Swing Trading Strategy: What a roller coaster – This is what they call the chop. The 10 year treasury yield simply won’t rally and again this morning you are looking at another drop in the rate. That of course has the futures again in a tale-spin. Yesterday, the market, rallied in impressive fashion, taking out

Swing Trading Strategy: Down, Up, Down. Up? Bernie Sanders is faltering big-time tonight, and to be honest, I thought Klobochar and Butt-Edge-Edge dropping out was too little too late, but apparently it was enough to give a boost to Biden and what looked just a couple of weeks ago to be a campaign on the

Swing Trading Strategy: Dead cat bounce or Buy the dip? You’re asking that question to yourself right now aren’t you? The price action today embodied that of a possible bottom in the market. I’m not overly confident that the bears are going to kill this market rally right away, but tomorrow will be a key

Swing Trading Strategy: One of the most helpful things that anybody can learn is to give up trying to catch the last eighth or the first. These are the most expensive eighths in the world. ~Jesse Livermore Perfectly timing bottoms or tops is insanely risky business and they usually come with a cost. I’m 100%

Swing Trading Strategy: Are you living to trade another day? I’ve shorted plenty, and I mean plenty of bear markets. Most of the time successfully. Look at my track record for Q4 in 2018 and I did quite well with that, and so far I’m doing pretty well with this one too. I’m profitable so

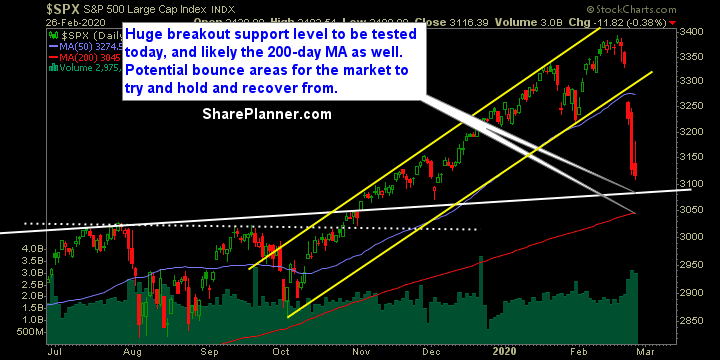

Swing Trading Strategy: I want to share with you, my notes that I shared with members of the Trading Block this morning, hoping it can be of some use for you as well… Another day where I am not putting any trade setups out there ahead of the market open. In a perfect world, I

Swing Trading Strategy: How am I now 100% cash!?! My two remaining long positions were stopped out – that stunk. Both were contained with AbbieVie (ABBV) being the worst at -6% and the other, Northrop Grumman losing -3%. But Short positions were straight fire – I covered United Parcel Service (UPS) for +10%, Caterpillar

Swing Trading Strategy: Holy cow what a crazy, freakin’ day! Granted, a 100 point sell-off on SPX is nothing like a 100 point sell-off back in January of 2018 when it was trading 500 points lower. However the impact that it has on the portfolio is still incredible. Most of my long positions over the

Swing Trading Strategy: The days of easy trading are but a distant memory now. This is why for the past month or so, I’ve been trying to add short exposure, gradually to the portfolio, and while it didn’t save me completely, it has certainly helped, but still some losses. Overall though, I was booking profits

Swing Trading Strategy: I took partial profits in a number of positions yesterday including +6% in Thor Industries (THO), +4% in Facebook (FB) and +5% in Coupa Software (COUP). I took a loss in my first foray into the crypto world by trading Grayscare Bitcoin Trust (GBTC). I think it could bounce here, but the overnight gaps and