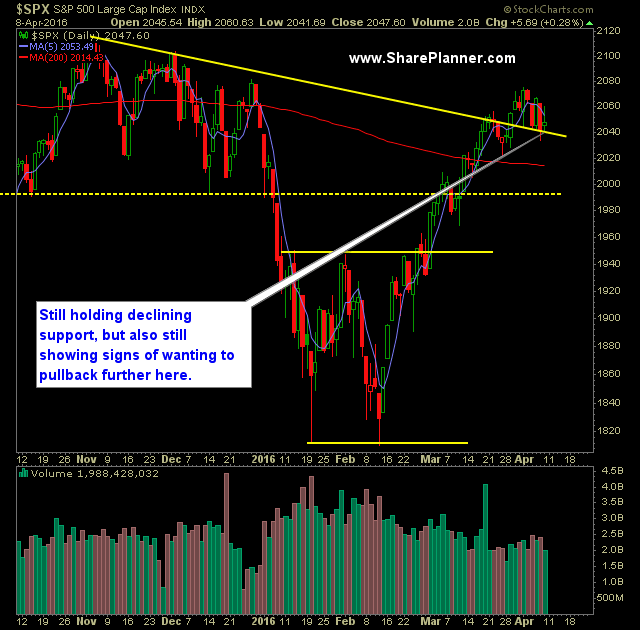

Technical Outlook:

- SPX gave up all of its intraday gains yesterday after a strong gap up.

- Nonetheless, it managed to close slightly higher an in the process hold on to its 20-day moving average.

- An interesting development on the daily chart of SPX is the downside cross of the 5-day and 10-day moving averages.

- Four previous occasions where this has happened, has resulted in sizable sell-offs in the broader market.

- SPY volume fell off a bit on Friday.

- The last four days have alternated down/up and has been very choppy overall. with three moves in excess of 1%.

- Be skeptical of any gap higher or lower in this market. Of late they have been great fading opportunities.

- VIX still off its lows, and showing signs it wants to break out of the base it has been in of late.

- T2108 (% of stocks trading above their 40-day moving average) still showing signs of rolling over despite its 4.5% bounce on Friday, taking it to 75%.

- Q1 earnings kicks off after the bell today with Alcoa.

- Oil has been on a solid bounce over the past few days wiping out about half of its recent losses since the highs of March were formed.

- SPX 30 minute chart still looks highly distributive and like it wants to roll over here.

- Overnight futures were down for the most part, until a random rally took price action on /ES about 1% higher off of its lows.

- Head and shoulders pattern on the 30-minute chart confirmed and is attempting to play out to the downside. The strength of today’s bounce will determine whether it can be sustained.

- 2100 on the S&P 500 remains the key price level to watch – its the declining trend-line off of the July highs.

- Two key price levels to watch today – 1) The Friday lows from last week. 2) The lows from March 24th. Particularly, if the latter should break, it would put in a lower-low into the downtrend.

- Between 2040 and the all-time highs the price action is very congested with plenty of resistance.

- April has been bullish in nine of the last ten years.

- Yellen’s dovish outlook as it pertains to rate hikes has been, in large part, the reason for the massive rally off of the February lows.

My Trades:

- Added one new swing-trade on Friday.

- Did not close out any swing-trades on Friday.

- Currently 10% Long / 20% Short / 70% Cash

- Remain long TLT at $129.52, SPXU at $29.07 (an ETF short play).

- Will look to add short or long exposure here today depending on the direction the market decides to take.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone