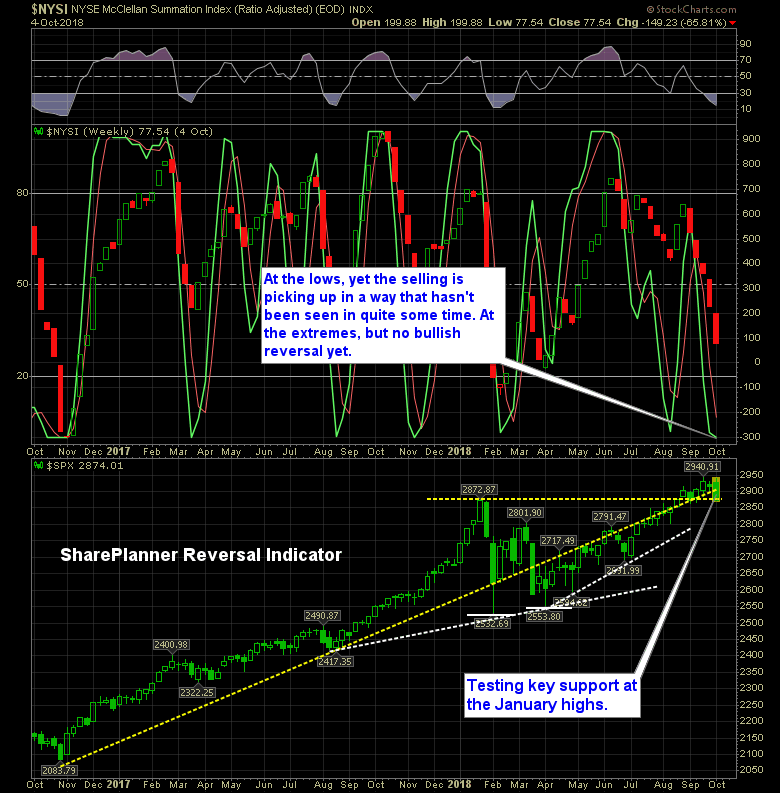

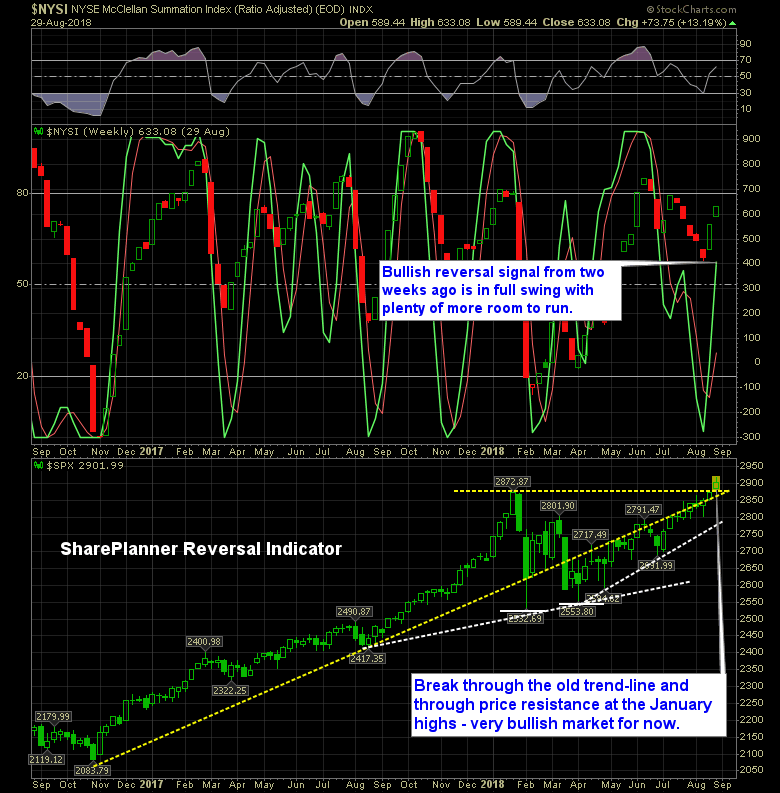

We were at extreme readings last week on the SharePlanner Reversal Indicator. This week…even more so.

