Swing Trading Strategy:

Dead cat bounce or Buy the dip?

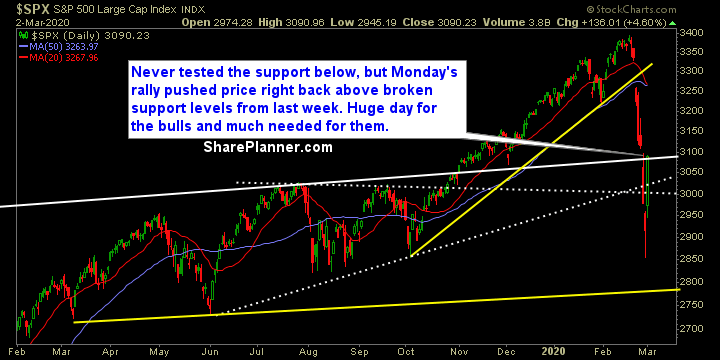

You’re asking that question to yourself right now aren’t you? The price action today embodied that of a possible bottom in the market. I’m not overly confident that the bears are going to kill this market rally right away, but tomorrow will be a key day for the bulls. I don’t necessarily expect as much buying as we did today, but even if we get a tenth of what we saw today, it would still be a good sign for the market.

I added two new long positions to the portfolio. I’m not digging myself out of the trenches like a lot of other traders and investors are having to currently do, following last week’s stock market crash. Instead I am building my portfolio that is already at all-time highs and remains there. I’ll add more positions tomorrow, if this rally can hold, and if it can’t, then my exposure to another market sell-off is minimal. I don’t have to know what this market is going to do, nor do I care to. I just manage the freakin’ risk and that is all you should concern yourself with too.

Indicators

- Volatility Index (VIX) – The index got taken to the cleaners today. Down 17% to 33.42. Way off of its almost 50 reading from Friday.

- T2108 (% of stocks trading above their 40-day moving average): A 63% rally in the indicator – strong move and typical of a temporary bottom. Out of the single digits and up to 11%.

- Moving averages (SPX): Back above the shortest and longest moving averages – the 5-day and 200-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Still blown away that the top three sectors of a +130 point rally on SPX was Utilities, Staples and Real Estate. If this rally is to continue into tomorrow, there will be plenty of opportunity in Technology, Industrials and Discretionary. They lagged the market rally today, which I find absolutely mind blowing.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.