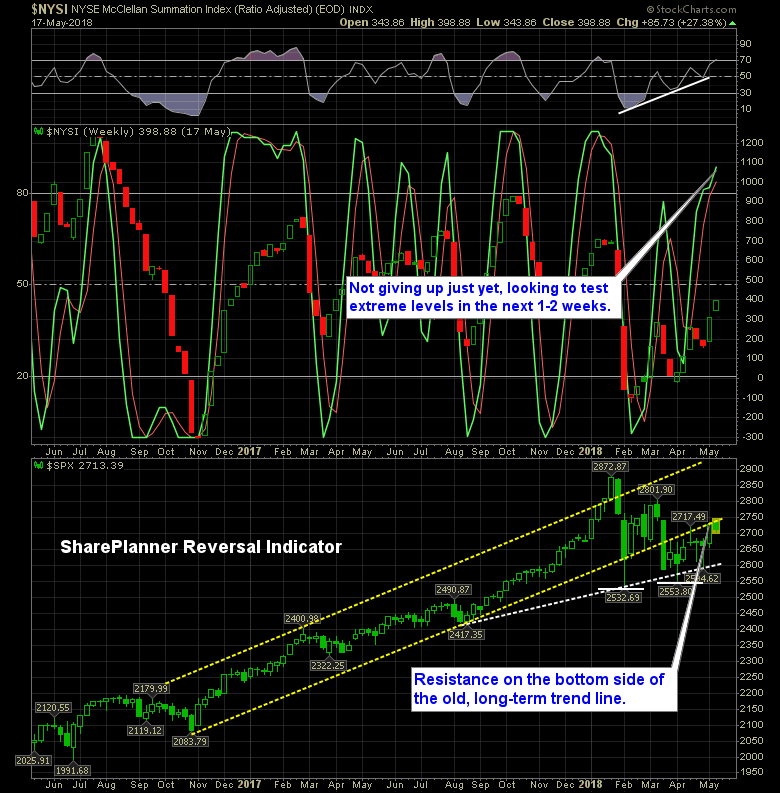

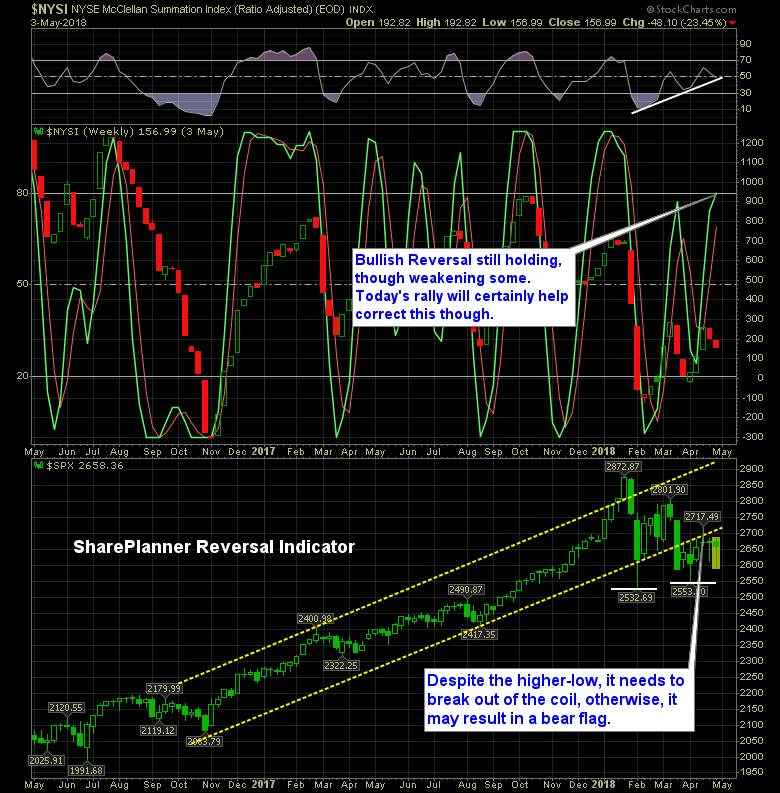

Last week’s update of the SharePlanner Reversal Indicator, I thought things might start getting bearish on the indicator. That didn’t happen.