Here’s the latest reading of the SharePlanner Reversal Indicator. We are sitting at extremes and poised to bounce.

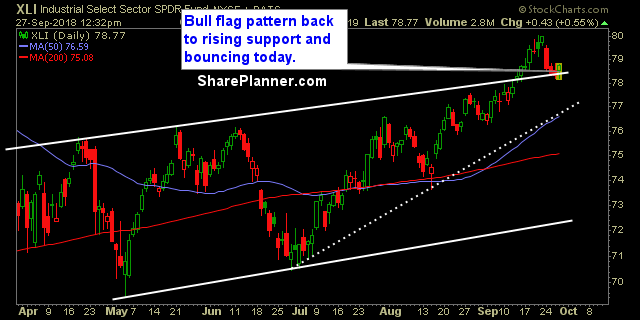

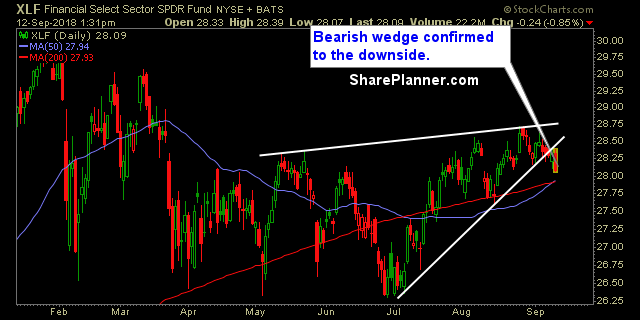

Sectors bullish as a whole, but still with some notable laggards. Financials suck, I’ve played them sporadically throughout the year, and every time, the gains have meager. Energy I have been incredibly skeptical of, though I have played them with much more success, I have stood by on its current rally because the sector itself

Information received since the Federal Open Market Committee met in August indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has stayed low. Household spending and business fixed investment have

