The stock market has undergone a dramatic transformation in recent years as millions of everyday investors armed with commission-free apps and social media coordination have become a force Wall Street can no longer ignore. From meme stocks to crypto frenzies, the retail trader is now a key player in market dynamics.

There was a time when the stock market was primarily the domain of institutional investors and wealthy individuals. Professional traders, hedge funds, and large financial institutions dominated the landscape, setting prices and controlling flows. But a perfect storm of technological advancement, regulatory changes, and social factors has fundamentally altered this dynamic, giving rise to what many call the “retail trading revolution.”

I remember when over twenty years ago, I hardly knew anyone that traded stocks, and had only their 401(k) and IRAs to speak of. Now, it’s the new form of sports betting, companies are their new teams, CEO’s are like their favorite football player.

This shift has profound implications for all market participants. Whether you’re a swing trader, long-term investor, or market professional, understanding how retail traders behave and influence markets is now essential knowledge. In this comprehensive analysis, I’ll explore the rise of retail trading, examine key events like the meme stock phenomenon, and share practical strategies for navigating this new landscape.

Retail Trading Revolution: How Commission-Free Trading Changed Everything

The retail revolution didn’t happen overnight, but a few watershed moments accelerated the trend dramatically. Perhaps none was more significant than the elimination of trading commissions.

The Fall of the Commission Barrier

Prior to 2019, most brokerages charged $5-10 per trade – a significant barrier for small investors who might only be trading a few hundred dollars at a time. The math simply didn’t work for frequent trading. But on October 1, 2019, Charles Schwab announced it would cut online trading fees to zero, forcing rivals like TD Ameritrade and E*Trade to quickly follow suit.

This pricing war, sparked by competition from app-based upstarts like Robinhood, suddenly made free trading the industry standard. For retail traders, it was like a starter’s pistol, and the race into the market began in earnest.

Mobile Apps and Gamification

Simultaneously, mobile trading apps were exploding in popularity. Robinhood’s intuitive interface attracted a new generation of investors with its zero-commission model and no account minimums. The growth was staggering as Robinhood’s funded accounts jumped from about 9.8 million in early 2020 to 22.5 million by mid-2021.

Other brokers also reported surges in new accounts. Schwab added 1.37 million new accounts in just the second quarter of 2020, more than the previous six quarters combined. By 2021, retail investors made up roughly 25% of all U.S. stock trading volume, nearly double their share from a decade prior.

These apps didn’t just make trading accessible – they made it fun. Confetti animations for first trades, simple swipe interfaces, and fractional shares allowing users to buy small slices of expensive stocks like Amazon or Tesla all contributed to the gamification of investing. The stock market was becoming a circus show, and the brokers were attracting a bunch of clowns – many of which would end up blowing up their account in short order.

The Pandemic Effect: Stimulus Checks and the Market

While the groundwork was laid in 2019, it was the COVID-19 pandemic that truly supercharged retail trading activity.

Lockdowns and Stimulus Fuel the Fire

When the pandemic hit in early 2020, several factors converged to create a perfect environment for the retail trading revolution to flourish:

