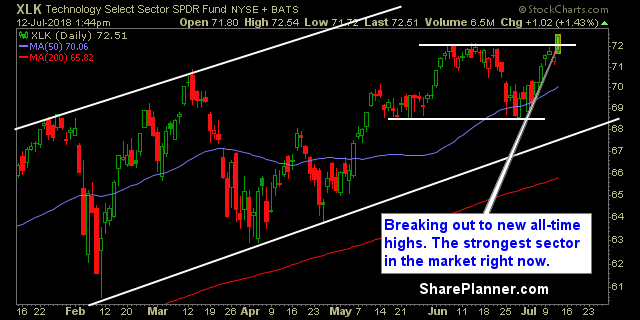

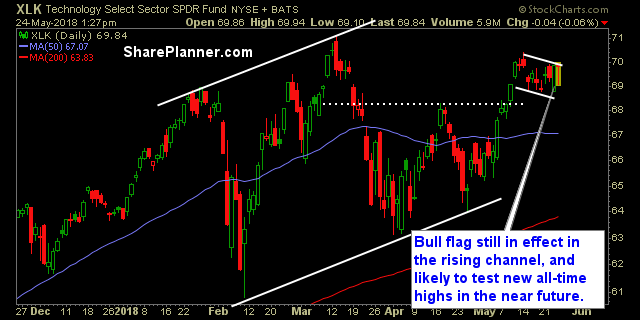

Half the sectors look solid – the other half, not so much. Technology continues to be the place to trade. The thing I have to be careful of is that I don’t get overloaded in that sector, because we have all seen the days where tech is selling but nothing else. So while it is

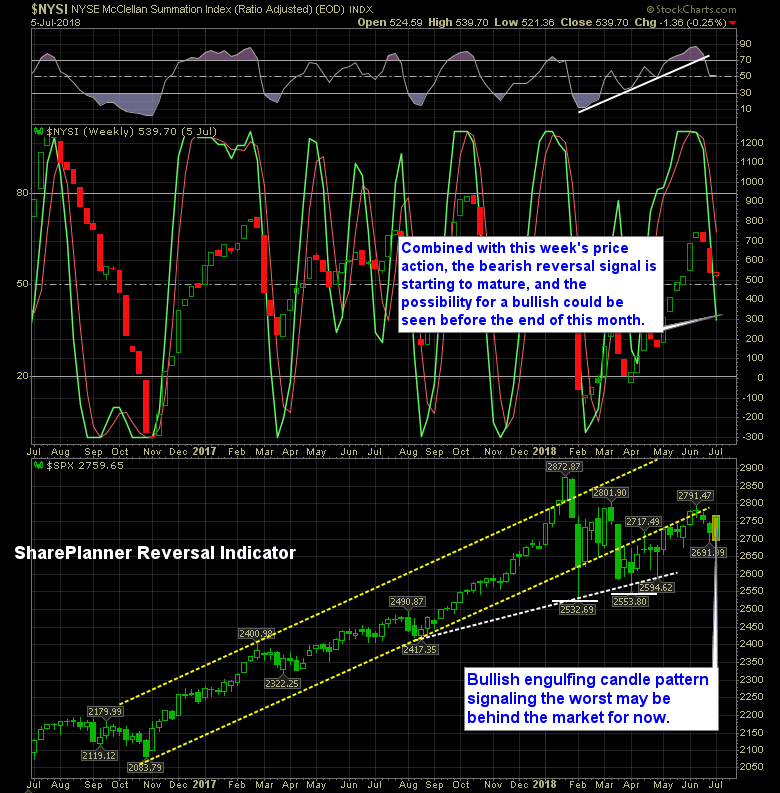

This has to seriously be the oldest story of all time. Markets go down a little bit, bulls panic, think the worst is upon them, bears fail to seize the opportunity, MARKETS RALLY!

Yeah, it’s a nice two day bounce the stock market is experiencing yesterday and today. But don’t take it for granted because a lot of the stocks you’d think would be rallying, simply aren’t.

