Despite hitting new highs on the S&P 500 just recently, at the close today, it finished the day in the RED for the year. It has been a long, long time since the last time I wrote those words. But unsurprisingly, my trading is in the positive on the year, and you can be a part

This month I am featured in Active Trader Magazine in their “Face of Trading” Segment. Here is an excerpt from the article. You can read the full interview by picking up a copy at any Barnes and Noble or Books-a-Million retailer: Ryan Mallory’s first exposure to the stock market came when he was 11. A

There are plenty of newsletters out there that offer success beyond your wildest dreams if you subscribe to them. But I don’t do that. I simply show you my past performance and let you be the judge of how successful my swing-trading has been over the years in the SharePlanner Splash Zone. Not only will

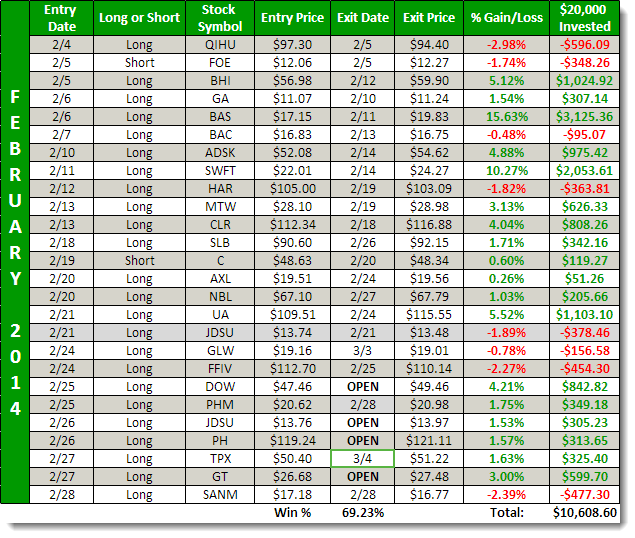

Ryan adds on another month of stellar trading in February. With 26 trades, Ryan adds another $10,608 to the portfolio. Below you will find all of Ryan's swing-trades for the month as he managed to trade with a 69% accuracy with winners like BAS that netted 15.6%, SWFT which banked 10.3% and many other consistent

We've rallied nearly 100 points off of the February lows from February 5th, and it has been nearly non-stop. But today we saw a possible change in the tides. Has it just been an over-glorified dead-cat bounce all along, or just a bump in the road before establishing new all-time highs yet again on the

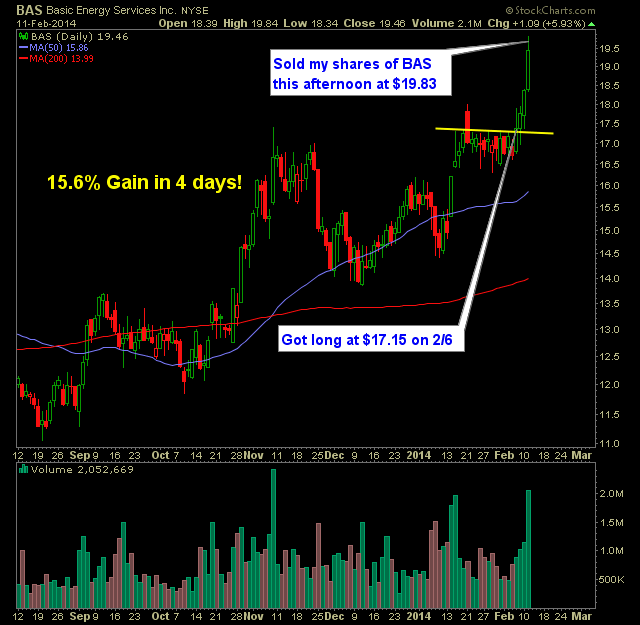

February is off to a great start with 8 positions already closed out amounting to a total of $6,447 in net gains for the portfolio. I still have three positions open in the portfolio also with profits, and will look to add more in the week ahead. With gains of 15.6% in BAS and 10.3%

It was a great day in the stock market but even greater day in the SharePlanner Splash Zone. While I’ve managed to get into positions where I am currently holding gains of 10.9% in SPLK, 6.2% in BHI and 6.5% in MU, they pale in comparison to the trade I closed out today with

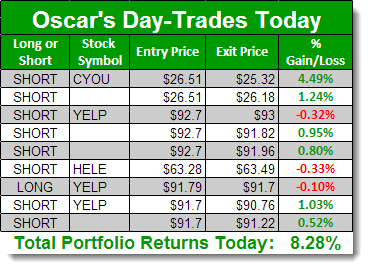

In a low-volume, sideways market, there are still profits to be made. There wasn’t much to work with out there, but nonetheless, opportunities still existed from the 4.5% made in CYOU today as a day-trade to the continuation of gains in our swing-trading in names like Splunk (SPLK) where there is now 7.9% in gains

Here’s tonight’s Watch-List: Long Prologis (PLD

I thought yesterday's profits were awesome.... Until today rolled around and Oscar's live calls in the SharePlanner Splash Zone via our live audio/video broadcast as well as real-time text and email alerts managed to book a solid 3.3% to the portfolio and and $913.38 with returns of 7.3% in IPHI, 6.3% in FURX and again in FURX