Current Long Positions (stop-losses in parentheses): GOOG (524.00), NFLX June 270 Calls, DF (10.48), NVDA (18.73), BKI (26.35), ADM (35.58) Current Short Positions (stop-losses in parentheses): None BIAS: 11% Long Economic Reports Due Out (Times are EST): Motor Vehicle Sales, ICSC-Goldman Store Sales (7:45am), Redbook (8:55am), Factory Orders (10am) My Observations

Current Long Positions (stop-losses in parentheses): GOOG (524.00), ADI (38.99), CA (24.09), NFLX June 270 Calls, DF (10.48), NVDA (18.73), BKI (26.35), ADM (35.58) Current Short Positions (stop-losses in parentheses): None BIAS: 44% Long Economic Reports Due Out (Times are EST): ISM Manufacturing Index (10am), Construction Spending (10am) My Observations and

Current Long Positions (stop-losses in parentheses): GOOG (524.00), ADI (38.99), CA (24.09), UNP (97.45), NFLX June 270 Calls, JNY (14.45), AMAT (15.49), DF (10.48), NVDA (18.73) Current Short Positions (stop-losses in parentheses): None BIAS: 48% Long Economic Reports Due Out (Times are EST): Personal Income and Outlays (8:30am), Employment Cost Index

Current Long Positions (stop-losses in parentheses): HRB (17.39), GOOG (524.00), ADI (38.99), CA (24.09), UNP (97.45), NFLX June 270 Calls, JNY (14.45), AMAT (15.49) Current Short Positions (stop-losses in parentheses): None BIAS: 62% Long Economic Reports Due Out (Times are EST): GDP (8:30am), Jobless Claims (8:30am), Pending Home Sales (10am), EIA

Current Long Positions (stop-losses in parentheses): DISCK (36.79), RAX (43.46), HRB (17.39), GOOG (522.00), ADI (38.99), CA (23.95), UNP (95.45), NFLX June 270 Calls. Current Short Positions (stop-losses in parentheses): None BIAS: 51% Long Economic Reports Due Out (Times are EST): MBA Purchase Applications (7am), Durable Goods Orders (8:30am), EIA Petroleum Status

It's been hard to find good long setups since Friday, and a lot of the past couple days' activity felt like a mass headfake. I went into 100% cash this morning and sat out the rest of the day. This past evening, I perused through about 200 of my closest charts, looking for easy-to-spot long setups.

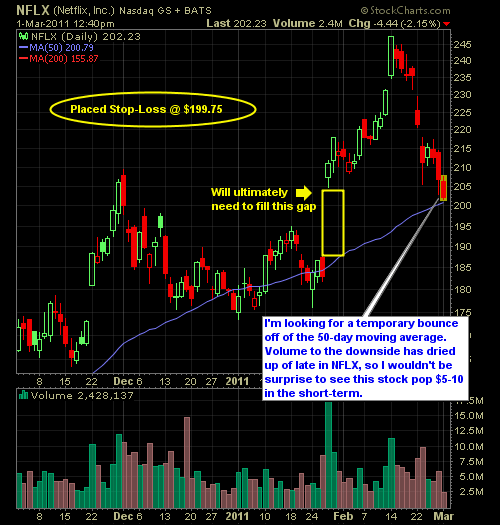

Current Long Positions (stop-losses in parentheses): CPWR (10.90), TICC (11.90), NFLX (199.75), PFE (18.89), PGH (12.65), SCO (43.99) Current Short Positions (stop-losses in parentheses): None BIAS: 28% Long Economic Reports Due Out (Times are EST): Employment Situation (8:30am), Factory Orders (10am), Treasury Strips (3pm) My Observations and What to Expect: Futures are flat

Current Long Positions (stop-losses in parentheses): CPWR (10.90), TICC (11.90), NFLX (199.75), PFE (18.89), PGH (12.65), SCO (43.99) Current Short Positions (stop-losses in parentheses): None BIAS: 45% Long Economic Reports Due Out (Times are EST): Monster Employment Index (6am), Jobless Claims (8:30am), Productivity and Costs (8:30am), ISM Non-Manufacturing Index (10am), EIA Natural Gas Report

spc 3325355 Date and Time: 3/2/2011 8:16:21 AM Machine Name: SHAREPLANNER IP Address: 192.168.2.3 Current User: SharePlanner\Ryan Operating System: Windows Vista IE Version: 8.0.7600.16385 Application Domain: stockFinderApp.exe Assembly Codebase:

I jumped in NFLX this morning at $203.94, but not surprisingly am a tad-bit underwater with the recent downturn we saw shortly thereafter in the broader markets. However, the 50-day moving average so far has held its own and if it this market can manage even a slight turnaround, we should see a descent