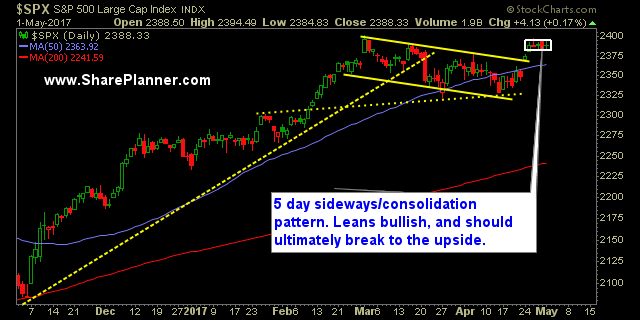

Breakout of Consolidation a Must SPX had that opportunity on Friday to really close out the month strong and breakout of that consolidation pattern that is more evident on the intraday charts than it is on the daily chart. Instead the market gave traders a gap and crap the entire day. Very little bounce and

Pulled back right before making new all-time highs It has been almost two whole months since we last established new all time highs (3/1) - which really is an eternity in today's Trump-induced market rally. Yesterday, SPX had its chance to do so, the Dow didn't even get close, and the Nasdaq had a hangover

New all time highs is the next step for the market No doubt all this talk about 15% corporate tax cuts are fueling this market run. If you have been short the last two days…my condolences. But trading is going where the market wants to take you, and not being in the backseat strapped in

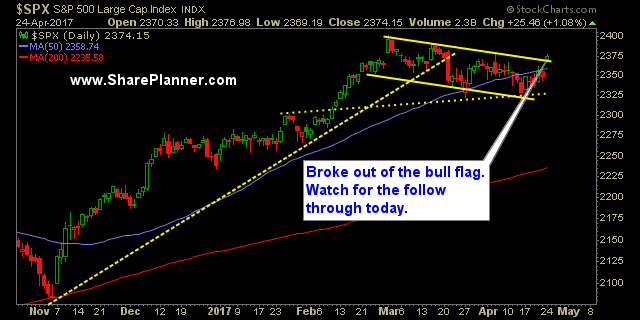

Shockingly the market didn’t sell-off the bull flag in the afternoon and maintained the breakout instead That afternoon sell off has been strong of late, but the bull flag held strong on the charts and the breakout is still in play. Should you be short right now? Not according to the charts. Yes, there is

Market breaks out of bull flag on French Election Results Not a bad way to start your week, if you are long on the market (and yes, I am long on the market). It all goes back to what I have been saying in these morning writeups, and that is, the market has been far

Watch resistance at the 50 day moving average, take two Everything looked fine and dandy yesterday for the market, and resistance at the 50-day moving average that I talked about in yesterday's trading plan, was going to be broken. But with 10 minutes to go, the bears dropped the S&P 500 5 points and, despite

Watch resistance at the 50 day moving average It had been acting as support prior to its break last week, but now the 50 day moving average has firmly converted itself into resistance overhead. Following the break last Tuesday, it has gotten close to pushing back above the 50 day moving average but each time

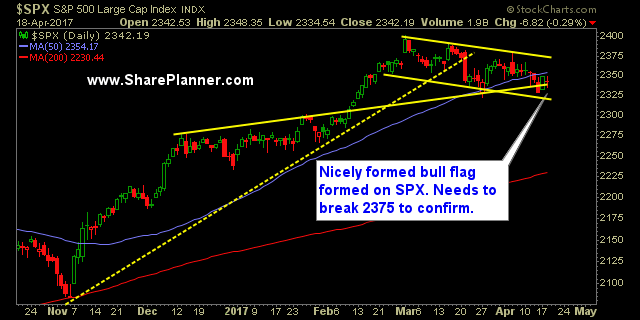

Bull flag chart pattern now in play on SPX SPX is forming a nice bull flag pattern. It doesn't feel that way, because nearly every day the market opens, it sells off. If it finishes higher on the day, it is well off the highs of the day. But back to the bull flag pattern,