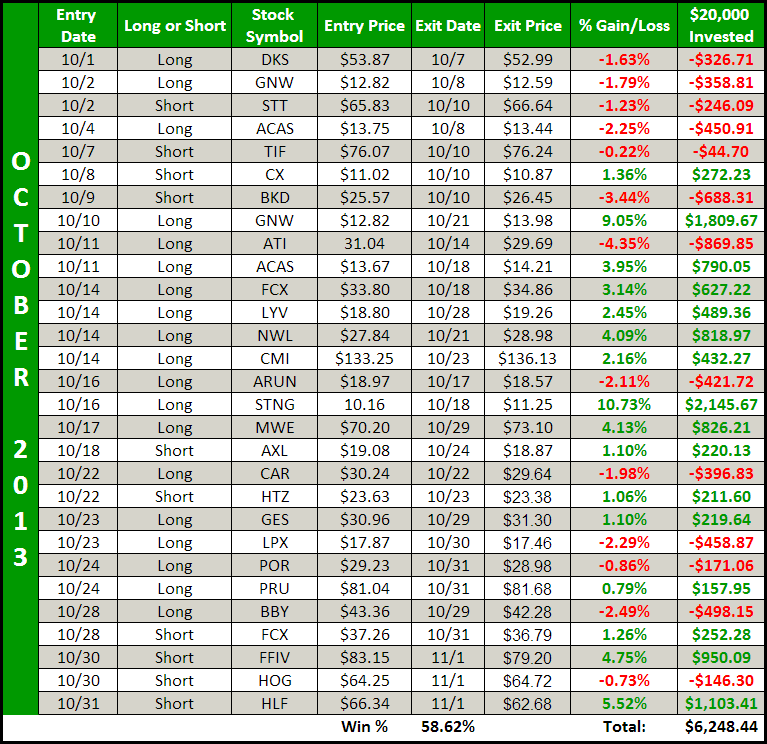

Folks - it was another outstanding month for the SharePlanner Splash Zone. For today I'll focus on the Swing-Trading results and come back at you with the October Day-Trading results that Oscar posted, tomorrow. Yes - that was a bunch of nice trading both to the long and short side, and if you are tired

Not slicing through the 10-day moving average is a bit warning sign that we may see some more upside movement out of this market – much like we saw back in July. While I was bearish on this market for most of this week, I’m quickly losing patience waiting for the bears to drive this

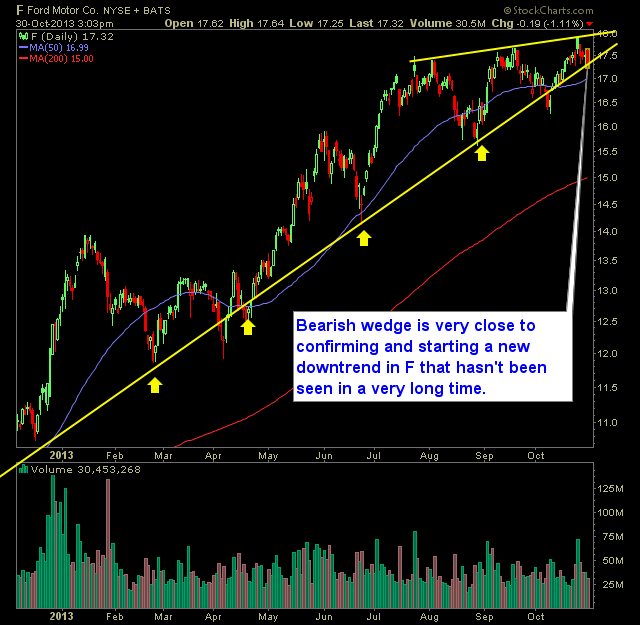

Bearish wedge is very close to confirming and starting a new downtrend in Ford (F) that hasn’t been seen in a very long time. Once the uptrend breaks it is an ideal short setup with minimal risk as you would place a stop at the highs. Here’s the F Technical Analysis:

Cisco (CSCO) is heading straight for $21 after retesting the downward trend-line off of the August highs. Also there is a still a huge gap to fill there as well. Then and only then would I entertain the prospect of a long position in CSCO.

