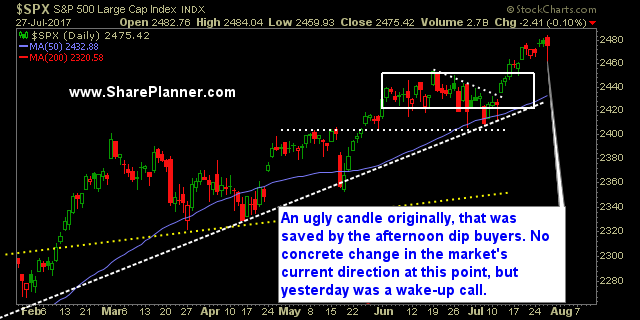

My Swing Trading Approach I plan to play it cool today. Right now, I have one short position as I exited my long positions yesterday. I could get heavily long on this dip, but I need to see some evidence out of this market that the lows from yesterday want to hold into today.

I thought I’d shake things up a bit, and redesign the daily trading plan. Honestly, I became a bit bored by how I was doing it before. And if I’m getting bored with it, you probably are to. So lets fix that with what I’ve put together to replace it: The Swing Trading Strategy Report.

Yesterday’s rally didn’t quite seem there was a great deal of conviction behind it. Perhaps with the Fed set to release its FOMC Statement today, we’ll get the market to provide us with a decent size move. Over the past four trading sessions, the market has been rather quiet.

3 days of selling of less than one point per day That is what SPX has averaged over the course of the last three days when it finished lower each day - less than one measily point. For the bears that has to be infuriating. I don't blame them - I would be too, if

I'm not a big fan of streaks when it comes to stocks I mean it is nice while it lasts, but like any financial instrument that is rallying, eventually there needs to be a pullback and on Friday you got one with a whopping 0.04% pullback on the Nasdaq. How amazing, right? That is the

June saw continued success for traders in the Trading Block. I was quite satisfied with my swing trading results, especially when you consider just how mundane the overall market was. There was plenty of ‘back-and-forth in the stock market.

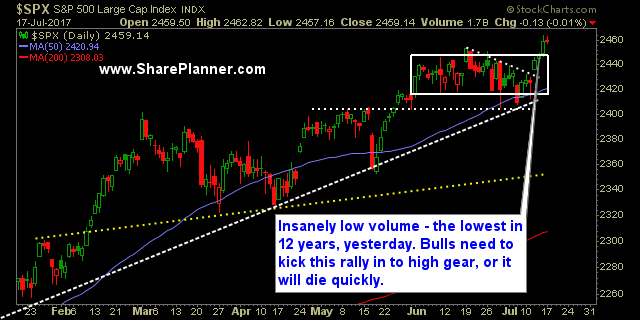

Support holding strong, dip-buyers still flying in at any moment of weakness. Yesterday was a sound day for the bulls from a technical standpoint. For one, the S&P 500, by a large margin, saw a huge uptick in volume from the day before. Which is good, because I kind of thought the market was dying

What was that yesterday? Where was the volume? That had to be one of the least interesting trading days in my entire trading career. I mean, it was horrible, miserable – and outright boring.

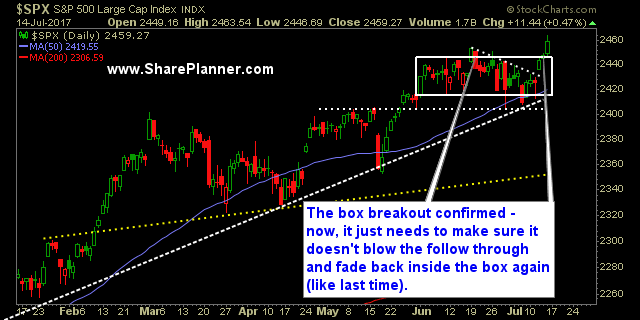

All time highs without a worry in this world. It really is impressive how the market will rebound every time from even the smallest of sell-offs to hit new all-time highs, time and time again. There is a lot of risk out there – tons of it. Despite all the horrible headlines that could readily