- People were stuck at home with extra time on their hands

- Traditional entertainment options like sports and casinos were shut down

- The government sent stimulus checks directly to Americans

- The market crashed in March 2020, creating a “buy the dip” opportunity

- Near-zero interest rates made saving their cash in banks unappealing

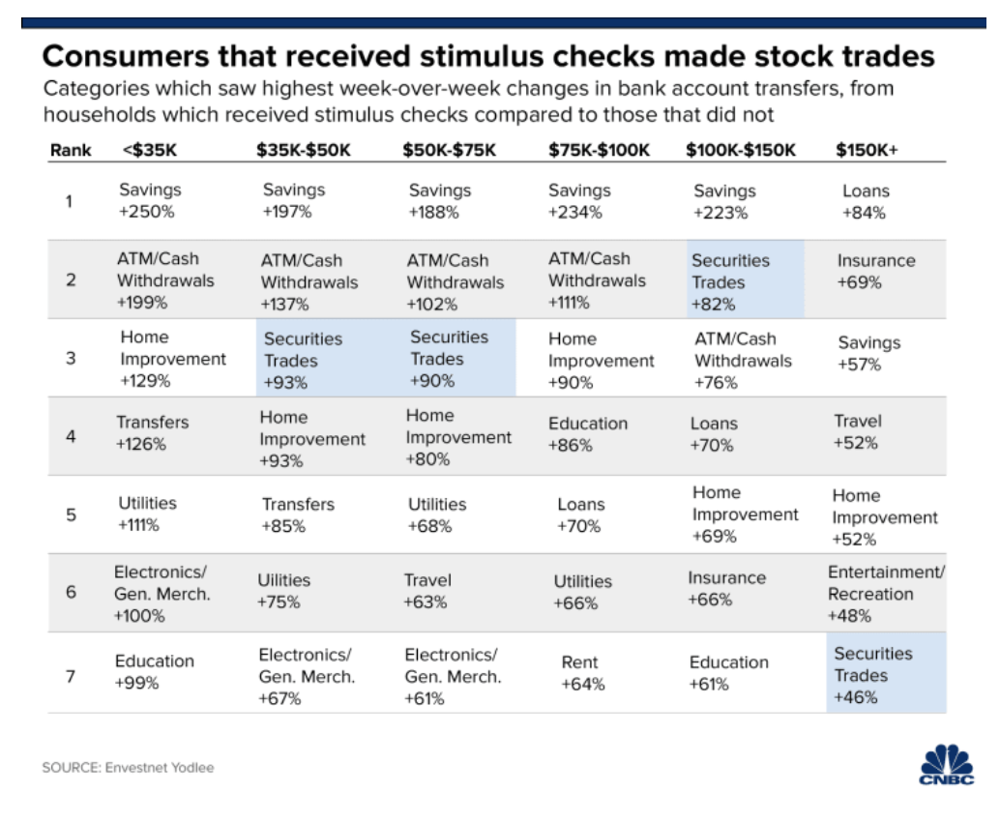

The influx of stimulus money directly boosted retail trading. One study found that after the first stimulus checks in April 2020, households in the $35k–$75k income range increased their stock trading by 90% the following week. Even higher-income households showed an 82% jump in trading right after receiving stimulus funds.

The 2020 COVID Rally

With zero commissions and lots of free time, new retail traders aggressively bought the March 2020 market crash. This wave of dip-buying helped fuel a ferocious rebound. By mid-2020, stocks were hitting new highs even as the economy was still reeling – a disconnect that left many professionals scratching their heads.

Retail traders tended to pile into the big “winners” of the pandemic: high-growth tech names and stay-at-home economy stocks. A Goldman Sachs index tracking 58 stocks popular with retail traders surged over 80% in 2020, far outpacing the S&P 500’s 14.5% gain that year. In other words, the basket of retail favorites (think Tesla, Amazon, Zoom) wildly outperformed the broader market.

A popular mantra emerged among this new class of traders: “stocks only go up”, which was a phrase (and still is) championed by Dave Portnoy as he live-streamed his day-trading exploits during the lockdown. Such was the euphoria among the new retail army.

The Meme Stock Revolution: GameStop and Beyond

The newfound power of retail traders truly made global headlines in January 2021 with the GameStop saga, which was a watershed moment that demonstrated retail traders could shake the foundations of Wall Street itself.

How Retail Traders Rocked Wall Street

GameStop (GME), a struggling video game retailer, was heavily shorted by hedge funds when members of the Reddit community WallStreetBets identified an opportunity. Inspired by discussions on the forum and a sense of “sticking it to the hedge funds,” swarms of retail traders started buying GME en masse, especially call options, forcing hedge funds that were short to cover their positions.

The result was explosive. In less than a month, GameStop’s share price rose over 1,600% – from under $20 to a peak of around $347 by late January 2021. At one point in intraday trading, GME touched $500+ per share. This spectacular spike was almost entirely driven by individual investors banding together, fueled by a mix of greed, stupidity, and internet memes.

Beyond GameStop: The Broader Meme Stock Phenomenon

GameStop wasn’t an isolated case – it was just the flagship of what came to be known as “meme stocks.” Other heavily shorted companies with loyal online followings, like AMC Entertainment (AMC), BlackBerry (BB), and Bed Bath & Beyond, also skyrocketed in sympathy. AMC, the movie theater chain, jumped 200% in the same week GME went parabolic. And the funny thing was, they weren’t even open, they couldn’t show movies because they were on lockdown as well.

The meme stock phenomenon showcased retail traders’ casino-style risk taking. Many were buying call options and pouring life savings into a single volatile stock. Stories emerged of small investors turning a few thousand dollars into hundreds of thousands and then losing it all. Some even took out loans, student loans, and second mortgages and lost that money as well.

