Episode Overview New traders often burden themselves with the need to make trading fun and exciting, when in reality successful swing trading is all about making it as boring as possible. In this podcast episode, Ryan explains why it is so crucial to make trading as boring and dull as possible and to avoid the

Episode Overview How to trade a stock split: in this podcast episode Ryan talks about the impact of what an announced forward stock split means for a stock that you are considering swing trading, or may already be trading. Also covered are the risks, and the strategy behind stock splits for investors and traders alike.

Episode Overview Ryan fields a number of questions from one of his swing trading listeners. Ryan discusses what to do when your capital exponentially increases, one of his more memorable good and bad swing trades, and how his trading strategy has developed over time. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps

Episode Overview Once you have your swing trading strategy in place, how do you make sure you stick to the rules and risk parameters that you have set in place? In this podcast episode, Ryan tackles the hard truths of being undisciplined as a trader, even when you have a risk strategy and

Episode Overview A new trader finds herself trading options and experiencing some instant success. In this episode, Ryan explores the educational opportunities for new traders, what to focus on in one's development, and how you have to be extremely careful with the Youtubers offering up advice. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights &

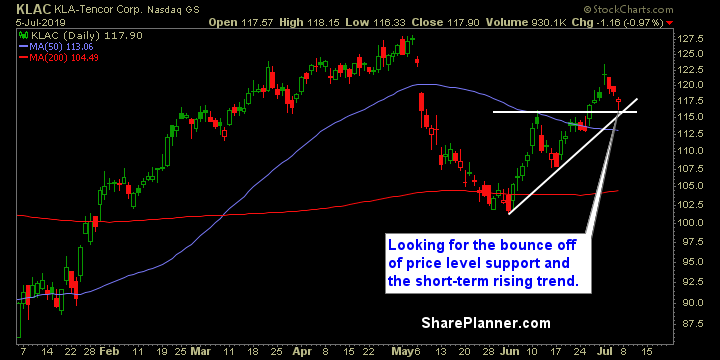

KLA Corp (KLAC) hitting oversold levels and testing a key short-term support level that could offer up a bounce opportunity. Rising support underneath, could also provide another. Semiconductors ETF (SMH) short term and long-term support so far holding up today and price is attempting to bounce off of it. Patterson-UT Energy (PTEN) Watching

Swing Trade Approach: I mean, the market gives little incentive to those looking to short this market, so it is hard to have any sizable short presence in this market. I have a few positions, but I am by and large, very long on this market. I’m looking for reasons to book gains at this

First off, a big salute to the veterans who read this blog and are either serving this country or have served in the past. There was a lot of commotion outside my office window this morning and then heard all of this great patriotic music and so I looked and outside a parade was starting.

Monday’s Swing-Trades: $KLAC $BLDR $NEWR Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: KLA-Tencor (KLAC)

Tuesday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long HD Supply (HDS)