Nasdaq selling off again, SPX flat The technology purge looks to resume again this morning, while most of the overnight gains have been lost by the large caps. This market is becoming a bit less predictable in the latter half of this month. yesterday's bounce looked reminiscent of the bounce following the May 17th sell-off,

Buy Machines Continue to Bounce following One Day Sell-offs If the premarket is any sign of what looms for the market today, it will be yet another hard bounce following a one-day sell-off.

Stocks and Indices continue to trend sideways Outside the first trading day of the month, the market has absolutely gone nowhere. Stock trends in general have been totally sideways or in more technical terms, “consolidating”.

Prepare for the funds to start window dressing their quarterly and 6 month reports This is one of those points in the year, where the funds become very concerned by their performance. So much so, that they’ll start what is commonly known as ‘window-dressing’ their portfolios with all the right stocks so that they can

It was another great May swing trading performance in the stock market for members of the Trading Block As you know by now, I am a huge proponent about swing trading transparency when it comes to my stock market performance. There are so few traders out there that actually show their results, much less go

The latest episode of “wild ramps” at market close, saw 10 straight 5 min red bars. The S&P 500 and the market as a whole was holding steady for the entire trading session until about 40 minutes remained and then that is when we saw another example of how wild ramps into the close can

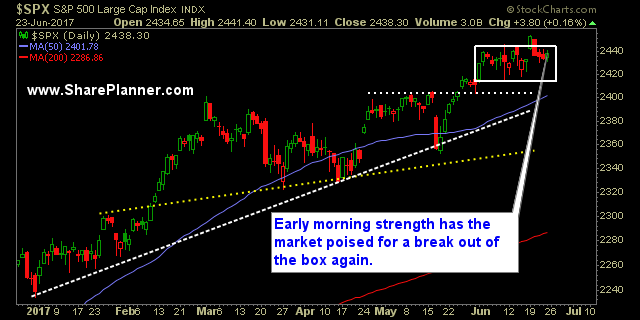

On Monday, it looked like the market was prime for a breakout in trading Since then it has only resulted in a head fake kind of maneuver. I'm glad to be back after a short summer vacation over the last week. But when it comes to trading, there isn't much time off, so while I

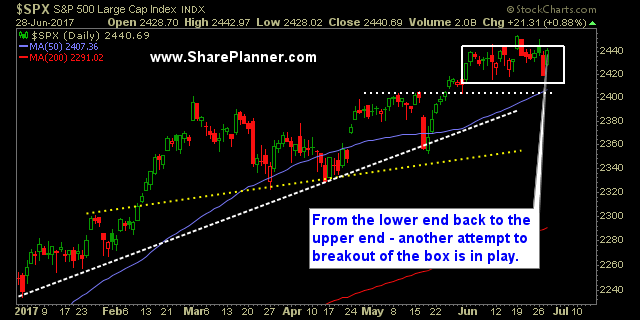

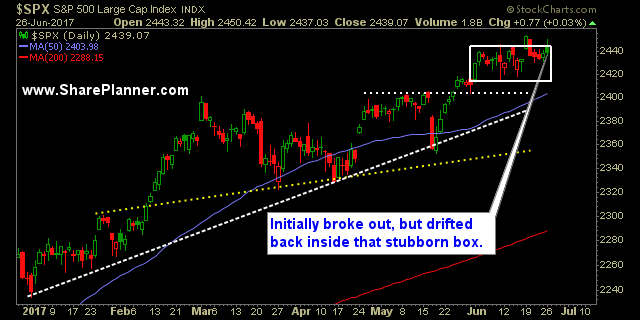

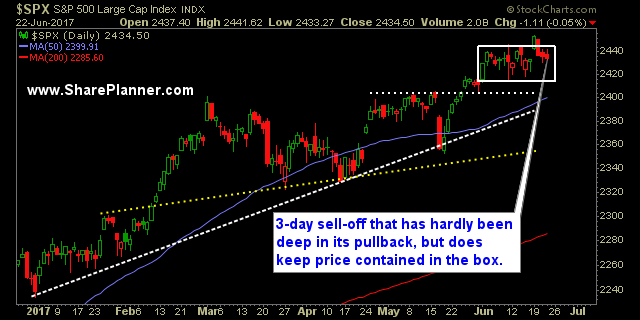

The famous Darvas Box Breakout setup is back at it again. But trading Darvas’ box breakout doesn’t mean you ignore the downside risk either, because if the market breaks down and out of the box, it becomes just as legitimate of a trade setup as the breakout would be.

Current Megaphone Price Pattern Starting to Favor Bulls The bears are letting yet another opportunity to correct this market slip through their hands. It is quite astounding really. I mean, you have a solid opportunity with last Friday's sell-off to put the bulls against the ropes, and they do, but along the way, they let

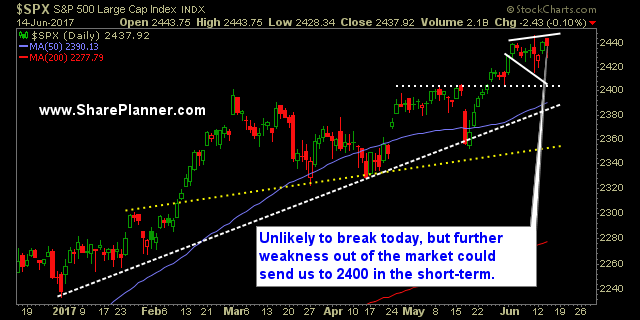

‘Hawkish Rate-Hike’ Gets the market in a tizzy But lets not kid ourselves, all this talk about a ‘hawkish rate hike’, whatever that means, probably gives the bulls another opportunity to by the dip. If the bears can pull it together today, it could be a very nice for their short positions. But it is