For awhile there, it felt like a populist uprising in the stock market: Main Street versus Wall Street. While the meme stock bubble eventually deflated, the episode had a lasting impact. It proved that coordinated retail trading could overwhelm institutional investors, trigger real losses for hedge funds (one prominent fund lost over 50% shorting GME), and create new paradigms of market risk.

The Retail Trader Mindset: FOMO, Dip-Buying, and Casino-Style Risk

To navigate markets influenced by retail traders, it’s crucial to understand their typical behavioral patterns. While every individual is different, in aggregate the retail crowd has shown some distinct traits:

FOMO Trading (Fear of Missing Out)

This is perhaps the hallmark of retail behavior in recent years. When prices are rising, retail traders often rush in because they don’t want to miss the next big win. FOMO can drive parabolic moves – a stock that’s already up 50% in a week might attract more buyers simply because it’s going up.

The danger, of course, is that FOMO buyers are often late to the party and end up buying the top. But that fear of missing huge gains has led many to chase rallies well beyond what traditional valuation would justify.

A JPMorgan study found that investors who started during the 2020-2021 bull market took on much greater market risk in their portfolios than prior cohorts, and although they dialed back after 2021, their risk levels remained elevated into 2023.

The Dip-Buying Reflex

Today’s retail traders are conditioned to “buy the dip” aggressively. After witnessing the V-shaped recovery in 2020 and many rapid bounce-backs since, retail investors tend to view almost any pullback as an opportunity.

This mentality has provided continual support to markets – it’s one reason sell-offs were often shallow or short-lived in 2020-2021. Retail dip-buying has been so persistent that it created self-fulfilling prophecies. However, as some learned in 2022, this strategy can fail in a true bear market.

High Risk Appetite (Casino-Style Trading)

Compared to institutional investors, retail traders generally show a higher tolerance for risk and often lack diversification. Many treat trading like gambling, by placing big bets on speculative stocks or daily/weekly call options that can double or go to zero overnight.

During the meme stock craze, it was common to see posts of people YOLO-ing (You Only Live Once) their entire account on one trade. Options trading boomed among retail because of the allure of huge percentage gains.

A JPMorgan study found that investors who started during the 2020-2021 bull market took on much greater market risk in their portfolios than prior cohorts, and although they dialed back after 2021, their risk levels remained elevated into 2023.

Hype Chasing & Trend Rotation

Retail traders love a good story or hot trend. They rotate into whatever is buzzing on social media, be it electric vehicles, AI stocks, cannabis companies, or the flavor of the month. In 2021 it was meme stocks and SPACs; in 2023 it was AI-related stocks after ChatGPT’s success.

This often leads to crowded trades where many retail investors rush into the same few tickers. The result can be explosive short-term moves followed by sharp reversals when the hype fades.

Beyond Stocks: NFTs and Meme Coins

Stocks weren’t the only assets booming from retail speculation. The retail trader mindset spilled over into cryptocurrency, NFTs, and meme coins as well.

The NFT Explosion

In 2021, alongside meme stocks, there was an explosion of interest in NFTs (non-fungible tokens) – essentially digital collectibles or art on the blockchain. Suddenly, it wasn’t just stocks like GameStop being hyped; people were talking about CryptoPunks, Bored Ape Yacht Club, and NBA Top Shot moments.

The NFT market’s growth was astonishing. In just the first four months of 2021, NFT trading volume exceeded $2 billion – which was 10 times the volume of all of 2020. NFTs went from obscure tech to mainstream buzz in a matter of months, with high-profile sales like the digital artist Beeple auctioning an NFT for $69 million.

Just like with meme stocks, many threw caution to the wind, buying digital assets for thousands or millions of dollars purely because they were going up in value. By late 2021, the NFT bubble showed signs of exhaustion, and eventually trading volumes collapsed (falling over 90% from peak).

The Meme Coin Phenomenon

The meme coin craze is another extension of this trend. Inspired by the original meme cryptocurrency Dogecoin (DOGE) – which itself soared by thousands of percent in early 2021 thanks to retail traders and Elon Musk’s tweets – newer and even more absurd meme coins emerged.

By 2023-2024, coins like Shiba Inu (SHIB), Pepe coin, and others grabbed headlines for massive short-term gains. Perhaps the pinnacle of this was in 2024 with coins like “Fartcoin” breaking into the top meme cryptocurrencies by market cap, surging to over $1 billion in value.

