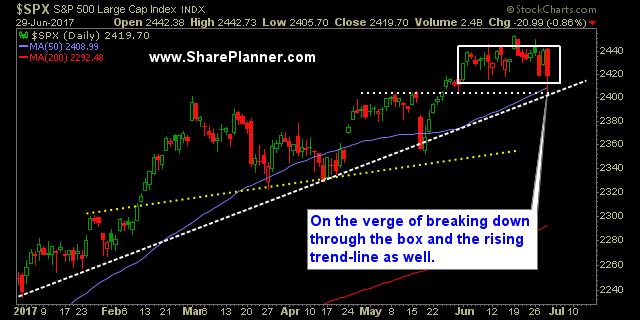

Stock market is on shaky ground

That doesn’t mean the market is simply going straight down from here – if it were only that easy.

That’s because, despite the sudden bearishness that has been prevalent throughout this week, there is still that pesky dip buying mentality of the stock market that won’t let the 8 year rally go away. That was evident on Wednesday when we had the hard bounce that wiped out all of the prior day’s downside.

But the game changer was yesterday, because it brought us the first dead cat bounce in quite some time. For those of you who don’t know what that is, it is a term for a stock market in decline that provides a relief rally, only to be sold again. That is what we had yesterday when SPX wiped out Wednesday’s rally, and much, much more.

The Volatility Index (VIX) was, at one point, up 51%, but gave up most of that to only finish 14% higher on the day.

The 50-day moving average was tested yesterday by SPX and while there was a momentary slip below it, for the most part it held, and eventually rallied to wipe almost half the day’s losses.

So today, we can see the market bounce back and continue the see-saw effect of the last four trading sessions, or get more action to the downside, and actually jump start a sustained market sell-off.

Oh, and it is quarter end today as well, just to spice things up a bit.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance:

- 2 Long Positions, 2 Short Positions

Recent Stock Trade Notables:

- Intel (INTC) Short at $35.21, covered at $34.46 for a 2.1% profit.

- Nvdia (NVDA): Long at $155.57, closed at $157.53 for a 1.3% profit.

- IBB: Long at $298.24, closed at $303.74 for a 1.8% profit.

- SPXU: Long at $15.68, closed at $15.25 for a 2.7% loss.

- Whirlpool (WHR): Long at $190.46, closed at $195.19 for a 2.5% profit.

- Ferrari (RACE): Long at $84.60, closed at $89.93 for a 6.3% profit.

- Amazon (AMZN): Long at $964.70, closed at $1001.23 for a 3.8% profit.

- American Airlines (AAL): Long at $49.18, closed at $50.62 for a 2.9% profit

- Alibaba Group (BABA): Long at $124.95, closed at $137.51 for a 10.1% profit.

- Starbucks (SBUX): Long at $61.78, closed at $63.68 for a 3.1% profit.

- Western Digital (WDC): Long at $91.24, closed at $89.29 for a 2.1% loss.

- Broadcom (AVGO): Long at $236.65, closed at $241.15 for a 2% profit.

- SPXU: Long at 16.60, closed at $16.98 for a 2.3% profit.

- JP Morgan Chase (JPM): Long at $87.84, closed at $85.98 for a 2.1% loss.

- Micron Technology (MU): Long at $29.00, closed at $28.04 for a 3.3% loss.

- Alibaba Group (BABA): Long at $116.25, closed at $124.09 for a 6.7% profit.

- Southwest Airlines (LUV): Long at $58.35, closed at 57.23 for a 1.9% loss.

- Broadcom (AVGO): Long at $223.63, closed at $228.65 for a 2.2% profit.

- Workday (WDAY): Long at 86.00, closed at 90.32 for a 5% profit.

- Univar (UNVR): Long at $30.96, closed at $32.20 for a 4% profit.

- Alibaba Group (BABA): Long at $111.91, closed at $115.48 for a 3.2% profit.

- Redhat (RHT): Long at $85.21, closed at $87.21 foor a 2.4% profit.

- Darling Ingredients (DAR): Long at $15.19, closed at $14.90 for a 1.9% loss.

- Apple (AAPL): Long at $143.82, closed at $147.11 for a 2.3% profit.

- Teradyne (TER): Long at $31.16, closed at $33.03 for a 6.0% profit.

- UPRO: Long at $92.75, closed at $94.78 for a 2.2% profit.

Sign up for Trading Block here.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.