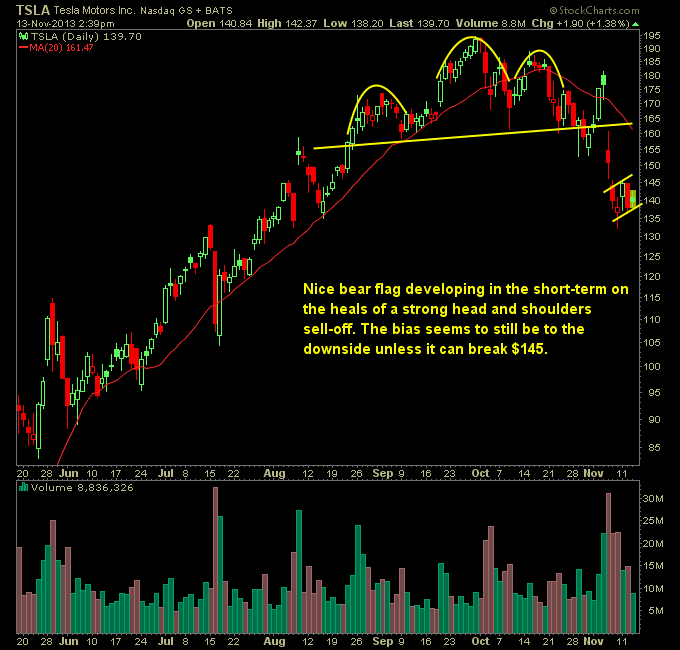

The ride down in Tesla (TSLA) has been great, and I won’t rule out that it may have more room to go, but at this point, the easy money has been made. I’d cover any short exposure you may have in the stock as the head and shoulders pattern has reached beyond its traditional target. It’s definitely

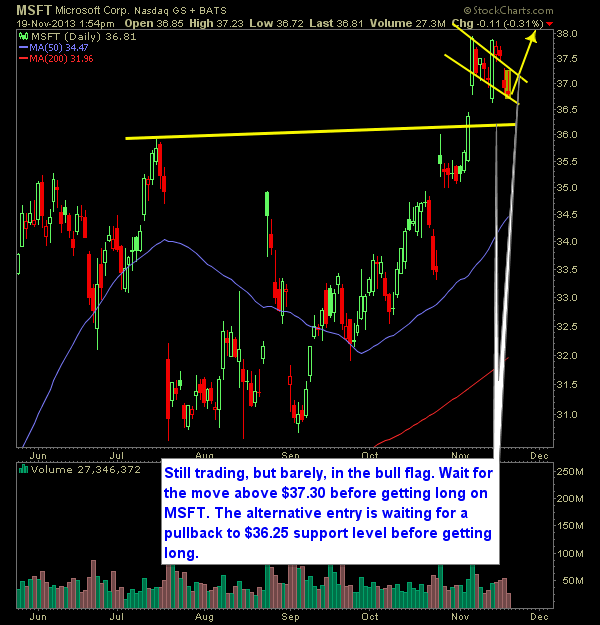

Microsoft (MSFT) is still trading, but barely, in the bull flag that I’ve been outlining for a couple of weeks now. Wait for the move above $37.30 before getting long on MSFT. The alternative entry strategy is to wait for a pullback to the $36.25 support level before getting long. Overall, I consider MSFT

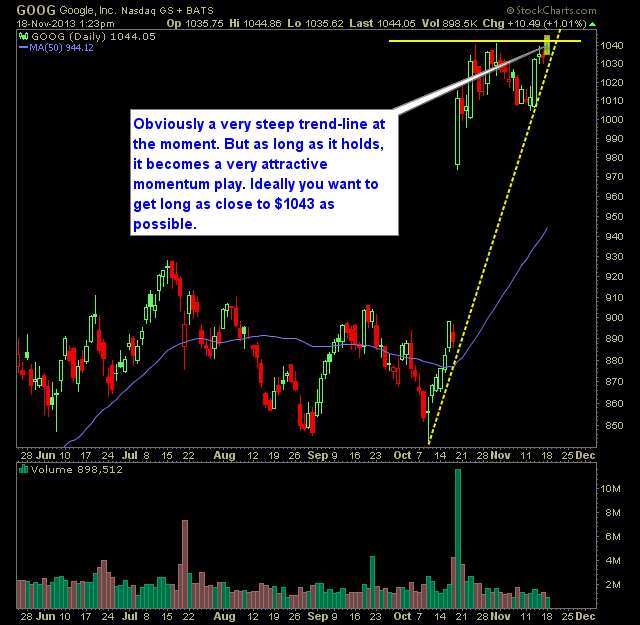

Obviously a very steep trend-line at the moment. But as long as it holds, it becomes a very attractive momentum play. Ideally you want to get long Google (GOOG) as close to $1043 as possible. Which is right about where it is currently trading. I’m honestly surprised it is doing this well. Last week,

We had a solid week in the SharePlanner Splash Zone!!! For starters, the swing-trading continues to lock in profits and move from trade to trade in a market that until Thursday was trading in a sideways manner. With that said, the Swing-Trading Portfolio is now up over $3,500 in gains for the month of November

Big move for Citigroup (C) today as it breaks out of the triangle pattern to the upside. Above $51.50 should attract additional buyers as well. There continues to be a huge level of support for the stock at the 200-day moving average, so that any move below it, should be a strong reason to exit any longs

I came across this video that was sent to me earlier this week and found it mesmerizing. I have long-time been a fan of Billy Beane’s “Moneyball” concept and how he manages his baseball team, Oakland Athletics, from a general manager stand point. I’ve never seen those same concepts applied to the sport of football

Nice bear flag developing in the short-term on the heals of a strong head and shoulders sell-off. The bias seems to still be to the downside unless it can break $145. Above $145 and you may have a runner. If it breaks $145 don’t hold any long positions beyond $165 as it could simply be

Here’s my apperance today on First Business News:

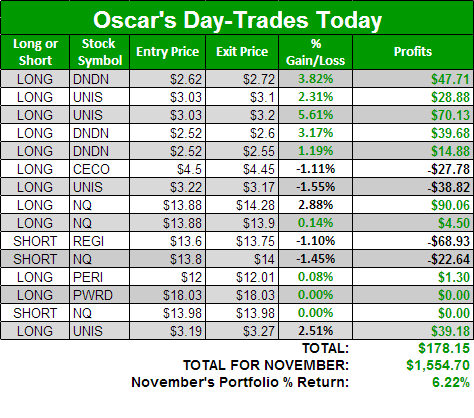

In terms of overall direction, the market continues to be mum in the short-term. However, that doesn’t stop us from trading and profiting in the process. It was a solid day both for swing-trading and day-trading. I managed to close out one of my positions in JWN for a 2.69% gain and an additional $538.