The idea that a coin named “Fartcoin” could be worth over a billion dollars underscores the speculative excess that retail traders were willing to indulge in (and believe me, there were far worse names that “Fartcoin”). Whether in stocks, crypto, or digital art, the mindset was the same: jump on the hottest trade, ride the momentum, ignore traditional valuation, and hope to sell before the crash.

Retail vs. Institutional Traders: A Fundamental Difference

Understanding how retail traders differ from institutional investors helps explain many market dynamics we see today:

Decision-Making Process

Retail traders often make decisions based on personal intuition, internet research, or tips from social media. The process can be fast and loosely structured – a retail trader might buy a stock within minutes of seeing a tweet or TikTok about it.

In contrast, institutional investors typically follow a more rigorous process with research teams, risk managers, and investment committees. This can make institutional decision-making slower or more methodical – sometimes missing fast-moving opportunities that nimble retail traders jump on.

Risk Management

This is a significant difference. Institutions usually have formal risk management protocols with position size limits, stop-loss levels, and portfolio diversification rules. A hedge fund manager must answer to clients if a trade goes wrong.

Retail traders, using their own money, have the freedom to throw caution aside – and many do. This explains why retail accounts sometimes experience dramatic blowups; there’s often no one to tell an individual “you’re overleveraged” until it’s too late.

Time Horizon

Retail traders typically operate on shorter timeframes – many look for quick swing trades or even day trades. They might measure success in terms of daily or weekly gains.

Institutional investors often work on longer horizons – quarters or years – especially in the case of mutual funds and pension funds investing for long-term growth. This difference in time horizon can create interesting market dynamics when both groups are active in the same securities.

How Retail Flows Changed the Market

The retail trading revolution has fundamentally altered market structure in several important ways:

Higher Volatility in Individual Stocks

With swarms of retail traders able to mobilize quickly, individual stocks can see outsized moves more frequently. Stocks that get popular on Reddit can gap up or down 20-30% in a single day – moves that used to be rare outside of earnings reports.

The casino-like flows from retail (especially via options) have also contributed to phenomena like gamma squeezes, where market makers hedging retail option trades further propel stock moves.

Extended Rallies and Deeper Corrections

Retail momentum can sustain trends longer than many expect. When retail traders collectively believe a stock is “going to the moon,” they can keep bidding it up beyond rational valuation.

This led to overextended rallies in stocks like Tesla (which soared roughly 10x from late 2019 to late 2021). On the flip side, when bubbles pop, they can crash hard – as seen with many speculative stocks in 2022 dropping 70-80% or more.

Sentiment as a Driving Force

Perhaps the biggest structural shift is that market sentiment indicators (like social media trends or Google search trends) have become critically important. In the past, one could focus heavily on earnings, economic data, and institutional fund flows.

Now, ignoring retail sentiment can be a costly mistake. The market has become more of a popularity contest in the short term – stocks that capture the public’s imagination can disconnect from fundamentals for extended periods.

Retail Trading Revolution Resurgence: The 2023-2024 Rally

After the wild ride of 2020-2021, the retail trading revolution showed some signs of cooling in 2022 when the market took a bearish turn. But retail traders have proven remarkably resilient.

By 2023 and 2024, the “retail army” was still a major market player and ready to jump in on dips and chase new rallies. For instance, in early 2024, stocks mounted a significant rally, and retail investors poured in to chase the upside.

Data from Bank of America noted that its private (retail) clients went on a record buying streak. By early 2025, BofA’s private clients had been net buyers of equities for 21 consecutive weeks, the longest uninterrupted buying streak in their data going back to 2008.

This resurgence was evident in what some dubbed the “April 2024 rally.” Retail traders appeared eager not to miss another bull run, having seen stocks recover from past dips. Fear of missing out (FOMO) likely played a role – as the market gained in early 2024, those who had sat on the sidelines in 2022 didn’t want to be left behind.

Swing Trading Strategies for a Retail-Driven Market

As a swing trader myself, I’ve adapted my approach to account for the new retail-driven dynamics. Here are practical strategies for navigating this environment:

Always Focus on Risk/Reward

In a frothy market, it’s easy to get swept up in the excitement of a hot stock. But risk management must come first. Before entering any trade, define your risk (where you’ll cut losses) and your potential reward target. Ensure the reward-to-risk ratio is favorable (e.g., aiming for $2 upside for each $1 of downside risk).

