I spoke to how well the swing-trading did last month, now I want to turn my focus to Oscar’s Day-Trading. For the month of November alone, using a minimum $25,000 portfolio, Oscar managed to bring in $4,249.77 in profits which comes to a 17% return on his portfolio. All of his trades are called out

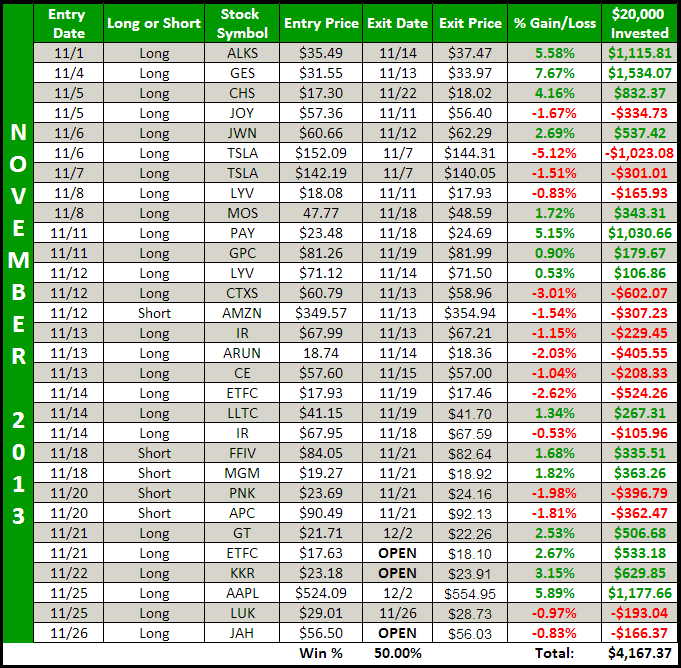

Chalk up another great month of swing-trading in the SharePlanner Splash Zone! Our portfolio was up another $4,167 in November bringing my total for the year to $31,445.94 in total profits and $156,114.45 since 2011 for our subscribers. Unlike 99.9% of subscription newsletters out there, I do not hide my past performance. Show me

At this point, I wouldn’t jump into Google (GOOG), instead I’d wait for a pullback to $1043, before jump-starting a long position. The pullback over the last two days looks fairly harlmless and one to be taken advantage of here once it hits my price. I’ve made a career off of buying the light

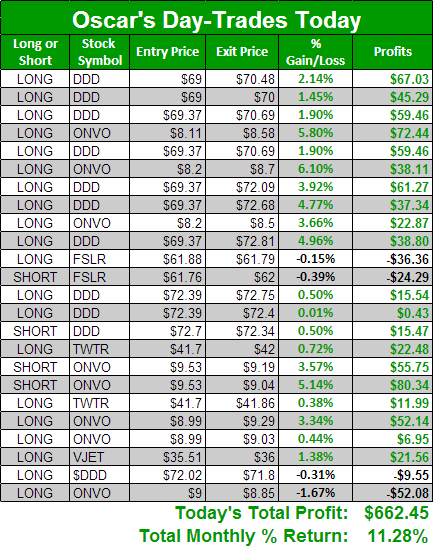

We haven’t stopped trading just because Thanksgiving is around the corner. Instead Oscar has a solid day of trading netting $667 in profits on his $25,000 portfolio and an additional 2.67% return on the day in the SharePlanner Splash Zone. Here’s the breakdown of all of Oscar’s day-trading sales: If you are interested and Oscar’s

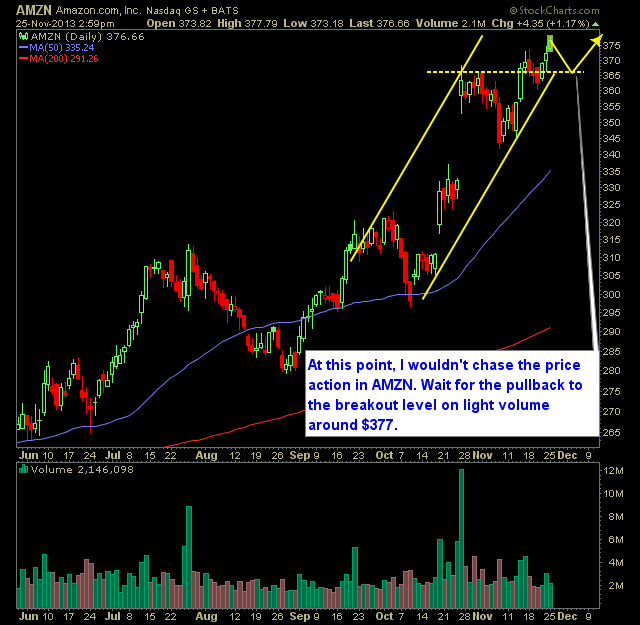

At this point, I wouldn’t chase the price action in Amazon (AMZN). Wait for the pullback to the breakout level on light volume around $377. The retest more times than not represents a clearer view of the risk in the trade, because if it drops below the breakout level, you get out – no

Textbook breakout here in Google (GOOG). Ideally if you can get in on a pullback to $1043, it would offer a great risk/reward opportunity. Also, follow the currently trend-line as I have outlined below, if this stock runs hard towards $1,100, use a break of the trend-line to cut-line and get out of the trade.

