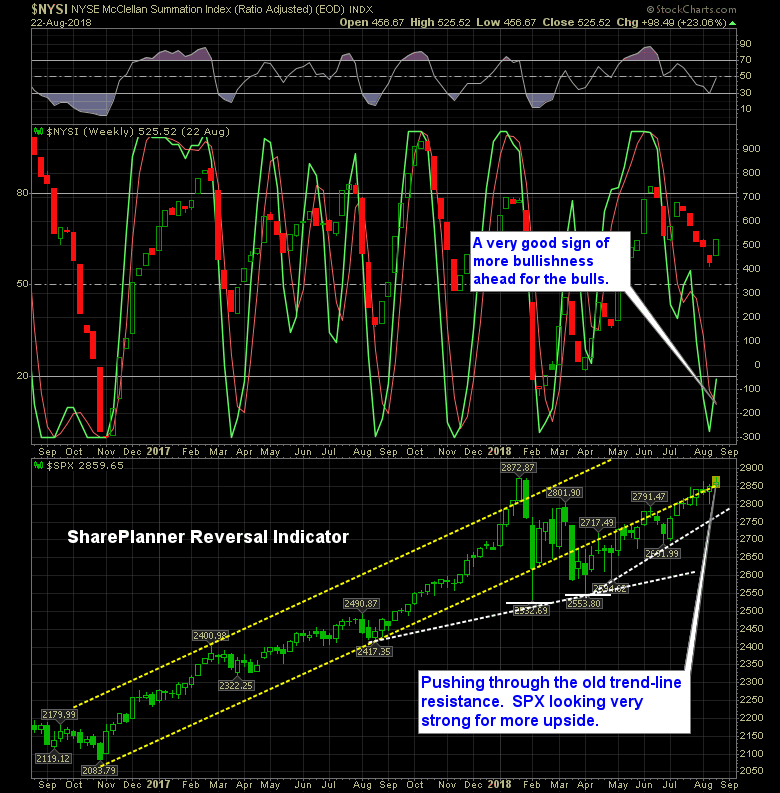

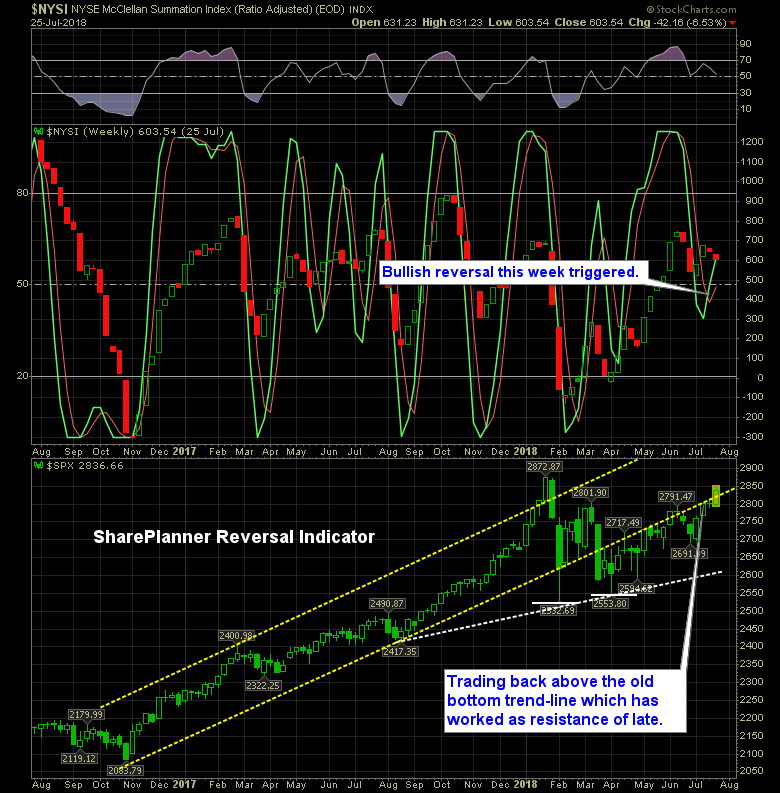

Sure, everyone in the market is waiting for some Trump headline to hit that shakes the market to its core. But you could be waiting a while (or it may not ever happen), and in the meantime, the SharePlanner Reversal Indicator is the most bullish it has been since the market bottomed back on February