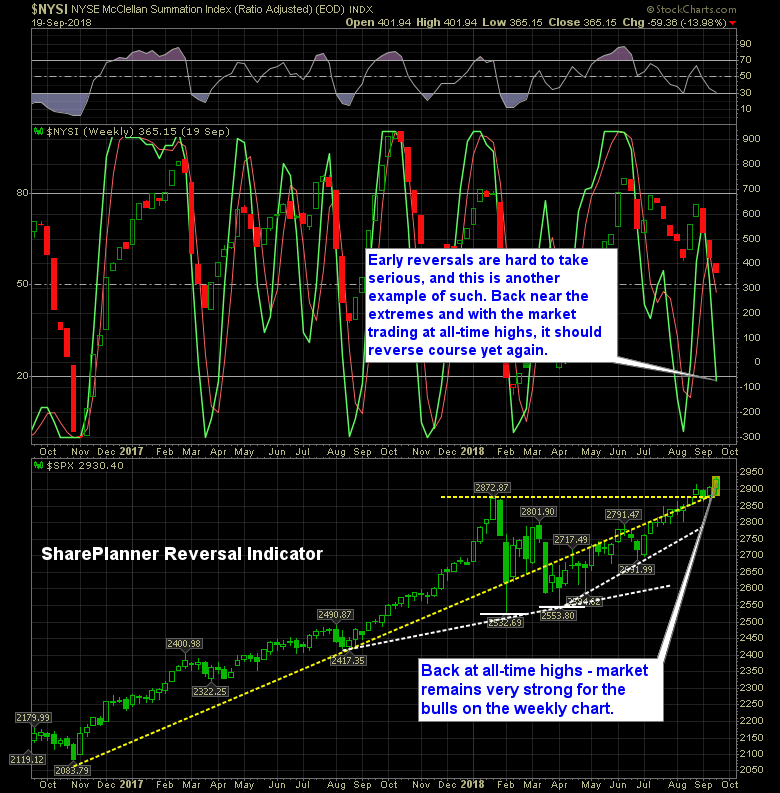

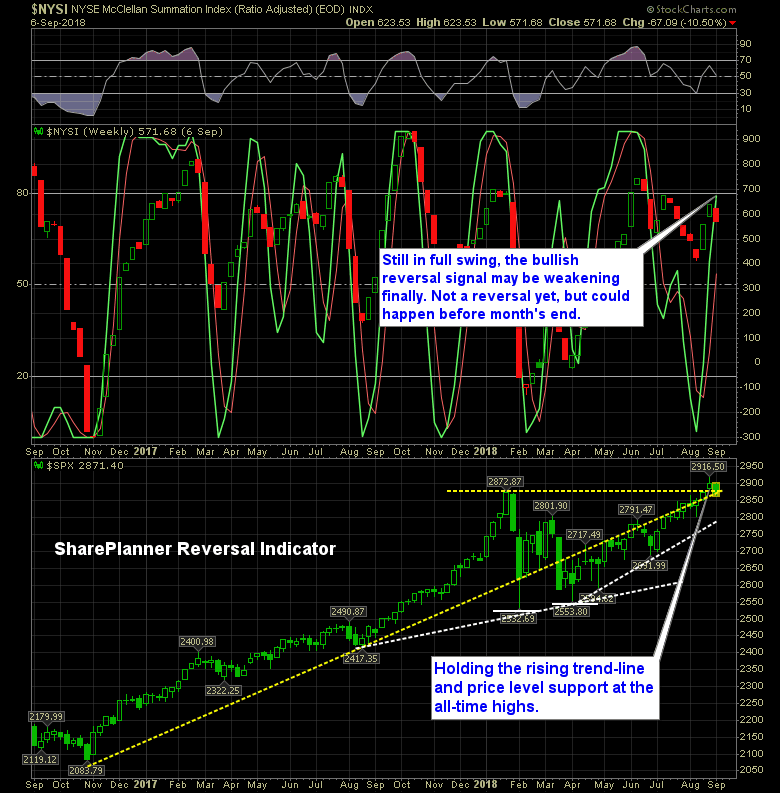

My biggest concern with this market over the past three months has been the lack of breadth in this market. And today it is hitting new lows. While the S&P 500 and Dow Jones Industrial Average continues to hit new highs over the past week, and the Nasdaq and Russell Index not too far

SharePlanner Reversal Indicator is going one way, while the market is going another. While today’s breadth is good, the T2108 indicator, still shows stocks lagging overall market price action, with only 53% of stocks even trading above their 40-day moving average.

