This market is the lurking evil that you don’t know exists until it is to late! It gives you just enough reason to get bullish, and when you think the coast is clear, the market reverses to the downside. Then when the market breaks that key level of support, it sucks you into the short

Trading would be pretty simple quite honestly if one could remove the human aspect out of it all together. In all my years of trading, the one thing that hampers traders more than anything else, is the inability to get out of their own way and trade the charts for what they are. Instead, ego,

Yesterday, as the markets were running away and pushing higher, a lot of traders took to social media calling for new market highs, and the end of sense-less "fear-mongering". But they made one mistake - they didn't respect the risk that was inherent still in the market. I personally have not held a single long

Above all else, I wait for the right setup to come along and take advantage of it in the right market conditions. Chasing rallies with long positions when the market is overbought, and pursuing downturns with new short positions when the market is clearly oversold is simply not for me. The sell-off that started

One of the best kept secrets out there is a service that gives its subscribers profits from trading month after month, after month. It's not sexy, and it doesn't give you that adrenaline rush that other newsletters provide you with. But on the other hand, it doesn't oversell itself, it's never needed to pay to

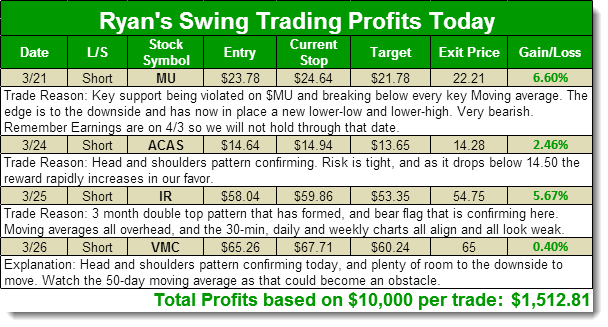

A Success March that Far Out Paced the S&P 500 Add another $5,652.44 to the year’s gains! Below you will find that I took 28 trades in the month of March but those 28 trades far outpaced the returns of the S&P 500 by 307%. This was one of the more non-eventful and sideways markets

Another Day of Profit Taking in the Splash Zone Despite a sideways market for all of March, and a flat market on the year, traders in the SharePlanner Splash Zone are having yet another profitable month. Today alone, I closed out four positions totaling over $1,500 profits using $10,000 position sizes. I am letting the

Patience is the number one ingredient that is required when trading stocks – especially during the month of March where stocks have been extremely non-committal in general. The S&P 500 has for seven straight days struggled with breaking through 1873. Today, it tested it and decided to drop hard and fast, falling 23 points off

There are a couple of things that seem to trip up traders the most. The first one is when there is a transition underway in the market from a bullish scenario to a bearish outlook or vice versa. The second comes in the form of when you have an extended period of choppiness. Right now

For the first two-and-a-half months of 2014 the stock market has been anything but reliable. January stocks were down, in February they were up, and March they have been trading breakeven. With that said, the S&P 500 was down on the year, until today, the Nasdaq and Russell are in positive territory, and the DOW