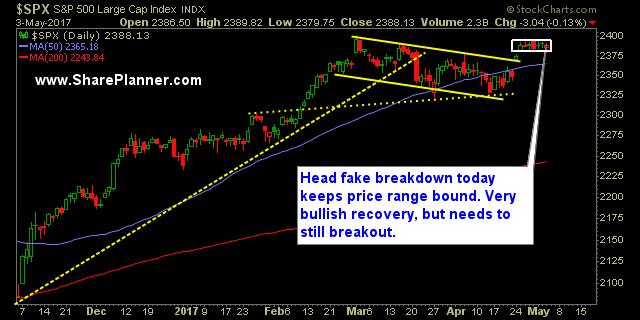

It could be a confusing day for the bulls and bears as they deal with head fakes and traps of all types Strong day out of the market yesterday but what does it really mean for the market today and the days ahead. Should we expect to seek the bulls get head faked once again

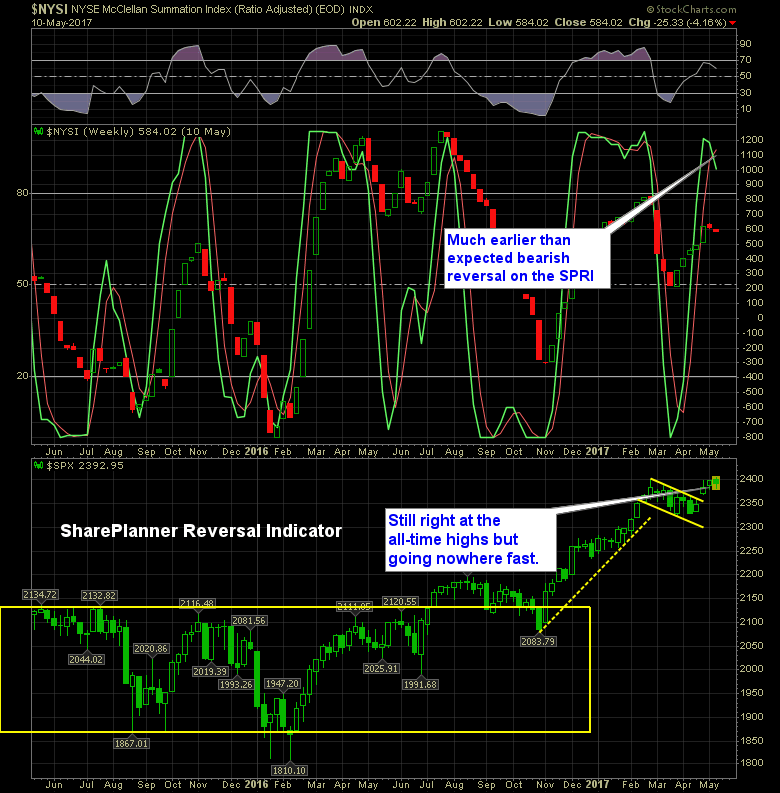

Bearish Divergences Warrants Caution You could have skipped the last three weeks of trading and you would have come back to a market that is virtually unchanged. It hasn’t moved, it hasn’t gone anywhere, and Friday’s price action exemplified that with another light volume trading session. VIX spent most of the week below 10,

Let’s check in on this whole volatility matter The story, from a technical standpoint, this week, was the fact that the Volatility Index (VIX) had dropped below the 10 level and was at one of the lowest readings of all-time. Then of course the comparisons between 20007 and 2017 and the fact that 2007

I feel like, honestly, the expression “Going nowhere fast” is creeping into every one of my posts these days. In reality, that is the state of the market. Market sells off hard and fast this morning, but by afternoon, it has managed to rally back to near break even. Prior to today, SPX had

What does this calm before the storm mean for the stock market? Everyone keeps talking about how right now in the stock market, you have a very similar “calm before the storm” trading atmosphere to that of 2007. Personally, I think it is a bunch of hogwash. What happened the following year in 2008 was

Market Not as Skittish About International Conflict Of late, I have noticed that the ties between the political fanfare and the stock market is becoming less and less. Until late, anytime Trump tweeted about anything that had the slightest connection to the stock market, the stock and/or industry it was associated with, woudl have a

The Wall of Worry The market isn’t giving us those warm, wholesome feelings, but that is what climbing the wall of worry is all about. Everyone is paranoid, traders with a concept of risk, are looking over their should the whole time, wondering when is this thing going to end. Meanwhile, others can’t take it

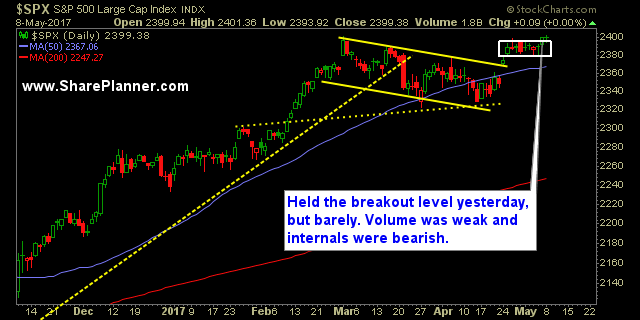

Show some follow through Friday’s move was quite subtle but very strong as well. What started off as a day trading sideways like each of the days of the past eight trading sessions, changed its tune in the afternoon and broke out of the short-term price range and rallied to new all time highs by

The Fourth is Strong with this Market For a moment there, just a moment, it looked like the market was going to lose its marbles and actually experience a legitimate sell-off yesterday. But nope, it didn’t and now you have “May the Fourth” playing Jedi mind tricks on the Wall Street bears in the pre market

This stock market can’t break out of the range bound price action The price action has become very dull among the indices. In fact, this is the tightest 6-day trading range in the last 23 years. For many of you, that is before you ever started trading. Needless to say, what goes up, must come