Netflix (NFLX) has my attention this morning – using Fibonacci support/retracement levels, dating back to the beginning of the rally back in July ’07, with it peaking four years later in July ’11, you’ll see that it has pulled back PERFECTLY to the 61.8% retracement level at $126 and has bounced. In fact, yesterday, when the market was

Current Long Positions (stop-losses in parentheses): QCOM Oct 60 Calls, AAPL Sept 420 Calls, SPY Sept 124 Calls, IR (31.32)

Today has been anything but boring as we have seen the market deal with two huge pieces of news in GDP and Bernanke's Jackson Hole Speech, and traders and investors have been taken on a wild, roller-coaster ride as a result. Surprisingly, the market is rallying on Bernanke's no-news event (or is it?) and trading

Current Long Positions (stop-losses in parentheses): QCOM Oct 60 Calls, AAPL Sept 420 Calls, SPY Sept 124 Calls, DZZ (3.79), NFLX (202.99)

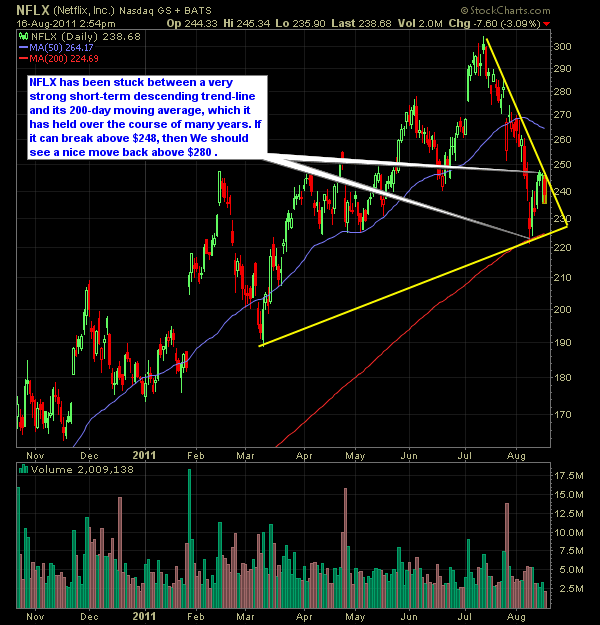

Netflix (NFLX) has been in a consistent downturn ever since it peaked at $304/share on news of it increasing its monthly subscription fees by 60%. Since then it has been beating its head against, a nasty downward trend-line off of those highs. But now it seems to have found some comfort at the 200-day moving

Wild couple of weeks, and when price seems to be dropping day-after-day-after-day with no bounces in sight, it can be very difficult on both the long and short end of things to find ideal plays. On the long-side, you don't want to be trying to catch the falling knife, while on the other hand, you

Current Long Positions (stop-losses in parentheses): PEP (70.10), NFLX (237.25), GLD (144.73), ANV (34.25), FDO (53.28), SLB (82.77) Current Short Positions (stop-losses in parentheses): None BIAS: 10% Long Economic Reports Due Out (Times are EST): GDP (8:30am), Jobless Claims (8:30am), Corporate Profits (8:30am), EIA Natural Gas Report (10:30am) My Observations and

After taking profits in all my positions except for Family Dollar (FDO), which included NFLX (+5.3%), GLD (+0.6%), ANV (+1.9%), and CMI (+3.2%), I decided to get into Schlumberger (SLB) at $84.17. I like the trade a lot and has the potential to make a run to $88 in the very

After taking profits in all my positions except for Family Dollar (FDO), which included NFLX (+5.3%), GLD (+0.6%), ANV (+1.9%), and CMI (+3.2%), I decided to get into Schlumberger (SLB) at $84.17. I like the trade a lot and has the potential to make a run to $88 in the very

Current Long Positions (stop-losses in parentheses): PEP (70.10), PCLN (502.75), SLV (33.36), NFLX (237.25), GLD (144.73), ANV (34.25), FDO (53.28) Current Short Positions (stop-losses in parentheses): None BIAS: 50% Long Economic Reports Due Out (Times are EST): MBA Purchase Applications (7am), Durable Goods Orders (8:30am), FHFA House Price Index (10am), EIA Petroleum Status