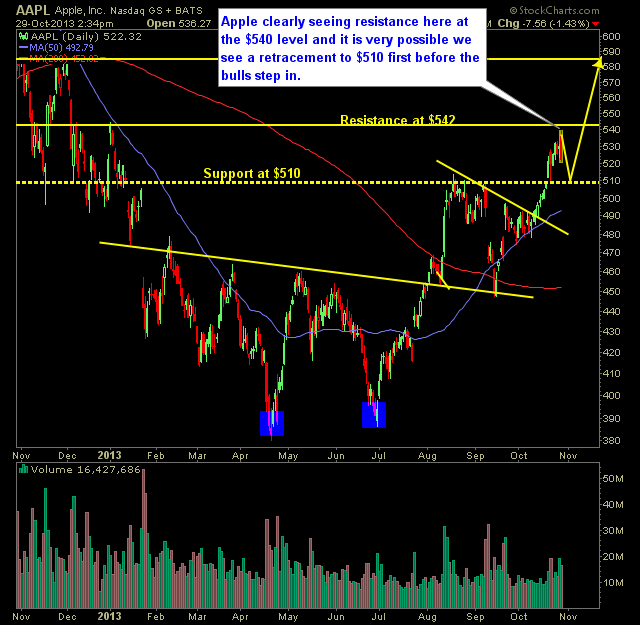

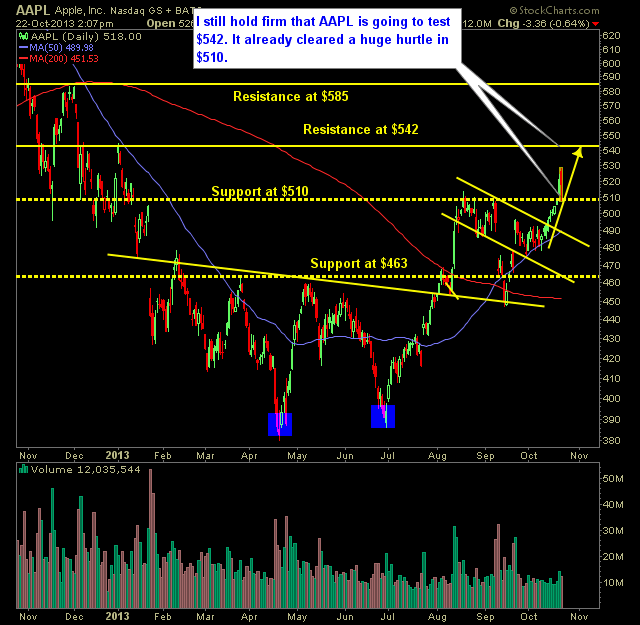

Apple (AAPL) reports earnings and it’s up, it’s down, and it’s all around. But ignore all the gyrations, the noise and hype surrounding the stock and stick to what we know: The stock was rejected at the $540 resistance level and has heavily sold off since. That leads me to think that the stock is

Triple bottom bounce play here in Molycorp (MCP). I like the setup enough to where if it can bounce off of the $5 level like it is doing today and get some follow through tomorrow, we could be seeing the potential for $6/share at which point it could have fill that massive gap from earlier