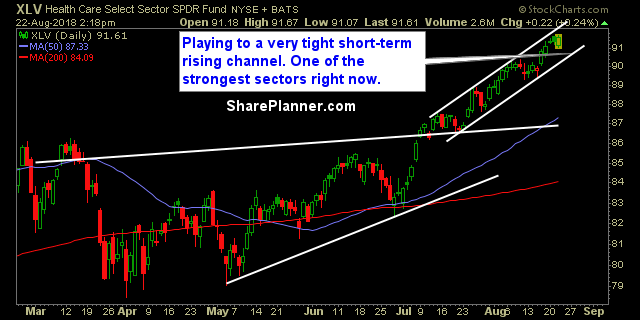

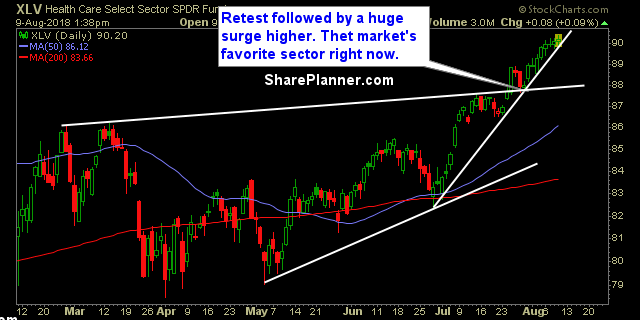

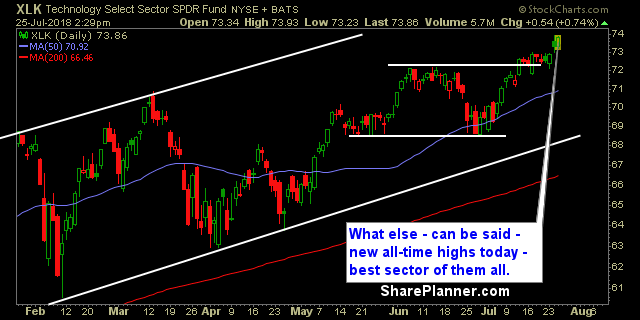

Sectors as a whole support the market’s move to new all-time highs. Outside of Energy and Materials, the sectors as a whole have shown some solid trend-lines and a willingness to push higher going forward.

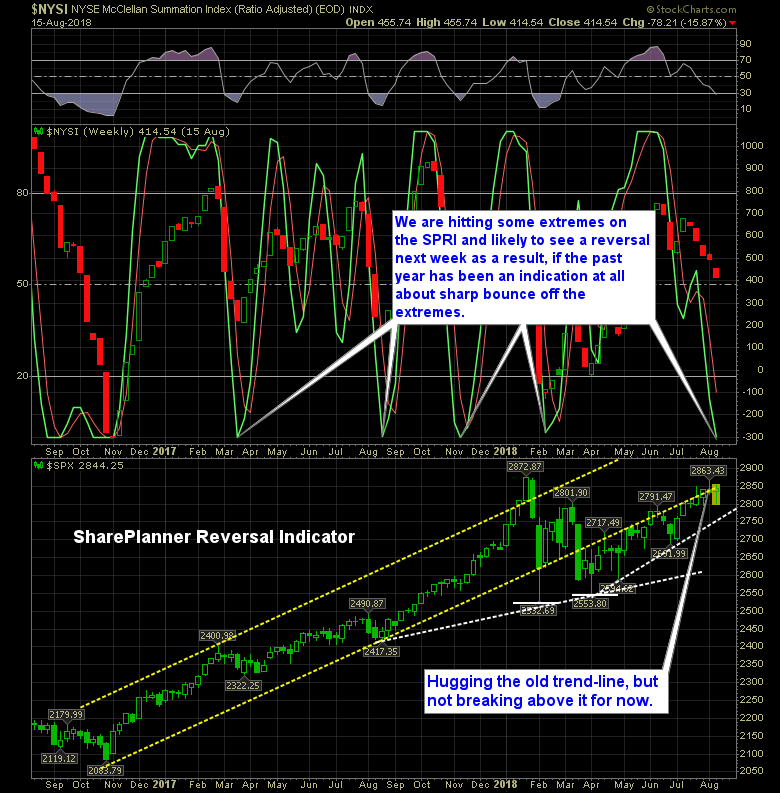

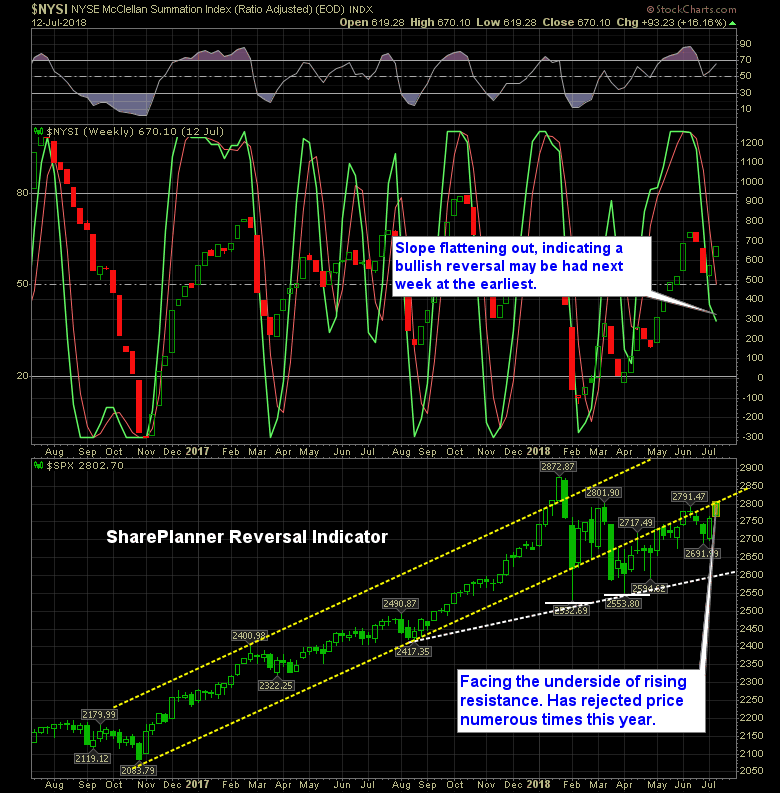

We thought there might have been an early bullish reversal a month ago, but that didn’t pan out, and the downside continued for the market. But now the SharePlanner Reversal Indicator is at an extreme place, and recent history (over the past year), suggests its time in the extremes is short lived. That’s why I

