Technical Analysis:

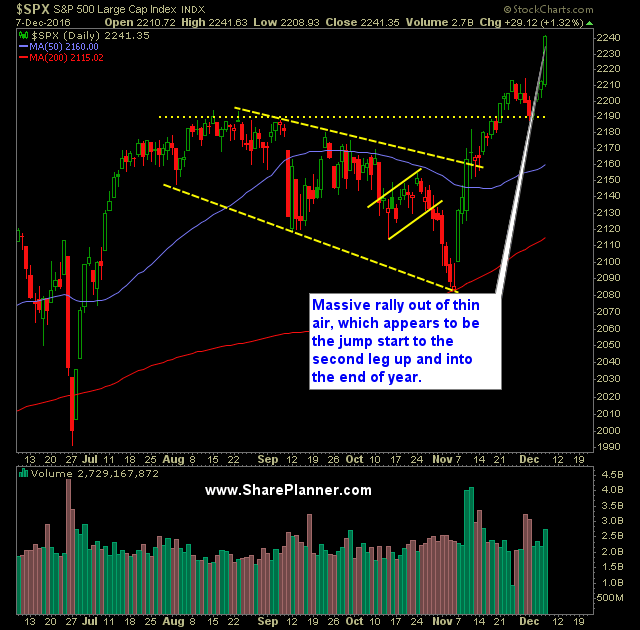

- Wow, what a rally, yesterday. Honestly, I don’t think anybody came into the trading day thinking that the Dow Jones Industrial Average (DJIA) would pop off 300 points or that the S&P 500 (SPX) would rally nearly 30 points. Nonetheless it did, and is why you always have to be prepared for any and all situations as it pertains to the stock market.

- Volume on SPDRs S&P 500 (SPY) came in strong yesterday and well above recent averages, which helps confirm the validity of the move from yesterday.

- Breadth was solid yesterday, however, there was an anomaly with the CBOE Market Volatility Index (VIX) where despite the huge market rally, it rallied hard off of the intraday lows to finish 3.7% higher on the day.

- Strong improvement in the T2108 (% of stocks trading above their 40-day moving average), with a reading of 72%. Ideally it needs to move back above the 80% level.

- 30 minute chart of SPX is straight parabolic and could use a little bit of time to work off the intraday overbought conditions.

- 3 out of 4 indices hit new all-time highs yesterday, with Nasdaq (COMPQ) only being a breath away from following suite.

- As I’ve said before, oil only matters when it is rallying. When it sells off, it completely shrugs off its impact on the economy.

- The Federal Reserve has no choice but to raise rates next week. They are out of excuses and have put themselves into a corner. So far the market hasn’t paid a rate hike any thought. Last year the market didn’t sell off until after the FOMC Statement.

My Trades:

- Added 1 new long position to the portfolio yesterday.

- Covered my short hedge in Agilent Technologies (A) at 44.93 for a 3.5% loss.

- I will be increasing the stop-losses on my current and profitable long positions.

- I will look to add 1-2 new swing-trades to the portfolio today.

- I am currently 50% Long / 50% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.