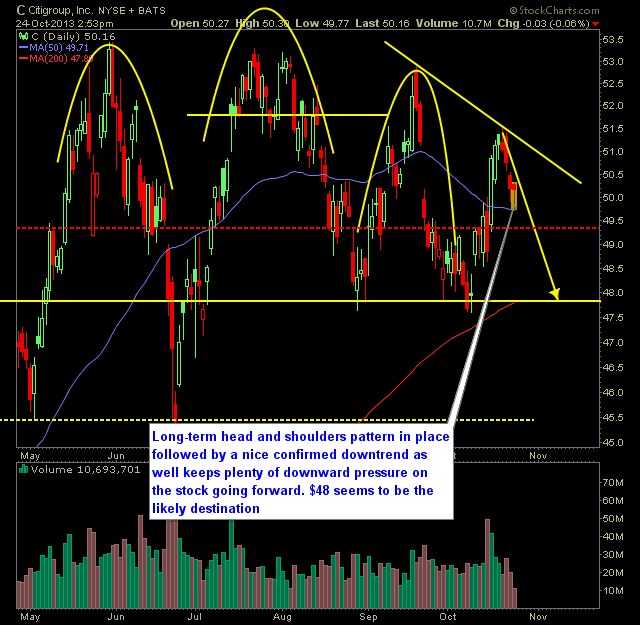

Long-term head and shoulders pattern in place followed by a nice confirmed downtrend as well keeps plenty of downward pressure on the stock going forward. $48 seems to be the likely destination Here’s the technical analysis:

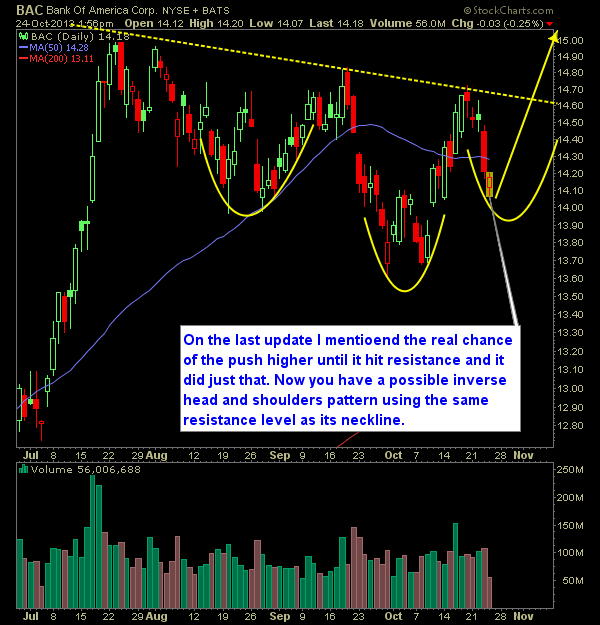

On the last update I mentioned the real chance of the push higher until it hit resistance and it did just that. Now you have a possible inverse head and shoulders pattern using the same resistance level as its neckline. Stay patient with the trade setup but it should happen. Here’s the BAC technical

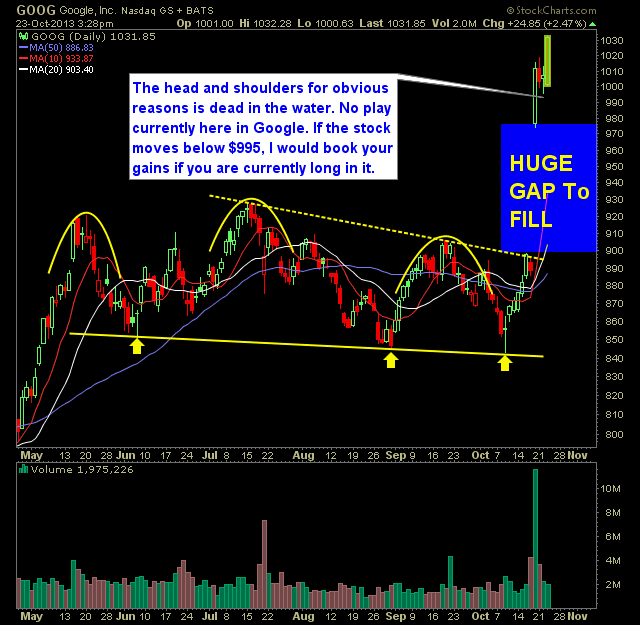

The head and shoulders for obvious reasons is dead in the water. No play currently here in Google. If the stock moves below $995, I would book your gains if you are currently long in it. Here’s the technical analysis on GOOG:

I still hold firm that Apple (AAPL) is going to test $542. It already cleared a huge hurtle in $510 and that was a big deal with a ton of resistance. Whether it can hit $585 or not will all depend on how the earnings report goes. Personally, I think Steve Jobs would flip