I posted the chart earlier in our chat-room real-time as I took the trade, and mentioned it in the 7 Stocks Flying Under The Radar post from this morning as well before taking this trade, but I have to say, that Tutor Perini (TPC) is looking like a stud so far. I have no clue as

I don’t know what it is with me and my love/hate relationship I have with Netflix (NFLX). I’ve had some of my best trades come from it, but then there was the chance that I had to add it to my long-term account 5 or 6 years ago when it was in its $20’s

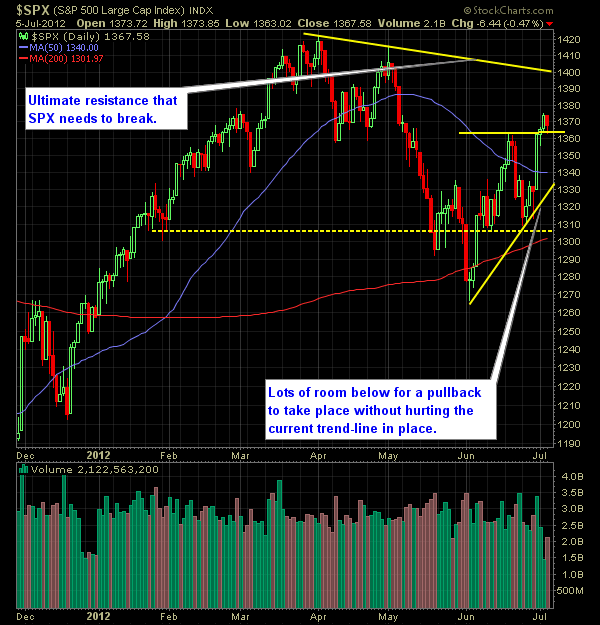

Pre-market upadate (updated 9:00am eastern): European markets are -0.8% lower. Asian markets traded -0.4% lower. US Markets are nearly 1% lower ahead of the opening bell. Economic reports due out (all times are eastern): Employment Situation (8:30am), EIA Natural Gas Report (10:30am) Technical Outlook (SPX): Yesterday’s pullback was light, and without any sense of

Since the market opened this morning, I’ve been able to post some incredible gains in my long positions in CMG, NFLX, UA and HD. I actually sold a bit early in Netflix (NFLX) at $77.68 from $70 due partly to my incredible distrust of the stock – only to see it march

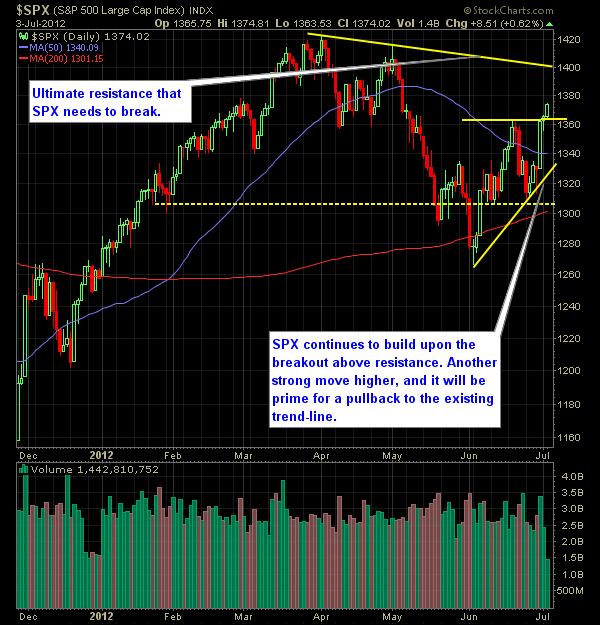

Pre-market upadate (9:00am eastern): European markets are trading flat. Asian markets traded mixed/flat. US Markets are looking at a slightly negative open. Economic reports due out (all times are eastern): MBA Purchase Applications (7am), Challenger Job-Cut Report (7:30am), ADP Employment Report (8:15am), Jobless Claims (8:30am), ISM Non-Manufacturing Index (10am), EIA Natural Gas Report (10:30am), Technical Outlook

I've gotta say, that I am somewhat surprised by the fact the market is moving this morning - albeit a little over 5 points, but honestly I thought it would be a total snoozer today. I've taken the opportunity to add Home Depot (HD) at $51.50 and Netflix (NFLX) at $70 flat. What's funny is that

I don’t typically dive into the fundamentals when deciding whether to take a trade, and rarely do I post this kind of stuff on SharePlanner. But nonetheless, I felt like it was necessary today, considering we are just a half hour away from its IPO launch and there is more hype behind this stock than

Last year I came up with a list of resolutions that would be meaningless if I didn’t review them in the new year and see how I did keeping to them. There were some definite hits and misses, so lets review: 1. Do a better job of keeping winners from turning into losers. I would say

Bank of America (BAC), like Netflix (NFLX), has been one of the year’s most talked about stocks. Before 2008, it would have been hard to believe we’d have a market that put BAC in $5 territory (or $2.50 back in 2009), but such has been the case of late. You have tons of rumors

It’s probably one of the biggest stories among individual stocks for 2011. A company that was breaking through $300 and on its way to $400, gets too comfortable in its own shoes, and instead of continuing to satisfy its existing customers and provide new and improved features, the CEO and his minions, out of the