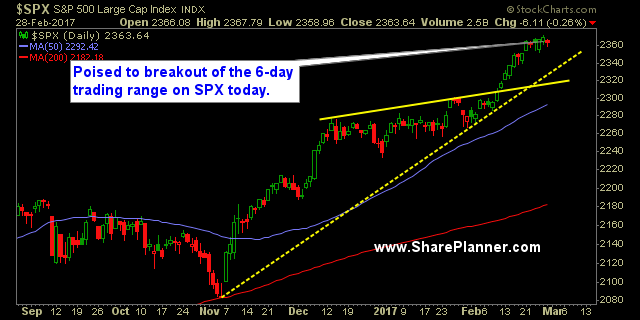

My Trading Journal for the Stock Market Today: I’m not talking about the speech itself, though I did think the speech was a pretty darn good one, and blew away everyone’s expectations. But I am talking about whether the Trump Rally itself can follow through into additional gains tomorrow. History says, “Sure”. I mean C’mon, the

Technical Analysis: The S&P 500 (SPX) took a breather yesterday when it decided to sell-off ever so slightly. The 5-day, 10-day and 20-day moving averages on SPX are converging and offered an excellent support level for the bulls to bounce off of yesterday. Watch that level of support, again today. Light Sweet Crude Oil Futures (/CL) still

Technical Analysis: A much cleaner trading session for the bulls, as the market opened and rallied higher on the day, leaving little doubt as to who was in control during the session. Biotechs saw a solid push higher yesterday which provided the market with a solid floor to work from. Nasdaq (COMPQX) looked re-energized

Technical Analysis: Volatile trading session to start the year with the initial gap up being all but squandered before the end of day rally restored much of the day’s morning gains. This was the first time S&P 500 (SPX) has traded higher during the “Santa Rally”. Today will be the last day of this rally –

Technical Analysis: A dour way to end 2016 on a 3-day losing streak for the S&P 500 (SPX). The last three times, the month of January has finished lower. It has yet to do so four straight months. But as we have seen plenty of times before, the market has no problem doing something for

Technical Analysis: A sell-off yesterday that was hardly a sell-off for the S&P 500 (SPX). Price fell by 0.66 points or 0.03%. Essentially it was a day of sideways price action. SPX found support right at the 20-day moving average yesterday by forming an indecisive doji candle just above it. Volume fell off some yesterday

Technical Analysis: The S&P 500 (SPX) jump started the Santa Rally with a hard sell-off yesterday that sent equities reeling nearly 1% and to the lower end of the short-term trading range. Price broke the 5-day and 10-day moving averages and threatens to test the 20-day moving average today. This is the strongest sell-off seen since the

Technical Analysis: Yesterday marked the twelfth consecutive day in which S&P 500 (SPX) was stuck in a sideways trading range of 29 points. Today is the beginning of the 5-day trading even traditionally known as the Santa Rally, which encompasses the last three trading sessions of the year and first two trading sessions of the new year.

Technical Analysis: Quiet day yesterday for the stock market as the S&P 500 (SPX) pulled back a meager 5 points. Volume on SPDRs S&P 500 (SPY) was dropped significantly from the previous day’s reading and was well below recent averages. You can expect even lighter volume today and tomorrow as more traders leave for the Christmas holiday. Price

Technical Analysis: The S&P 500 (SPX) exhibited dull price action but nonetheless managed to rally higher yesterday and out of the bull flag it had been trading in the previous few trading sessions. Volume on the SPDRs S&P 500 (SPY) dropped off just a smidge yesterday and remains below average. The drop off in the last two days