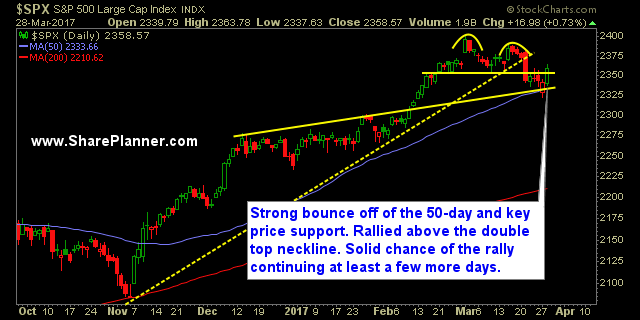

Solid bounce yesterday, but can the markets today follow through? For many years now, when we see the dead cat bounce come about, stocks overall will look to continue the bounce for several days going forward. For the markets today, will that ring true yet again? The futures are slightly down, but that has

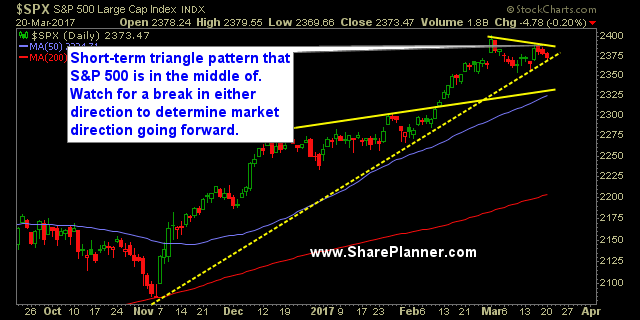

Short-term triangle pattern on SPX SPX has been coiling in a triangle pattern the past three weeks now, or essentially, this entire month of trading. It has pulled back to the rising trend-line that forms the bottom half of the triangle pattern. However, it has only experienced a mild, light volume pullback over the past

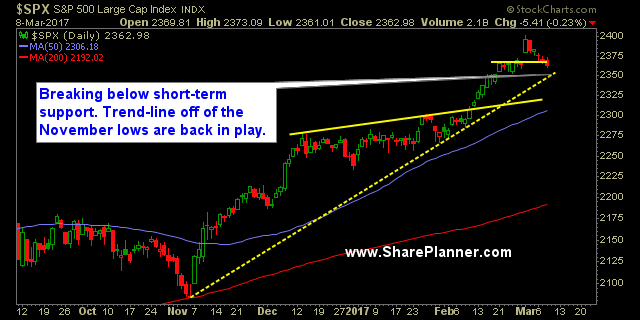

Watch the trend-line on the chart of the S&P 500 A lot can change here today or this week if the rising trend-line as noted in the chart of the S&P 500 below fails to hold. You have a potential topping pattern – emphasis on “potential” – with a new all time high that was

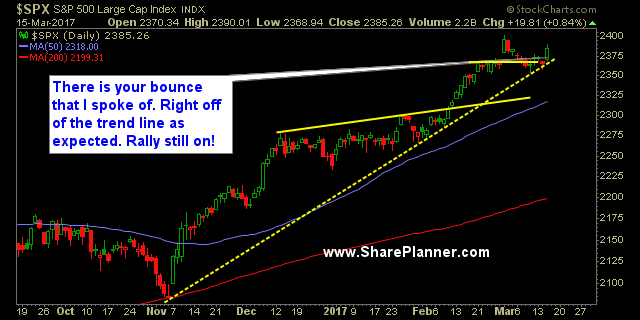

The Fed Up Rally Takes Price Back to Almost All-Time Highs Of couse I am using a play on words as this Fed Up Trump Rally is hated and despised by most and defies the logic of investing in general. I mean, c'mon it has been since last October - almost a half of a

Technical Analysis of the S&P 500's current stock trend remains in tact That doesn't necessarily mean that all the stocks out there are holding it together because most of them are not. But the large caps, the ones that really drive the market's direction, like Apple (AAPL) for instance, is still holding it together and

Stock TA Diverging Hard from Market Price Action The price action is dull in the overall market, and while the price on the indices still hovers at the all-time highs, the TA of stocks (technical analysis) continues to falter under the surface. Breadth is dismal, and without a catalyst to continue pushing the market higher

Trading the 3:30 Ramp Okay so the headline might be a bit of an exaggeration but the past two trading days, when 3:30pm eastern typically triggers an end of day run, the exact opposite has happened where stocks start to slide out of absolutely nowhere. Perhaps it is just a temporary thing, but one can’t

My Trading Journal for the DJIA Today: Nasdaq still doesn't look so bad, Russell index does look pretty rough, the S&P 500 is giving up all of Wednesday's market rally, but the DJIA today managed to hold that 10-day moving average with a three day pullback that was quite shallow in nature. If it holds tomorrow,

My Trading Journal for the Stock Market Today: SPX did what it does best following a morning sell-off, and that is, to buy the freakin’ dip. (‘BTFD’ for those looking to add another acronym to their life). Support that I marked in the chart below on yesterday’s trading plan identified this as a potential bounce area.

My Trading Journal for the Stock Market Today: Futures pointing lower, markets like the dip still. It seems like a recipe for a buying opportunity, but remaining disciplined in an undisciplined trading environment still requires that you maintain stops, keep them manageable, and don't come unglued when the market does not act the way you expect