This principle doesn’t change, even if “everyone” on Reddit says a stock is a sure thing. As I often say: manage the risk, and the profits will take care of themselves. And don’t trade position sizes that you can’t manage your own emotions on (i.e. “going all-in!”).

Avoid Chasing Parabolic Moves

If a stock has already gone parabolic (straight up) on retail hype, resist the urge to jump in late. FOMO trading is a primary cause of losses. Often, by the time you hear everyone talking about a stock, the easy money has been made.

Instead of buying high in a frenzy, either wait for a pullback to support or look for the “next” opportunity that hasn’t been discovered yet. Remember, there will always be another opportunity tomorrow. It’s better to miss a few rockets than to become a bag-holder when the music stops.

Use Technical Analysis to Gauge Entries/Exits

In emotionally charged markets, technical analysis helps to clear up the picture and eliminate the noise and emotion of trading. Crowds tend to react at obvious technical levels (support, resistance, trendlines) even if they don’t realize it.

Keep an eye on volume patterns – a surge in volume can confirm a retail-fueled breakout, while a climax in volume might signal a blow-off top.

Don’t Fight the Trend (But Know When It’s Exhausted)

When retail money is flowing strongly into the market, it can create powerful uptrends. It usually pays to trade in the direction of those flows. Fighting a retail-driven rally by shorting too early can be painful (trust me, I know all about this!) and plenty of seasoned short-sellers learned this in 2020-2021.

As a swing trader, you can ride the trend but keep raising your stop-losses to protect profits as prices start mooning, and don’t be afraid to take partial profits. And if you have conviction that a move is a bubble, it’s okay to step aside rather than short it too early. Cash is a position too.

Tune Out the Noise and Stick to Your Plan

In the age of social media, one of the biggest challenges is constant noise. You’ll hear hundreds of opinions daily on Reddit, Twitter, Discord – it can be overwhelming and lead to second-guessing your trades.

While it’s good to be aware of retail sentiment, don’t let the crowd override your trading plan. If you entered a trade with a plan (entry, target, stop) based on your analysis, stick to it. Don’t suddenly sell just because someone tweeted a bearish take – and don’t hold longer than planned because forum users insist the stock is going higher.

I often remind traders: the market will always test your emotional control. Those who can keep emotion at bay and execute their strategy systematically will outperform those swayed by every twist of crowd sentiment.

A New Normal?

The rise of the retail trader has undeniably reshaped the stock market landscape. We’ve gone from a market dominated by institutions to one where “the little guys” collectively wield significant influence.

These retail investors bring high energy and risk appetite, driving trends that can confound traditional analysis. Their behavioral patterns add both liquidity and volatility to markets. We’ve seen them behave at times like a massive crowd of momentum-chasers, at other times like stubborn contrarians who won’t sell despite warning signs.

For swing traders and market participants, this new normal means we must pay attention to market sentiment and retail flows as much as we do to earnings and economic data. It means strategies must account for sudden retail-driven moves, both up and down.

Importantly, it reinforces age-old lessons about risk management: when irrational exuberance is in the air, disciplined trading is your anchor. The market can feel like a casino when everyone around you is gambling, but you don’t have to play that game. You can profit from the opportunities the retail wave creates while still practicing sound strategy.

The retail trader revolution is likely here to stay. The faces may change with each generation, and the hot assets will evolve, but the idea of the individual trader moving markets is now an integral part of the ecosystem.

If you’re an average trader, not a pro, know that you are part of a formidable collective that can move mountains, but that cuts both ways. Trade smart, swing trade with a plan, and don’t let the crowd dictate your fate. Don’t let them influence your trading decisions. In this market, knowledge and discipline are the edge that will set you apart.

Become part of the Trading Block and get my trades, and learn how I manage them for consistent profits. With your subscription you will get my real-time trade setups via Discord and email, as well as become part of an incredibly helpful and knowledgeable community of traders to grow and learn with. If you’re not sure it is for you, don’t worry, because you get a Free 7-Day Trial. So Sign Up Today!

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Trading what you see and not what you think is one of Ryan's popular trading expressions that he has lived by in his 30 years of trading experience. In this podcast episode Ryan explains why it is so important to not think your way through the market but to be a trader who sees what to trade and reacts accordingly. If you are struggling as a trader, it may very well be that you aren't seeing but thinking your way through your swing trades.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.