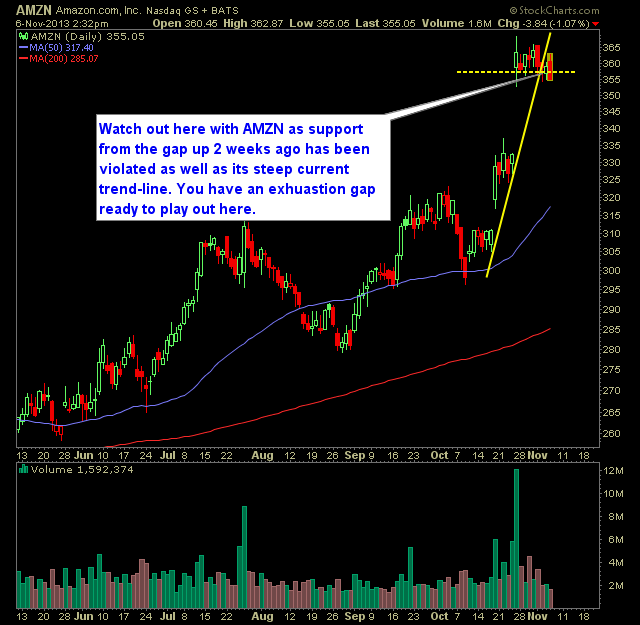

Last week, I posted that Amazon (AMZN) was on the verge of breaking down and that was finally confirmed with a huge break though key support. Now that we’ve broken key support in AMZN, it is now retesting that broken support and being rejected as a result. Look for a move to $330 now.

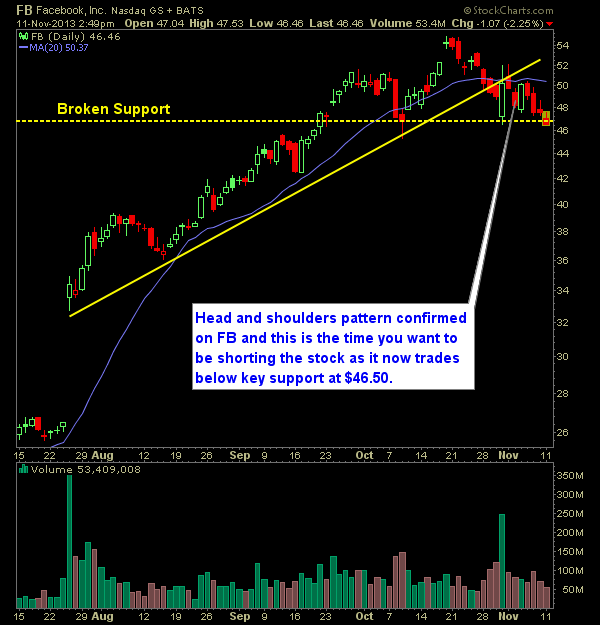

Head and shoulders pattern confirmed on Facebook (FB) and this is the time you want to be shorting the stock as it now trades below key support at $46.50. I think the stock is far over-hyped with too much retail money in it. I get more questions from people about this stock than any other,

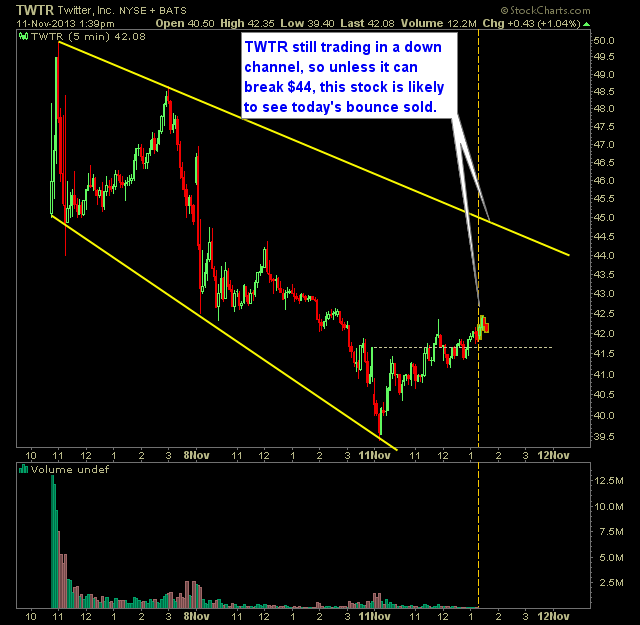

At this point you can only judge and do technical analysis on Twitter (TWTR) based on the 5-minute chart. Perhaps you can sneak out to the 10 minute chart and still be okay but I’d stick with the former. Now you have TWTR trying to bounce for us today but I would take it with a grain

Just in case you missed out last week on Oscar’s phenomenal four days of trading, I wanted to post it here for you to look over this weekend and consider whether you want to be a part of the action on Monday when another week of trading kicks off. And yes, it doesn’t happen often, but every

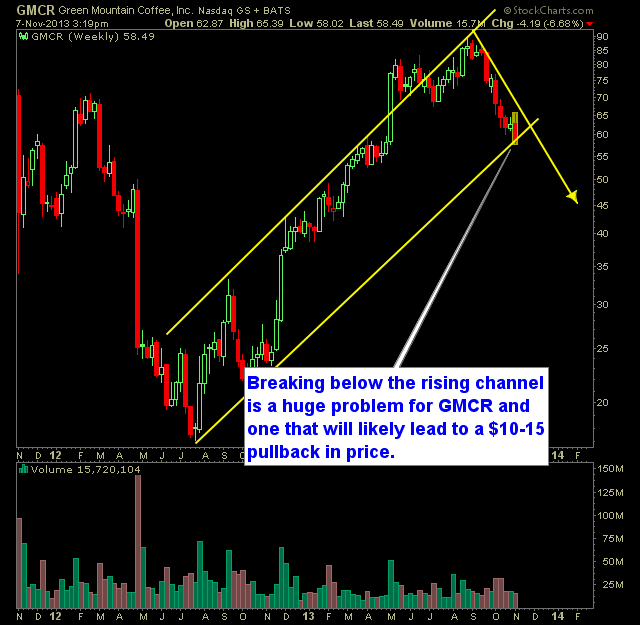

Breaking below the rising channel is a huge problem for Green Mountain Coffee Roasters (GMCR) and one that will likely lead to a $10-15 pullback in price. Overall this sets up GMCR for a nice short setup with high reward and low risk scenario. Here’s the technical analysis:

Solid day of trading in the SharePlanner Splash Zone. We are still building up the long positions in the swing-trading portfolio after covering all of my shorts on Friday. So far we are about 60% long, but have yet to close out any positions so far this week. However, the day-trading has seen plenty of

Watch out here with (Amazon) AMZN as support from the gap up two weeks ago has been violated as well as its steep current trend-line. You have an exhuastion gap ready to play out here and in the worse case scenario a move back to $310 filling both gaps in October. To say the

It’s not too often you use the words “Breakout” and “Microsoft” in the same sentence, but that is definitely what we are seeing here today. Microsoft (MSFT) has a strong uptrend already in place and now breaking out above heavy resistance around the $36.50 area. Here’s the Microsoft technical analysis:

Most problematic for Facebook (FB) is the fact that it has broken the strong uptrend that started on the previous earnings report. Today confirms the bearish trend break in FB. At this point I’d assume that a move to $46.50 is likely, where there is strong support, followed by a move perhaps to the