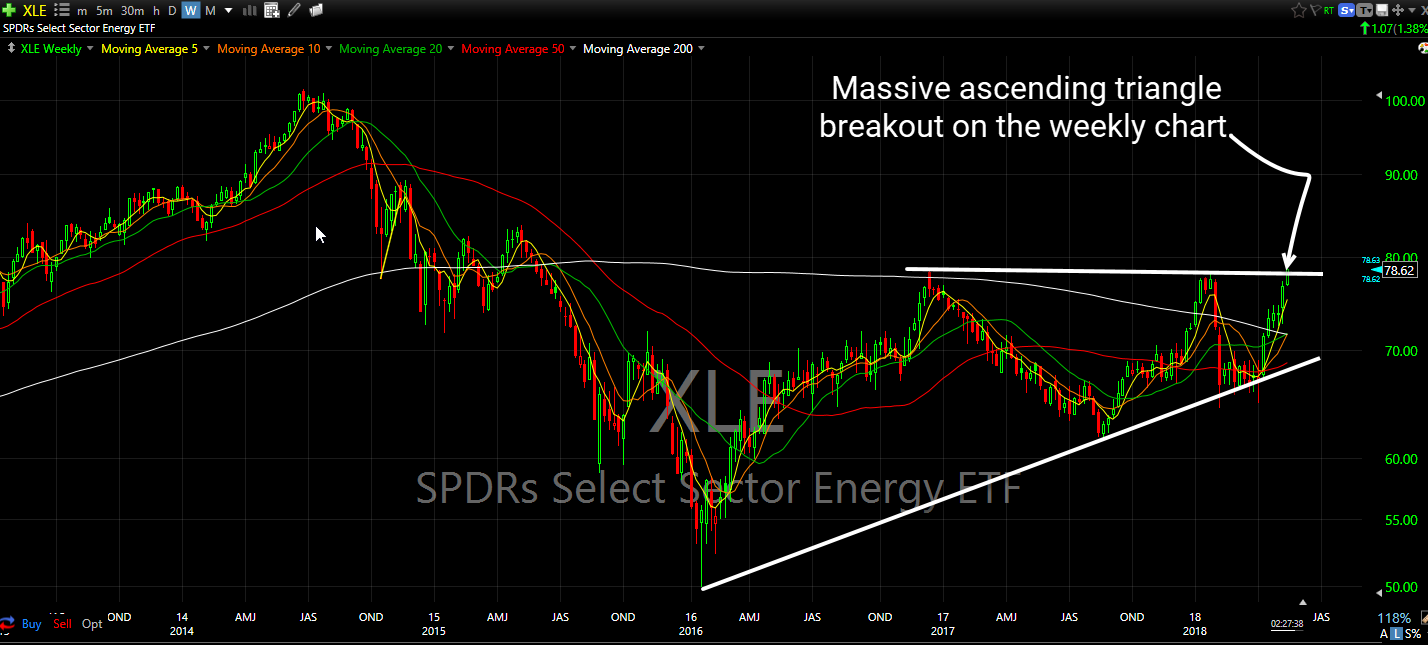

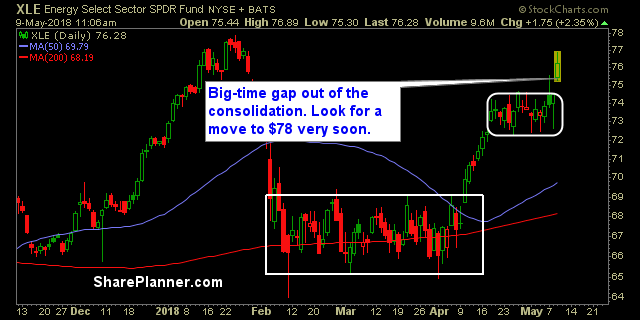

The hottest sector in the stock market is no doubt Energy. And it may only get better from here!

