Technical Analysis: The Federal Reserve raised interest rates yesterday by a quarter point. Initially the S&P 500 (SPX) tried to rally on the news but quickly gave up its gains on the day to finish 0.8% down on the day. SPX also managed to close below its 5-day moving average for the first time since 12/2

Technical Analysis: The S&P 500 (SPX) keeps marching higher with little resistance to counter its momentum, rising another 14 points towards the goal of 2300. Even more so, the Dow Jones Industrial Average (DJIA) is up 22 of the last 26 days (over 84% win rate) and has made new all-time highs 7 days in a row. Despite

Technical Analysis: S&P 500 (SPX) experienced a light amount of selling yesterday, forming a doji candle pattern after establishing intraday all-time highs, yet again. The Dow Jones Industrial Average (DJIA) is up 21 of the last 25 days (84% win rate). It was the only index among the big four that finished higher yesterday. The Federal

Technical Analysis: S&P 500 (SPX) put together another strong rally, but under the surface, there was some signs of deterioration in the quality of the rally with the breadth to the upside being slightly outdone by declining issues. Typically, on a day like Friday, advancing issues should be rising on a 2:1 clip, at least.

Technical Analysis: S&P 500 (SPX) put together another strong rally, but under the surface, there was some signs of deterioration in the quality of the rally with the breadth to the upside being slightly outdone by declining issues. Typically, on a day like Friday, advancing issues should be rising on a 2:1 clip, at least.

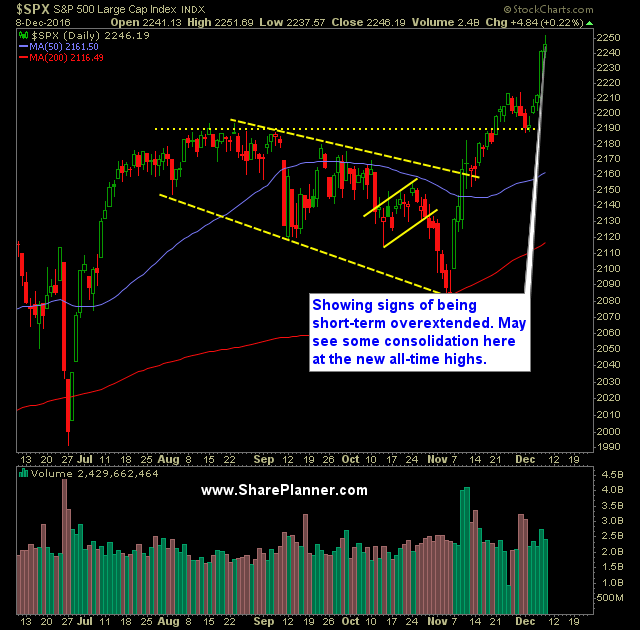

Technical Analysis: S&P 500 (SPX) rallied for a fifth straight day this week and well overextended. Still the market continues to rally. Volume on SPDRs S&P 500 (SPY) was once again above average and strong, though not to the same extent seen on Wednesday. Amazingly, SPY has been up 17 of the last 23 days since

Technical Analysis: Wow, what a rally, yesterday. Honestly, I don’t think anybody came into the trading day thinking that the Dow Jones Industrial Average (DJIA) would pop off 300 points or that the S&P 500 (SPX) would rally nearly 30 points. Nonetheless it did, and is why you always have to be prepared for any and all situations as

Technical Analysis: Third straight day of higher gains for S&P 500 (SPX) after successfully holding support at the 2190 level. An intraday test of the 10-day moving average resulted in an immediate surge in price that lasted throughout the rest of the day for SPX. Russell 2000 (IWM) saw record highs yesterday after completely erasing a 5-day decline

Technical Analysis: The S&P 500 (SPX) did little to nothing on Friday as price maintained the status quo while also upholding support at the August 2016 highs. There exists still the potential for a test of the 20-day moving average. Volume on SPDRs S&P 500 (SPY) fell for a second consecutive day, and came in below recent averages.

Technical Analysis: A rare day of near-unabated selling yesterday in the S&P 500 (SPX), that saw the index drop a resound 7.7 points! (gasp!) All kidding a side, you have the 5-day moving average starting to tilt lower, as well as the 10-day moving average being broken in a convincing manner. Good chance at this point,