What a day it was for Oscar. He added another $662.45 to his $25,000 portfolio. In percentage terms that is another 2.6% in just one day. For the month that brings his day-trading total to $2,820.53 or 11.3%. I've posted the trade results below. If you'd like to join us and start seeing the same

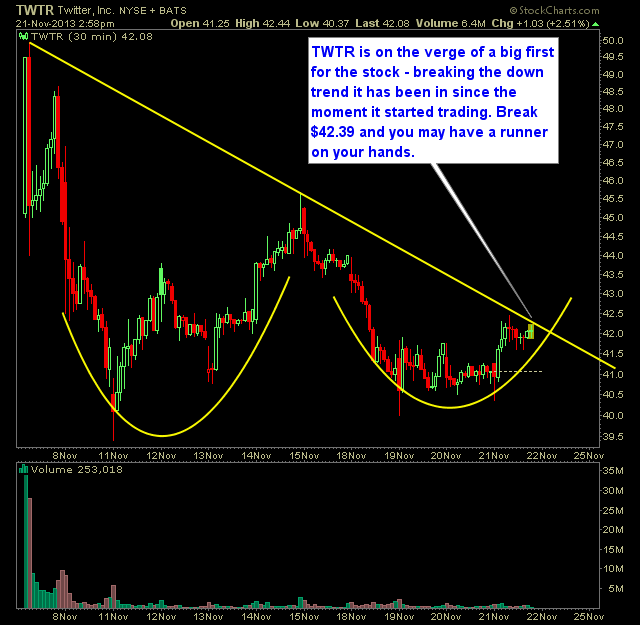

Twitter (TWTR) is on the verge of a big first for the stock – breaking the down trend it has been in since the moment it started trading. Break $42.39 and you may have a runner on your hands. Right now the only time frame I’d recommend using for technical analysis is the 30-minute chart

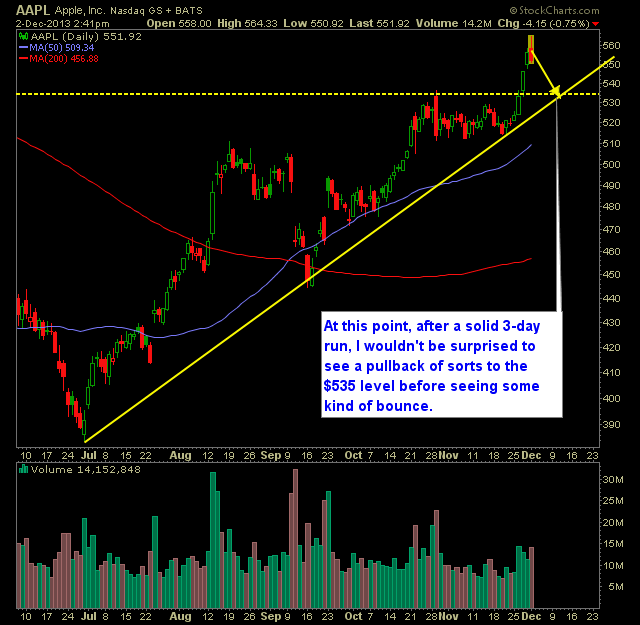

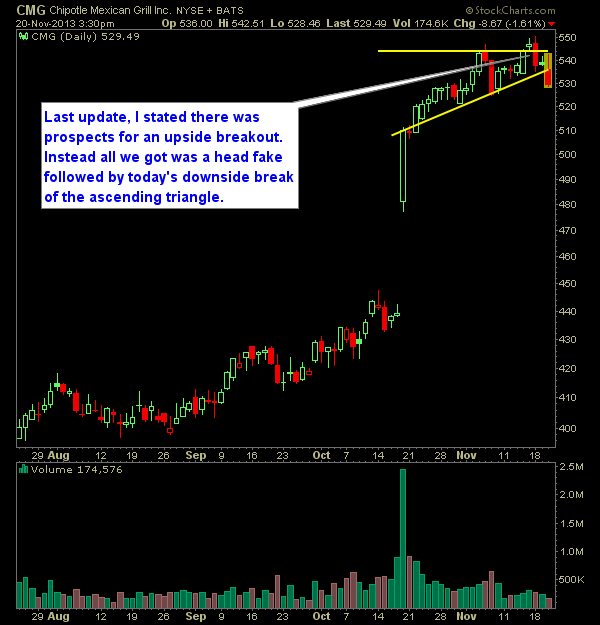

Last update, I stated there was prospects for an upside breakout. Instead all we got was a head fake followed by today’s downside break of the ascending triangle. From here, look for targets to the downside that includes $510 and if that cannot hold, a move to the lower $480’s is possible, though this