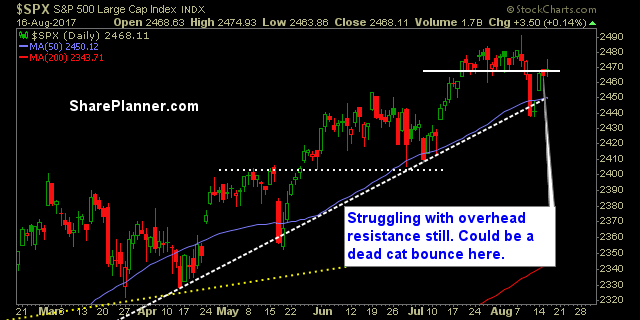

My Swing Trading Approach Slightly bearish portfolio, but ready to flip to the long side depending on how the Yellen speech at Jackson Hole goes. Indicators

My Swing Trading Approach Neutral portfolio – I’ll go the direction the market decides to take today. Indicators

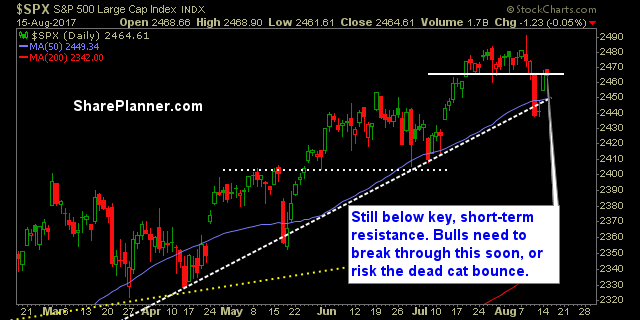

My Swing Trading Approach I’m playing both sides of the market right now, as it is becoming near impossible to put full faith in the case of the bulls or the bears. Indicators

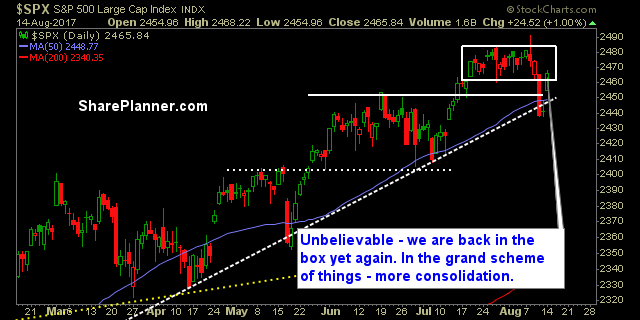

My Swing Trading Approach The bulls are putting together, in the premarket at least, the makings of a bounce. If the early morning strength can hold, and improve matters technically, I’ll be a buyer. Indicators

My Swing Trading Approach Still net short, but in there with some long exposure. I’ll need to see a move from the market today, whether up or down, to convince me to add more trades to the portfolio. Sideways price action won’t lure me into making another trade. Indicators

My Swing Trading Approach I closed out my one long position early on Tesla (TSLA) and added an additional short position before anything ran hard against. Yesterday proved to be a very profitable day, and will look to add more short positions today, if the market has more downside in the cards.

My Swing Trading Approach I booked some profits and cut my long exposure yesterday, while adding a short position and making my portfolio “neutral”. I’ll add more short positions today if the current pre-market weakness persists.

My Swing Trading Approach Playing it cautious for now, as I am willing to get short again if this bounce dies out. Maintaining my long positions for now.

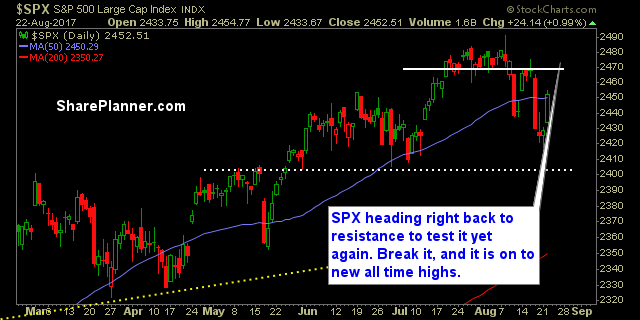

My Swing Trading Approach Shorts look like the outcast yet again. The bounce yesterday and the pre-market one today, makes the long setups the only relevant trades to consider.

My Swing Trading Approach Futures are up. I like my short positions that I have, I don’t trust the bounce one bit, so I’ll likely move to neutralize my portfolio bias, with additional longs, if the bulls decide to run with this today.