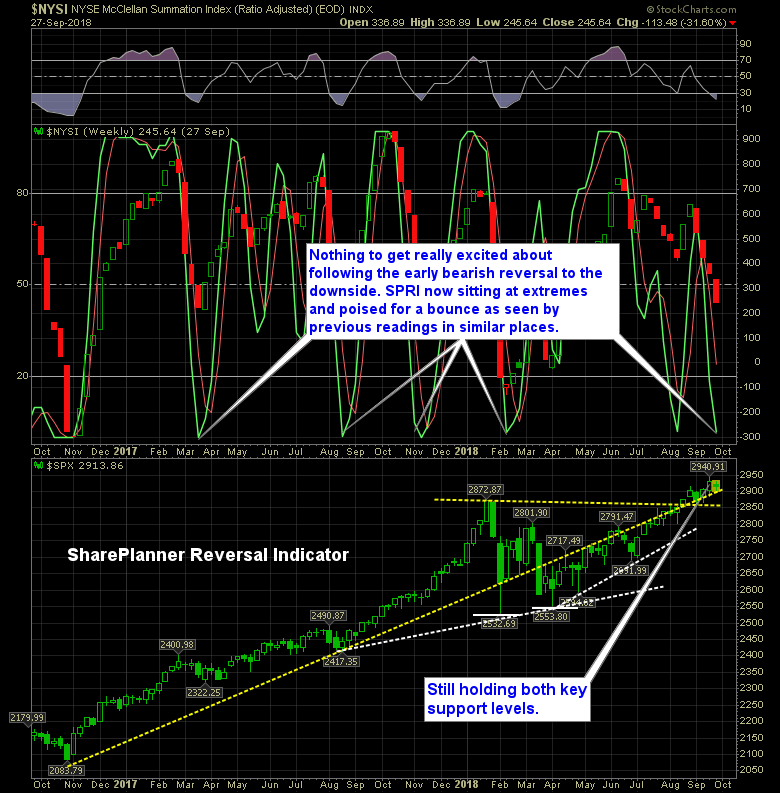

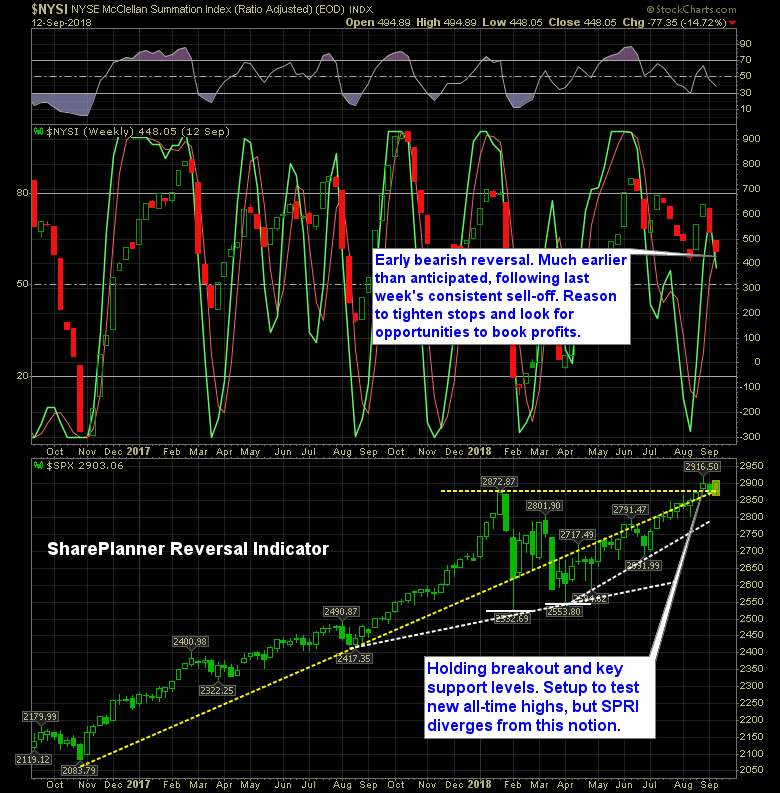

This week’s edition, if you want to call it that, of the SharePlanner Reversal Indicator has some unexpected bearishness. Obviously, last week had its share of bearishness but I never thought it would be enough to to trigger a bearish reversal in the market. But considering that breadth has not been all that great, I

Sectors as a whole remain bullish, despite recent market pullback. The two sectors that I like the least are the financials and the materials. Both of them look problematic, and the financials are showing more weakness today, despite already being oversold.

The Bulls have done absolutely nothing for themselves this week, and that goes back to Thursday of last week as well, when the 6-day sell-off began. Obviously all the Trump headlines, tariff wars, and wage growth in this morning’s jobs number, doesn’t help matters, and while there is nothing novel about the headlines (they’ve been

The bulls should continue to push this market higher, despite the selling seen today. Sure the market is overheated and overbought, but it can stay that way for quite some time, before rationale minds start to take profits.