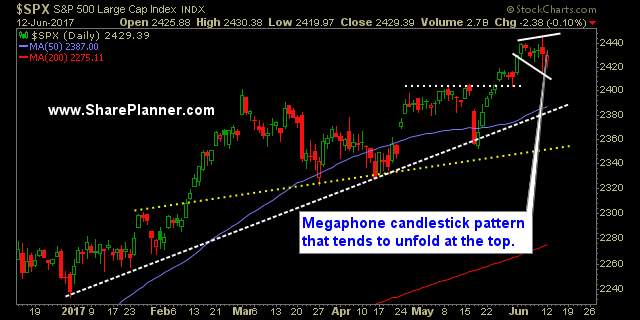

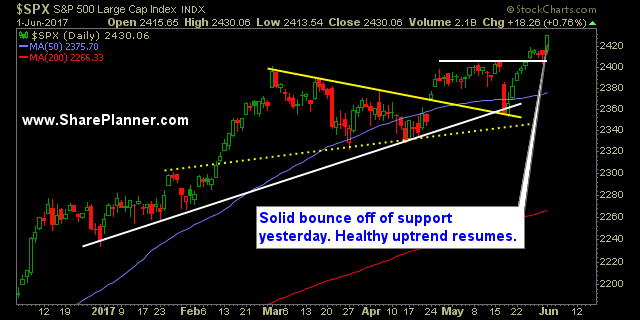

Megaphone trading pattern being tested by the dip buyers Of course, you get the feint scent of a sell-off or down day of any kind in the stock market, the bulls will buy the dip as fast as they possibly can, which makes trading patterns like the megaphone, difficult to realize its full potential. That

Short-term bearish megaphone pattern showing itself. Much of it comes from the fact that Friday’s crazy doji pattern has created this megaphone pattern, but nothing happened today to change the look of it either.

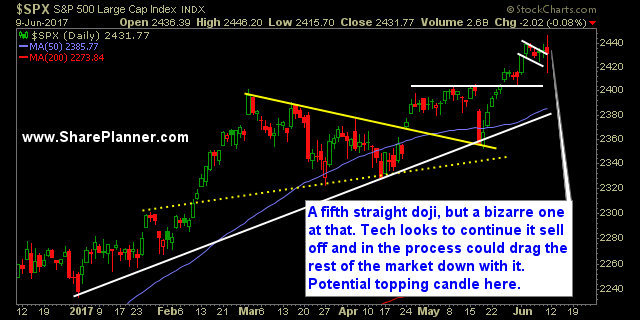

Inflection point: Let tech bust here or buy the dip once again. That is the choice the market has because what we saw on Friday with everything tech related being sold in a frenzy, made it seem like that suddenly, no one wanted to be in anything Nasdaq or tech related. Heck, did you

James Comey done talking, Dodd-Frank Repealed in House, and Bristish Snap Election Surprise Only the James Comey hearing seemed to matter to the talking heads today, but key Dodd Frank regulations being repealed by the House, and Theresa May possibly being ousted after surprise gains by the Labour party crippled her majority. Futures have been busy

Comey and the markets collide Ultimately, I don’t expect much from this testimony. Comey prepared with the special counsel, Robert Mueller. For one, I don’t think he wants Comey’s testimony blowing up his investigation, and much of what could hurt Trump is already out there in the remarks yesterday. Politics aside, the market is only

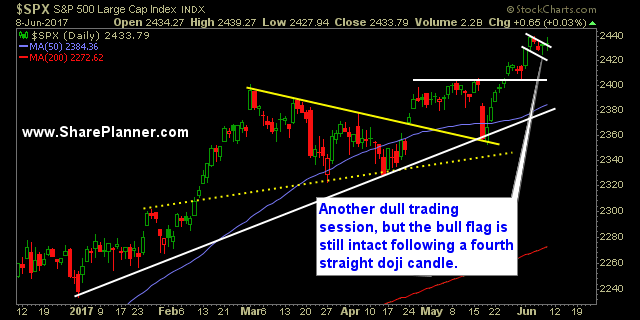

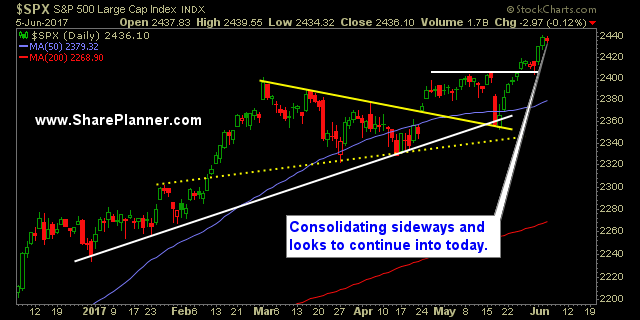

The ugly sideways price action is likely to persist I think that we are likely to see more of the same price behaviors yet again today. Yesterday’s price action started off typical, open lower, and then spend the rest of the day rallying back towards break even on the day.

Barely a sell-off yesterday, market cooling off now When you can get a 3 point sell-off these days on the S&P 500, you might want to consider it a generational buying opportunity as stocks rarely do anything but go up these days.

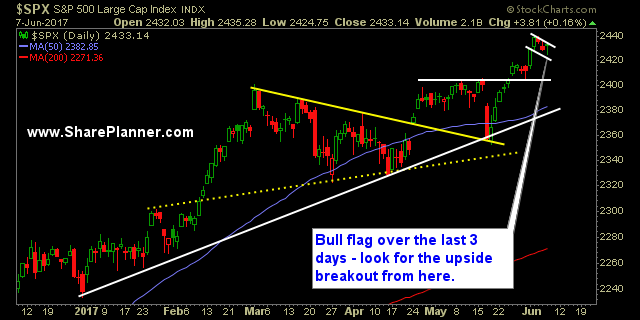

Market Euphoria still strong, but no top yet. And that is what you have to trade right now. That doesn’t mean that with market euphoria in full blow out mode, that you shouldn’t continue to trade to the long side, because you should, but you should always be prepping yourself every day for what you’ll

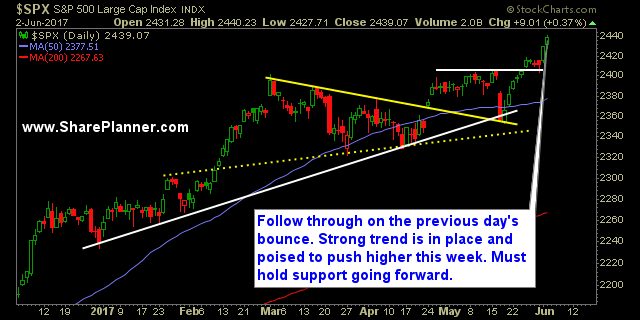

What a solid bounce yesterday for stocks off of short-term support When you have a 15 point pullback in today’s market over a 3-day period, it becomes a ‘Generational Bottom’ or better yet, a ‘Generational Buying Opportunity’ for the bulls. Yesterday the market had a solid rally, a bit unexpected, as I didn’t think much

May was a good swing-trading month for me, but I’m ready for some volatility in June There was literally one day of trading in the month of May that showed the market still had a heartbeat to it still. Nonetheless, I managed to make it another profitable month of swing-trading as you can see the