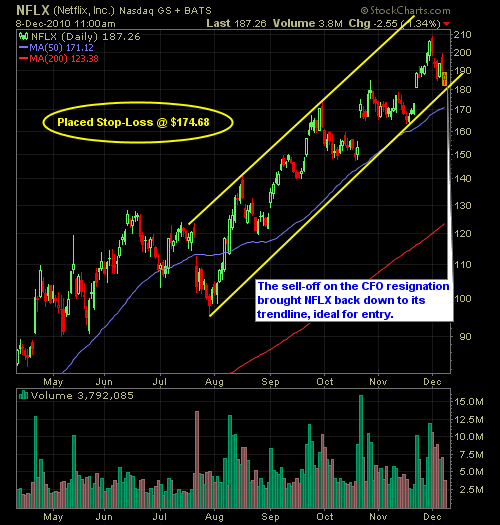

Current Long Positions (stop-losses in parentheses): TICC (10.28), NFLX (172.58), MCD (77.74), BIDU (111.99), SPY (119.90), CTXS (64.13), MENT (11.08), MON (61.20), GS (160.40), HRS (44.99), HTZ (11.78), KR (22.36) Current Short Positions (stop-losses in parentheses): None BIAS: 73% Long Economic Reports Due Out (Times are EST): Retail Sales (8:30am), Empire State Manufacturing

Current Long Positions (stop-losses in parentheses): TICC (10.28), NFLX (172.58), MCD (77.74), FLIR (28.18), BIDU (111.99), SPY (119.90), CTXS (64.13), MENT (11.08), MON (61.20) Current Short Positions (stop-losses in parentheses): None BIAS: 73% Long Economic Reports Due Out (Times are EST): Consumer Sentiment (9:55am) My Observations and What to Expect: Futures are down

Current Long Positions (stop-losses in parentheses): TICC (10.28), NFLX (172.58), MCD (77.74), FLIR (28.18), BIDU (107.15), SPY (119.90), CTXS (63.20) Current Short Positions (stop-losses in parentheses): None BIAS: 68% Long Economic Reports Due Out (Times are EST): None – Veterans Day My Observations and What to Expect: Futures are trading with moderate weakness

Current Long Positions (stop-losses in parentheses): TICC (10.28), NFLX (165.00), MCD (76.92), QID (11.92), FLIR (27.19) Current Short Positions (stop-losses in parentheses): None BIAS: 33% Long Economic Reports Due Out (Times are EST): MBA Purchase Applications (7am), International Trade (8:30am), Jobless Claims (8:30am), Import and Export Prices (8:30am), EIA Natural Gas Report (10:30am), EIA Petroleum

Current Long Positions (stop-losses in parentheses): TICC (10.28), NFLX (165.00), MCD (76.92), QID (11.92) Current Short Positions (stop-losses in parentheses): SBUX (31.37) BIAS: 7% Long (-10% short considering the leverage in QID) Economic Reports Due Out (Times are EST): ICSC-Goldman Store Sales (7:45am), Redbook (8:55am), Wholesale Trade (10am) My Observations and What to

Current Long Positions (stop-losses in parentheses): TICC (10.21), NFLX (165.00), MCD (76.92), QID (11.92) Current Short Positions (stop-losses in parentheses): SBUX (31.37) BIAS: 4% Short (-20% short considering the leverage in QID) Economic Reports Due Out (Times are EST): None My Observations and What to Expect: Futures are showing some weakness Asian markets

Current Long Positions (stop-losses in parentheses): TICC (9.97), SNDK (36.59), AMZN (161.90), JACK (23.16), GHL (75.95), NFLX (165.00), MCD (76.92), QID (11.92) Current Short Positions (stop-losses in parentheses): None BIAS: 6% Long (-10% short considering the leverage in QID) Economic Reports Due Out (Times are EST): Employment Situation (8:30am), Pending Home Sales Index

Current Long Positions (stop-losses in parentheses): TICC (9.62), GLD (130.99), SSO (42.57), SNDK (36.59), AMZN (161.90), JACK (23.16), GHL (75.95), NFLX (165.00) Current Short Positions (stop-losses in parentheses): None BIAS: 53% Long Economic Reports Due Out (Times are EST): Monster Employment Index (6am), Jobless Claims (8:30am), Productivity and Costs (8:30am), EIA Natural Gas

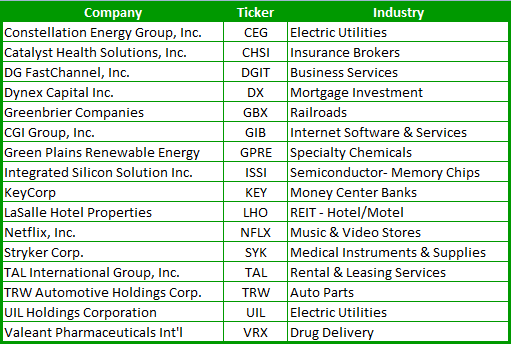

By far one of my best screens in determining who is buying what on the street! What you will find are those stocks that, among other variables that I use, 1) Gaining an increased amount of coverage by brokerage firms and analysts, and 2) Being upgraded on a regular basis. This is a good screen to