My Swing Trading Approach Neutral portfolio until it can be determined whether the market can break through resistance at all-time highs. Indicators

My Swing Trading Approach Ahead of a weekend where there is a major hurricane hitting Florida and North Korea planning on another missile test, I don’t want to get heavy to the long side. I’ll look to keep a neutral portfolio into the weekend. Indicators

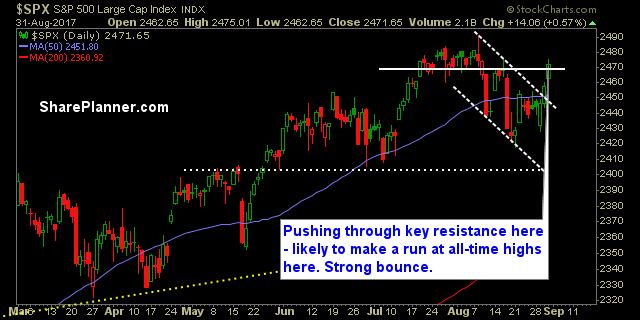

My Swing Trading Approach SPX still struggling with pushing through July resistance at the all-time highs and establishing new ones of its own. Until that area breaks, it is hard for me to be overly aggressive to the long side. Indicators

My Swing Trading Approach North Korea overnight risk creates some pause for this market and the likelihood of some kind of boiling point being reached as a result of their provocations. As a result, it is difficult to get confidently long on this market, and best practice suggests playing both sides of the trade. Indicators

My Swing Trading Approach I’m concerned about the weakness coming into today, and may curb my long exposure while adding some short exposure. Indicators

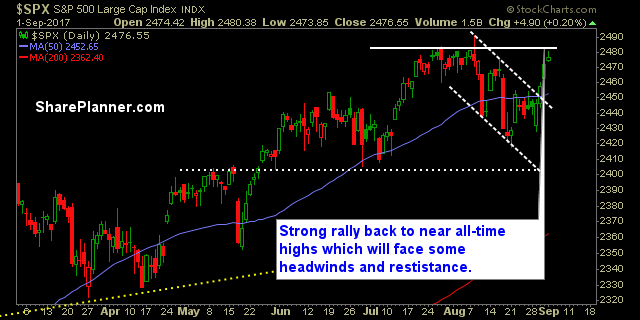

My Swing Trading Approach The bounce of late has been a hard bounce, and more than a dead cat bounce. This bounce should be respected and played. The biggest risk to consider remains North Korea. Indicators

My Swing Trading Approach Price action is becoming mre reliable for the bulls here, however, shock events still loom large on SPX with North Korea. I will look to aggresively increase my stops on my profitable positions. Indicators

My Swing Trading Approach I’m choosing to stay flexible with my portfolio with a mixture of long and short setups. I don’t have a high degree of trust in this market, so maintaining the ability to flip the portfolio folio in either direction is key here. Indicators

My Swing Trading Approach I’m short on this market and will continue to be so as the day evolves. I’ll have one eye on the bulls and whether they can buy the dip. I’ll look to add additional short positions if the market can find more traction to the downside. Indicators

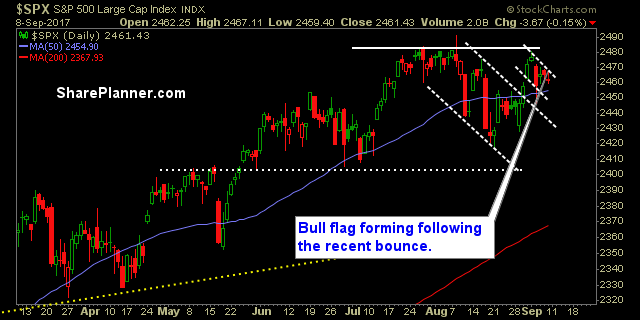

My Swing Trading Approach Keeping a slightly bearish portfolio here as the bulls continue to show the inability to rally this market thorugh key resistance levels. Though I am ready to flip to the long side if necessary. Indicators