Technical Analysis:

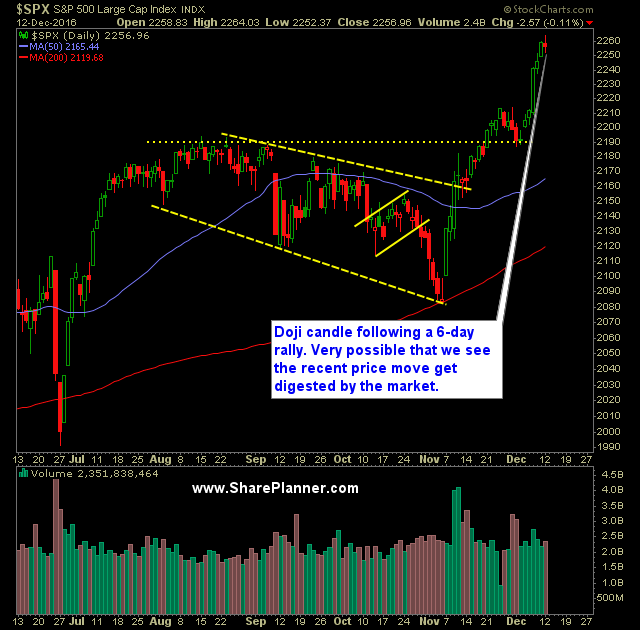

- S&P 500 (SPX) experienced a light amount of selling yesterday, forming a doji candle pattern after establishing intraday all-time highs, yet again.

- The Dow Jones Industrial Average (DJIA) is up 21 of the last 25 days (84% win rate). It was the only index among the big four that finished higher yesterday.

- The Federal Reserve will release its FOMC Statement tomorrow, which is almost certain to raise interest rates. The market has rallied very hard over the past month – in particular with the banking sector. If there was ever a moment to be concerned with a “sell-the-news” moment for the market, this would be it.

- That doesn’t mean we’ll see the markets sell-off, but the possibility of it happening is greatly enhanced, especially when you consider how much the market sold off last year following the December rate hike.

- I don’t plan to go into the FOMC Statement with a strong bias.

- The CBOE Market Volatility Index (VIX) popped 7.6% yesterday and is higher 3 out of the last four days, indicating some concerns for the market under the surface.

- Light Sweet Crude Oil Futures (/CL) looks to continue yesterday’s rally. Though it gave back a good chunk of yesterday’s gains, it still managed to trade at its highest level since July of 2015. Careful, considering yesterday’s candle, that you could be seeing a blow-off top unfolding.

- SPX 30 minute chart is showing some signs of slowing down as it manages to consolidate yesterday, following the major move of the past week.

- Weakness in tech, relative to the rest of the market is still apparent and real.

- Volume on SPDRs S&P 500 (SPY) picked up some steam yesterday with trading volume coming in above average.

My Trades:

- Sold Suntrust Banks (STI) at $54.18 on Friday for a 1.7% profit.

- I added a short position as a hedge against my existing long positions.

- May look to add some additional short exposure as a hedge against current positions.

- I am currently 40% Long / 10% Short / 50% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.