losses in parentheses): None BIAS: 73% Long Economic Reports Due Out (Times are EST): Retail Sales (8:30am), Empire State Manufacturing

Current Long Positions (stop-losses in parentheses): TICC (10.28), NFLX (172.58), MCD (77.74), FLIR (28.18), BIDU (111.99), SPY (119.90), CTXS (64.13), MENT (11.08), MON (61.20) Current Short Positions (stop-losses in parentheses): None BIAS: 73% Long Economic Reports Due Out (Times are EST): Consumer Sentiment (9:55am) My Observations and What to Expect: Futures are down