Swing Trading Strategy: Bears getting bullish… Lots of rumors of long-term bears suddenly turning bullish on this market now and wanting to buy stock. They are feeling bold, a little cocky, and want to stroke their ego by getting bullish ahead of everyone else. Like that annoying friend who double dips his chip in the

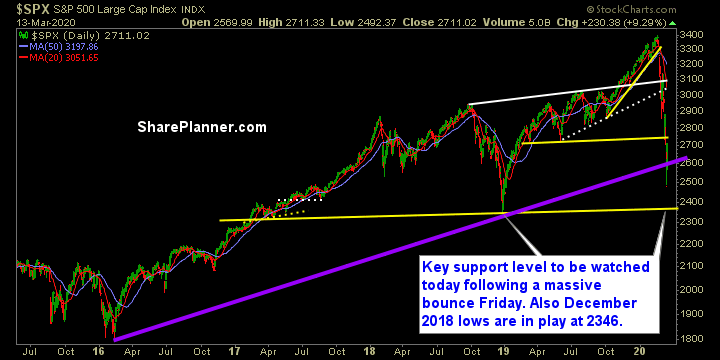

Swing Trading Strategy: Be careful of what you put your faith in… Before you do anything else – watch my video on the stock market and its outlook that I posted this weekend! It was a nice rebound for the market. S&P 500 rallied 143 points. Huge. I mean, even a 10 point rally would

Swing Trading Strategy: How low it goes, nobody knows… Before you do anything else – watch my video on the stock market and its outlook that I posted this weekend! Today’s price action was earth-shattering on every level. I mean, could you imagine back in November saying “The Dow is going to rally 3000 points

Swing Trading Strategy: When being in cash actually feels like a position… Before you do anything else – watch my video on the stock market and its outlook that I posted this weekend! That’s because it is! Cash is always a position, and right now, if you’re not short heading into the market open, which

Swing Trading Strategy: Is this the bottom… There are plenty of people out there that love to tell you that this is the bottom, or others who will say this is a temporary relief rally, aka ‘dead cat bounce’. But in all honesty – none of them know, or have any ability to know for

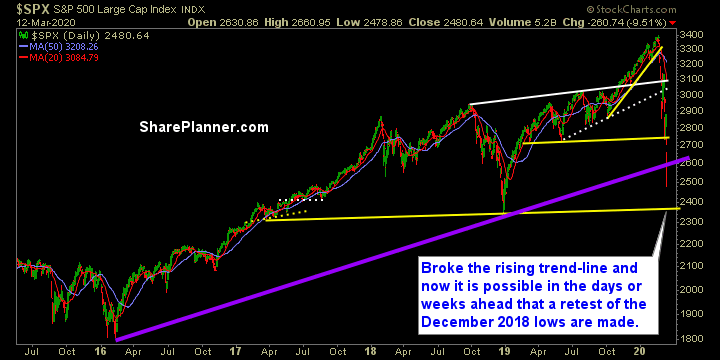

Swing Trading Strategy: Where Panic sets in… Hitting levels all throughout this week that seemed like a bounce was near, and the following a Presidential prime time address that the market puked all over, the futs are limiting down in pre-market action and stocks look to bathe in the blood of investors. Today has the

Swing Trading Strategy: Another one-day rally? Shaken out early on with my positions I carried over from yesterday, but managed to quickly jump back in like a chicken with his head cut off and capture the profits in those positions – so I am happy about that. What tipped me off was the shakeout early

Swing Trading Strategy: Tell me more about these ‘limit downs’? So President Trump has a press conference, says some good feeling things, the market rallies, now, what if, and bear with me a second, what if we limit up tomorrow? The market is 20% off of its all-time highs, and you’re telling me you’ll

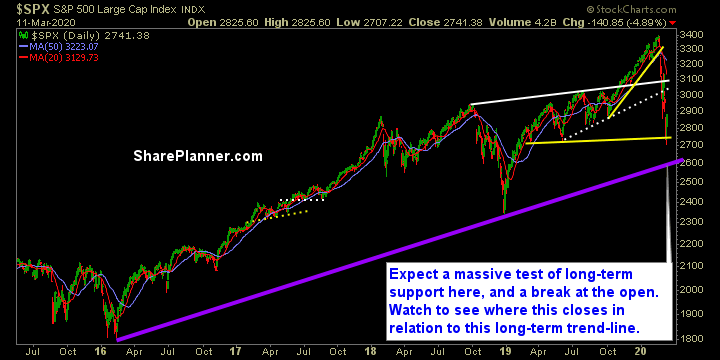

Swing Trading Strategy: A scary market indeed! These are by far uncertain times for the stock market, bond market, currency markets, let me think, what else? Oh yes, commodities too. Have you seen oil prices crashing tonight? Down -32%! DOWN 32%, I say!!! While Coronavirus has had an impact on oil, this has more to

Swing Trading Strategy: Oh the places the stock market will take you. For those who are just starting out in the stock market for the first time, you are witnessing some of the most volatile trading days that you’ll ever experience. You certainly can learn a lot from market turbulence like this. I’ve done it