Big time move out of ZNGA by breaking out of the long-term triangle, and then consolidating at the stock’s highs. From here a move above $3.90 would surely attract more buyers. But $4.00 should provide some resistance as it also represents the March highs. Here’s the ZNGA technical analysis:

Microsoft (MSFT) is at an interesting juncture here. Break through $34 and it will no doubt make a run to $35.20. So far price resistance has been broken through, but the down trend off of the July highs has only been tested…. Stay tuned! Here’s the MSFT technical analysis:

Expect some resistance overhead at the $130 mark. Also notice the double bottom formed over the past 2 months. If $130 breaks, I expect it to run to $137.50 at a minimum. Here’s the Gold (GLD) chart’s technical analysis:

Two things with Tesla (TSLA) that must be mentioned: 1) HUGE and I mean HUGE support on the 20-day moving average on this stock. 2) A well defined bearish wedge that will be forced to make a move in the ver near future. $182 will be the first level of support violated, but once

Ohh yes, it was another great month in the SharePlanner Splash Zone! Ryan’s swing-trading was stellar as usual, and netted his best month of the year, with a whoppin’ $7,743 in profits with 23 trades. Among those trades, 17 were profitable: a 73.9% winning percentage! The great thing is that you can be part of

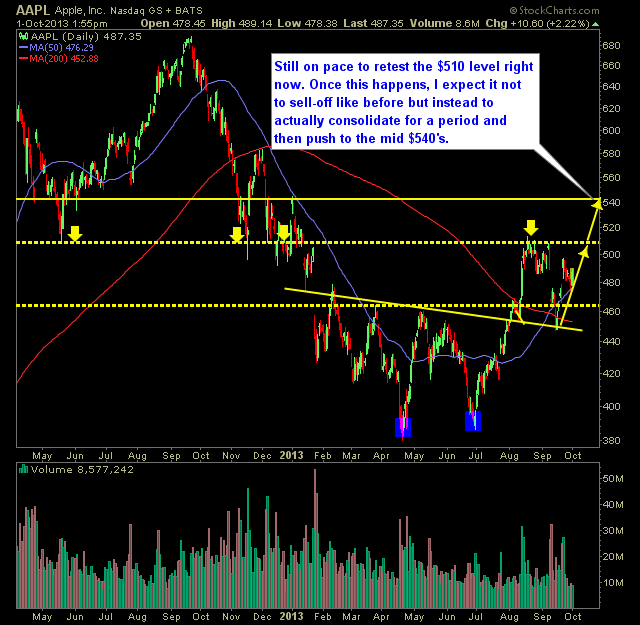

Oh, I’m likely to be praised by some and vilified by others for this post. No doubt there is a lot of passion and opinion when it comes to the Apple stock. I’ve been pretty much on target with my analysis, almost too good with it since it confirmed its double bottom back in July.

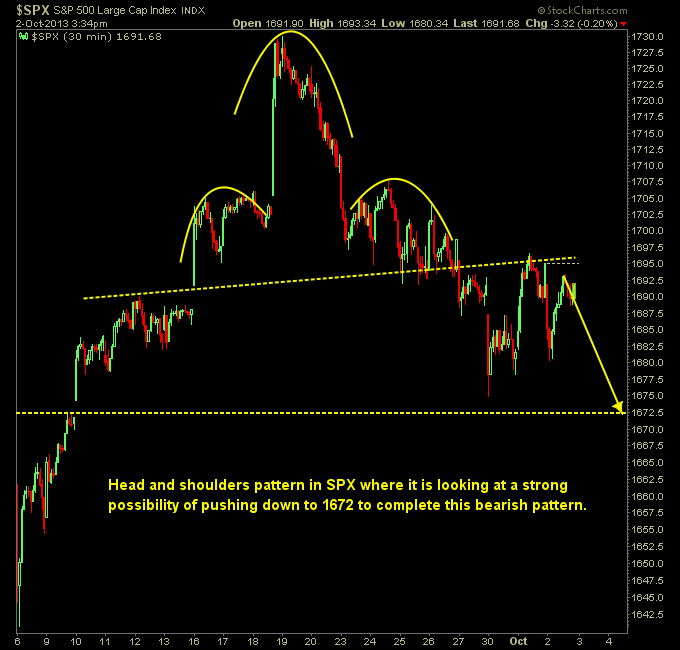

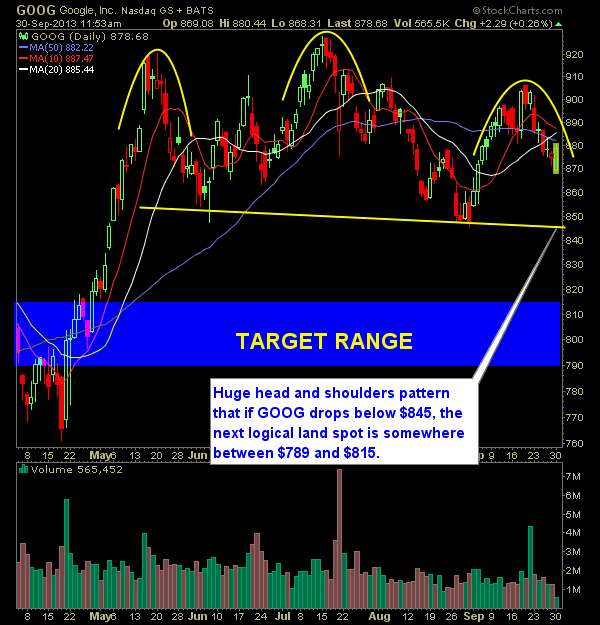

Google (GOOG) has been a great stock for swing trading this year. The key has been fading the moves that have occurred. Specifically those between $850 and $930. But as a result of those moves a nasty head and shoulders pattern has emerged that should take this stock much lower if it crosses and

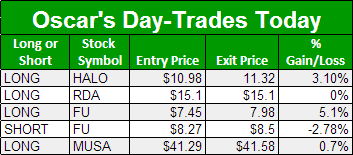

Despite the first losing week in the month of September for the markets, the SharePlanner Splah Zone recorded another profitable week. Being a day-trader doesn’t always require that you make a twenty or thirty trades in a single day. In Oscar’s (@fuinhaz) case, he did with simply 5 trades in all. Like always, the results

BlackBerry bulls have had a awful time this year. It is a warning on trying to find value in technology stock. Despite that the fact that BlackBerry is trading at a discounting its potential takeover, I think shareholders would be wise to sell now. This will be a short post. Like I said, BlackBerry shareholders