Technical Analysis:

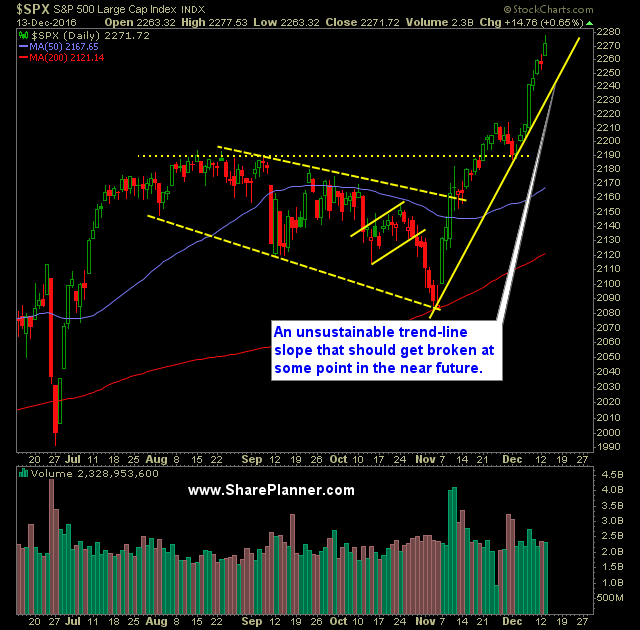

- The S&P 500 (SPX) keeps marching higher with little resistance to counter its momentum, rising another 14 points towards the goal of 2300.

- Even more so, the Dow Jones Industrial Average (DJIA) is up 22 of the last 26 days (over 84% win rate) and has made new all-time highs 7 days in a row.

- Despite all of this bullish price action, you have the VIX that has risen for the fourth time in the last five days, and breadth in the market isn’t resoundingly strong.

- Today the Federal Reserve will likely announce a rate hike in its FOMC Statement at 2pm eastern, followed by a press conference with Janet Yellen at 2:30pm eastern. Expect there to be some volatility in price movement for the stock market.

- Last year when the FOMC announced its expected rate hike on December 16, 2015, the market actually rallied hard that day, but the two days that followed resulted in a sharp sell-off.

- Volume on SPDRs S&P 500 (SPY) saw an increase in its volume for a second consecutive day as well as above average volume overall.

- If there was ever a moment for a blow-off top, a buy-the-rumor, sell-the-news kind of price action, this would be it. The banks and the market as a whole has largely priced in a rate hike, so it would not surprise me at all, if we eventually see a sell-off reminiscent to the sell-off we saw in December last year.

- Light Sweet Crude Oil Futures (/CL) has struggled to move beyond the trading range of the past two days, and stands to sell-off some today. Some retraction in oil prices is likely a given at this point in time.

- Nasdaq (COMPQ) decided to get be a market leader once again, and the main reason for yesterday’s broad market strength.

- Though it went through the end of the day ritual of getting pummeled prior to the close, the CBOE Market Volatility Index (VIX) still managed to close higher on the day. At this point, there is a divergence in equities and the price action I am seeing on VIX, but it is not drastic enough to do anything with at this point.

- SPX 30 minute chart remains very much overextended. That is really all you can say about it at this point.

My Trades:

- Sold eBay (EBAY) at $29.98 yesterday for a 0.5% profit.

- I did not add any additional positions ot the portfolio.

- I may look to add some new swing-trades to the portfolio, following the FOMC Statement today.

- I am currently 30% Long / 10% Short / 60% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.