Overall the week has been a good one for the market, and it’s much needed, following its flirtation last week of a break of the 200-day moving average (SPX). Honestly, I thought this week’s rally would have fixed a somewhat problematic trend developing in the SharePlanner Reversal Indicator, but it didn’t. Instead, the slight bend

I’m not a huge fan of using technical analysis on indicators, particularly when the y-axis on the chart is a percentage basis capped at 100%. But this T2108 chart, I believe has some merit as it pertains to support and resistance. For those needing a refresher, the T2108 measures the percentage of stocks trading above

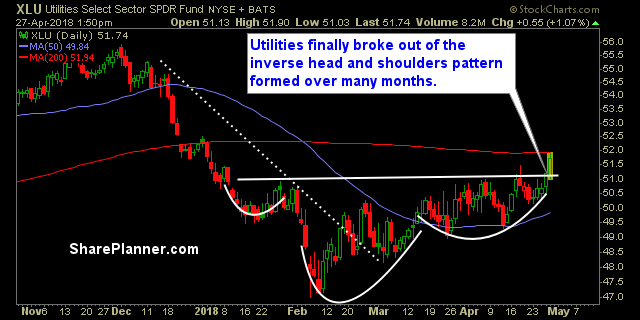

There are a lot of positives and a lot of negatives in this market right now. Not all sectors are soaring as you might think. A lot of them are downright miserable. There are also a lot of failed patterns breakouts as you will see below. Those lead the way in terms of worst sectors

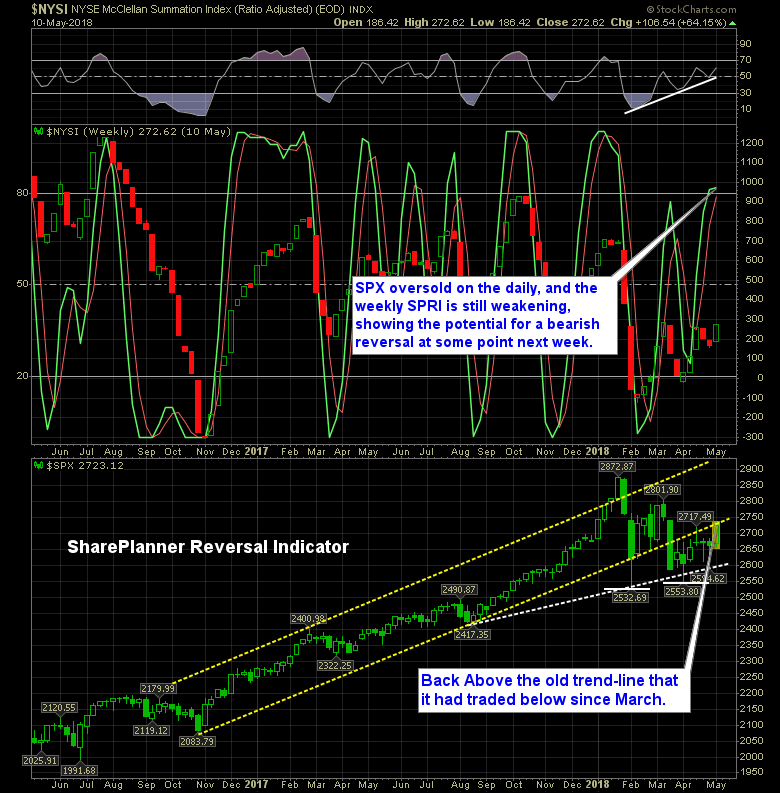

My reversal indicator is still providing me with a very strong bullish reading. As a result, I remain bullish on the market as a whole, but in a tepid fashion. I’m not going out and buying everything I set my eyes on, in fact, I am trying to stay away, as much as possible from

Here's the latest from the state of our market. A possible base if forming, but right now there is nothing to really act on here. I cover SPY, 58.com (WUBA), Netflix (NFLX) and E*Trade (ETFC).

Sometimes I think it is pointless to convince someone not to short stocks into earnings, when they already have it in their blood to do so. The worst thing that can happen to these traders is to have a string of winning trades related to shorting a stock ahead of their earnings. It gives them

Sectors losing their long-term trend and have been extremely choppy When you have a market that isn’t establishing new highs, nor is establishing any new lows on the charts, mix that with huge price swings for the past three months and you have some very confused, and in some cases, directionless sectors.