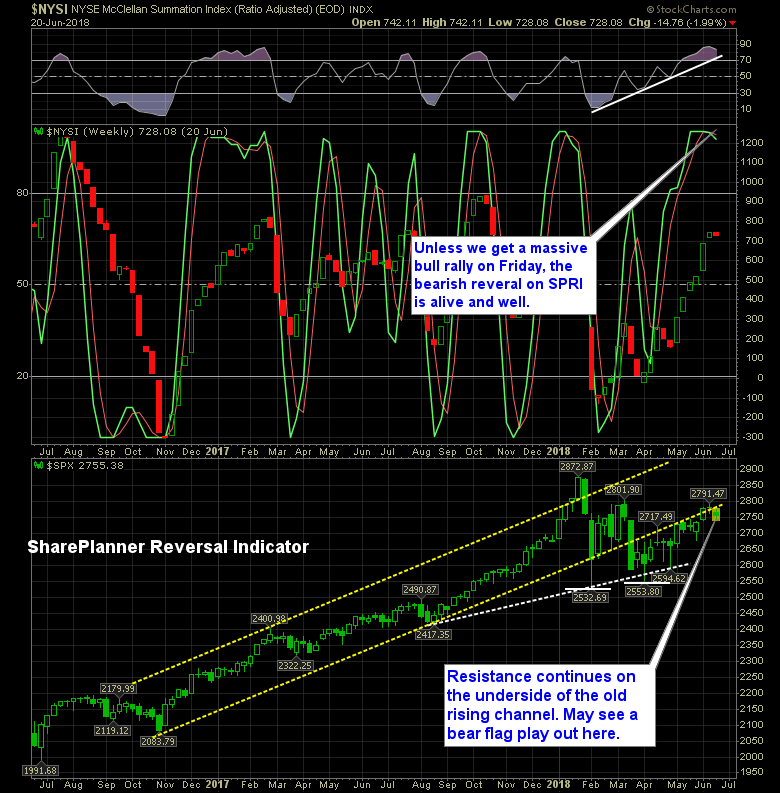

Recent leading sectors starting to struggle Let’s be honest, it is never good when utilities are leading the way. And not even mentioned in the rankings below, is the fact that staples are starting to show signs of life once again. Meanwhile, technology is struggling, discretionary is showing signs of breaking down and healthcare is

