Possible that $FSLR breaks out of that base here. Very volatile and wild stock for swing trading at times. . $SPY attempting to set the stage for an end of day rally with this inverse head and shoulders forming. $CMC solid bounce off of the trend-line, with potential room to run up to resistance at

Chevron (CVX)Analysis 1) Short-term support broken, setting up for a retest of long-term trend-line. 2) Declining trend-line above creating lower-highs. 3) Short-term trend-line also broken. First Solar (FSLR) declining channel remains perfectly intact and seeing a hard rejection off the upper channel band today. Apple (AAPL) starting the week by pressing up against declining resistance.

Strong move out of $SNAP today, but needs to clear year-long resistance in order to breakout and fill the gap to $15. Not a lot of support underneath on $CVNA, so I would be taking this sell-off serious, and looking for a potential landing spot in the low-to-mid-$18's. $BTC.X clearing major resistance on strong volume.

$NVDA attempting to the rising trend-line from the January lows and bounce and back to new recent highs.

Resistance to watch on $NKE ahead of their earnings this afternoon.

$FSLR broke the head and shoulder neckline. Strong potential for an extended move downward from here.

Keep an eye on $FSLR and this developing head and shoulders pattern. Not confirmed, but getting close.

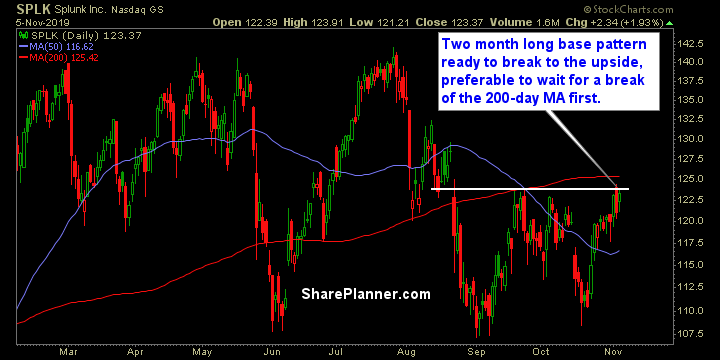

Wednesday’s Swing-Trades: $SPLK $HFC $FSLR Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Splunk (SPLK)

Wednesday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long Splunk (SPLK)

My Swing Trading Approach Still long on the market. I dabbled to the short side some yesterday, it didn’t work. Now that is out of my system, I remain long and will look to add 1-2 new positions today on market strength. Indicators