Las Vegas Sands (LVS) has made a huge run of late and now hitting the upper channel which could signal a pullback to $64. The stock is heavy and while I thought in Late September I never thought it would rise above $65, it has reached a boiling point now that suggests the bulls will be

Key support here for GMCR. If it breaks through $67.50, it is likely it heads to $60. If you are a long in Green Mountain Coffee Roasters (GMCR) then you have a clear line in the sand – if price violates that key support level, you must depart company with it. Here’s the GMCR technical

GOOG is by no means out of the woods yet – this stock is clearly in a distribution pattern if I’ve ever seen one. There is a clear support level for this stock as it bounced for the third time. If that breaks at $841, the bulls are doomed. Ok, not doomed, but they stand

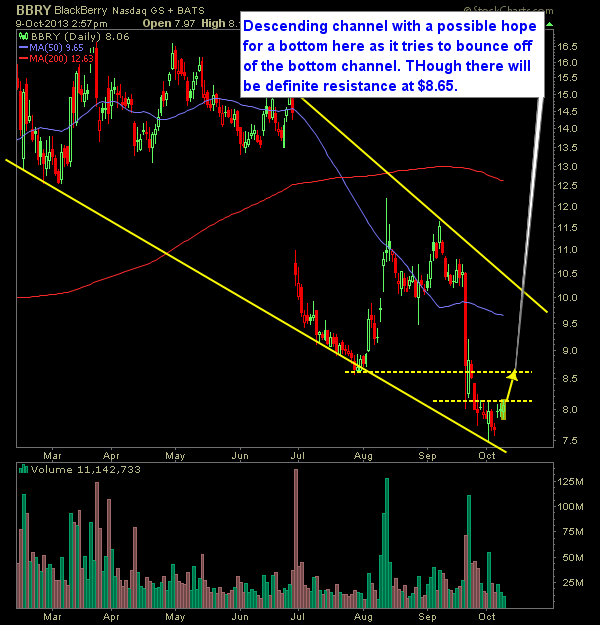

Descending channel with a possible hope for a bottom here as it tries to bounce off of the bottom channel. Though there will be definite resistance at $8.65, I think there is a legitimate opportunity for a an 6-8% move in this stock. The key though is for the base to hold. Below $7.71 I’d

I see two possible scenarios with the bull flag playing out in Apple: 1) Bull flags all they way back to support and then bounces up to $510 then $540 2) Holds the 20-day moving average and then breaks through $490 for a move to $540. There’s a lot of emotions in this stock right

Worse case scenario is PCLN slices through two critical support levels and makes a run for its long-term trend-line in place which is currently around $830-840. That would no doubt be a huge drop, but in either case, PCLN is seeing some drastic changes taking place today. and there are two support levels, at $927

Listen, I’m not some doomsdayer, or person who tries to call the tops in the market. I take what the market gives me and as a result I have been long on this market for well over a year now, and hardly ever find a reason to short it. But today is a bit of

While the market sank drastically today, and took a lot of bulls out of their positions, Oscar (@fuinhaz) managed to nail a nice day-trade in Taser International (TASR). After getting subscribers in at $14.20, the stock rose and traders closed their position out at $14.75. A great way to start the week despite the market's

LinkedIn (LNKD) is double topping and that can’t be good, especially as it comes after finishing off a strong up channel of price action since June. I’m Targetting $215 with any major move going forward. It will however be interesting to see how LNKD reacts to to the upcoming Twitter (TWTR) IPO. Here’s my technical

Amarin (AMRN) has a messy inverse head and shoulders but it is definitely an IH&S pattern. Above $7.38 I think it becomes a screaming buy. However, the biggest question is the stop-loss. Ideally if it can provide me with some consolidation before the breakout occurs, that would be best scenario for a high reward