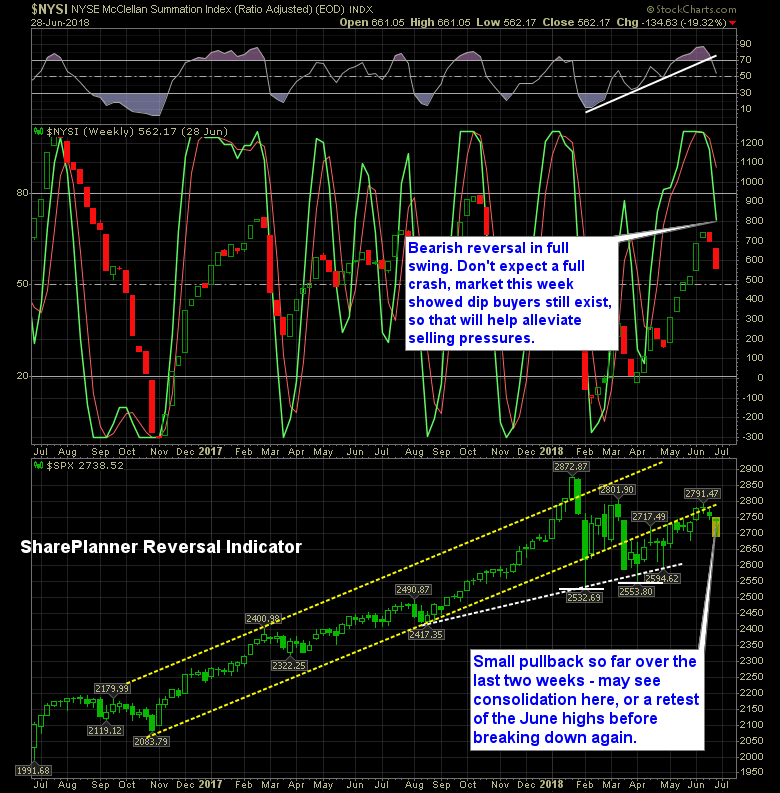

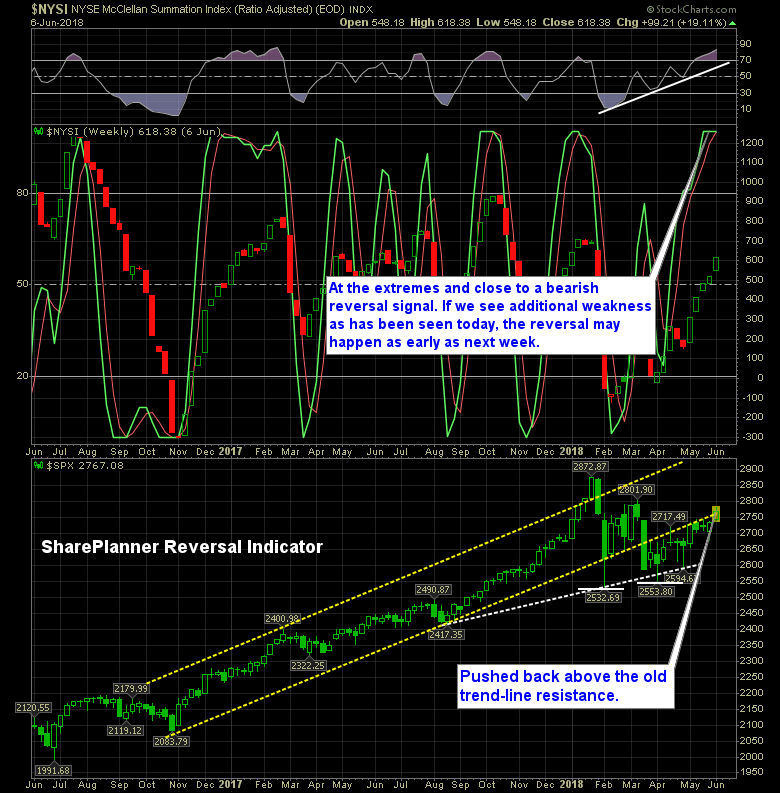

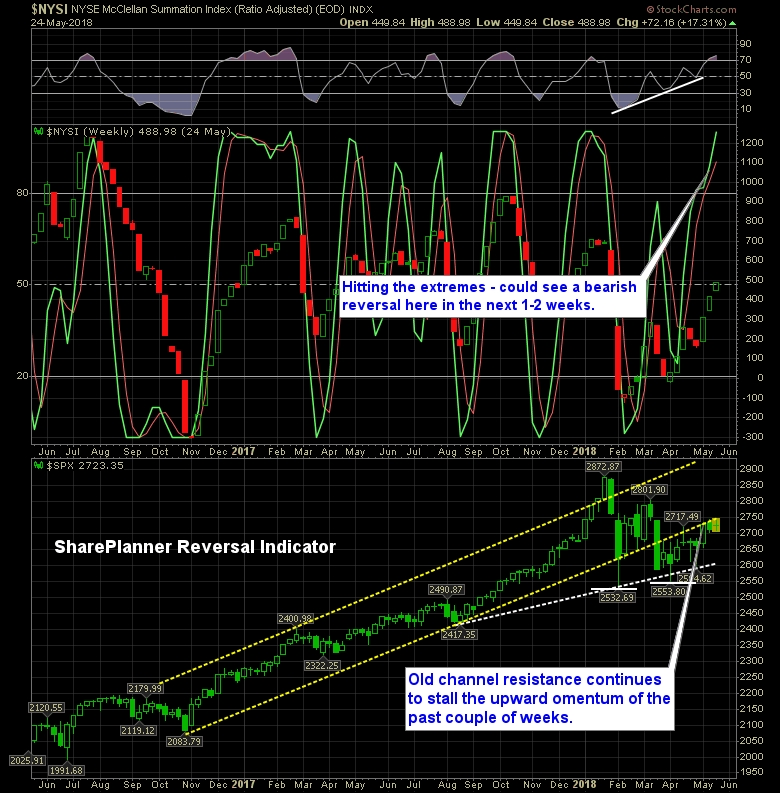

The last time the SharePlanner Reversal Indicator flashed us a bearish signal was back in March. For about two weeks the market pushed notably lower too. But before that, it was mid-January, and well, the market ignored everything back then.

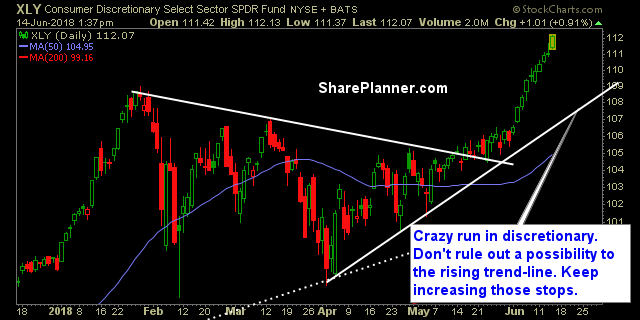

The Leaders of this market still leading In fact if you look at my top three sectors below the only difference is I have swapped out Industrials for Healthcare. Otherwise, the 1-2 punch of this market still remains Technology and Discretionary.

Information received since the Federal Open Market Committee met in May indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Job gains have been strong, on average, in recent months, and the unemployment rate has declined. Recent data suggest that growth of household spending

The bulls have had a great run since the May lows were established, rally 170+ points off of those lows. Much of the rally can be attributed to a few strong days that sent the market soaring higher, while much of that time was confined to sideways trading.

Bulls are hitting an extreme, but that doesn’t mean it is the end of the road for the current rally. While the rally here in May has helped investors out, it may only have a few more weeks left.

Most of the sectors are in good shape right now. This bodes well for the overall direction that the market has been on this month. Yes, there are some obstacles for it to overcome, in forms of strong price resistance overhead, but we are seeing the typical market resiliency that we saw during much of