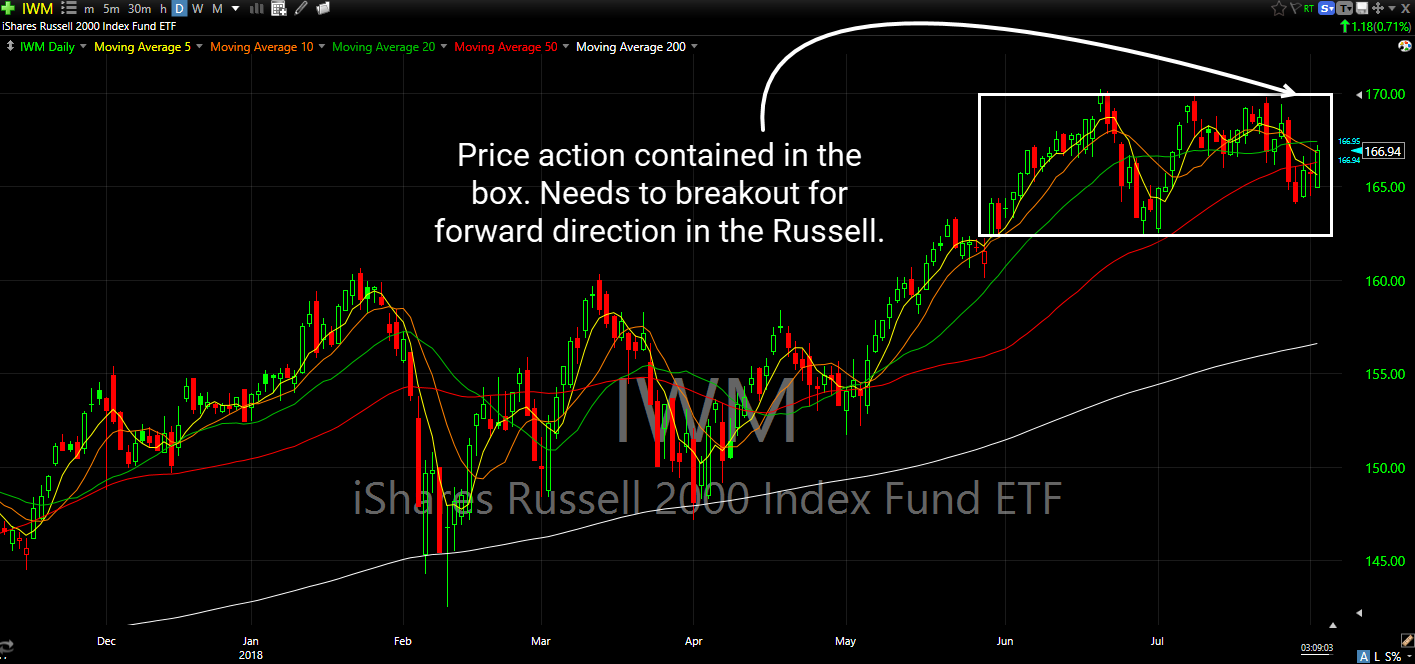

Most of the sectors are showing sideways trading patterns. The market isn't entirely untradeable but it is getting pretty darn close to it. I'm finding the breakout plays to be more difficult than most, and instead focusing on the stocks that are forming a base and coming out of that base, following a sell-off. Most

Each of the indices are telling a different story, and they can shift quite regularly. But after the surprising, not-so-surprising bounce off the lows of the day, to rip the hearts right out of the bears, the markets are showing themselves to be willing to push higher – particularly the Nasdaq and S&P 500.

Information received since the Federal Open Market Committee met in June indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has stayed low. Household spending and business fixed investment have

The bearish reversal in June is no more. The bulls have managed to correct the ship and put together a bullish reversal of their own. With strong price action over the last three weeks, market behaviors confirms the reading on the SPRI.

Reviewing the sector charts - there is plenty to like, from a bullish perspective. Pretty much every sector I looked at, I could find myself a reason for why there could be a bullish take on it. So overall, the charts aren't all that bad. What I am concerned with more than anything else, is

A divergence is popping up on the charts that was the same as the one seen back in late January. Of course that divergence ultimatley led to the massive -10% correction off of the all-time highs.

The bulls are up to their old ways of doing things again. Sure the tariffs are still lingering as an issue. Yes, there is no way to know what North Korea will ultimately do. Oh and at any moment, Bobby Mueller could rattle the markets with an announcement of his own.