Swing Trading Strategy:

Holy cow what a crazy, freakin’ day! Granted, a 100 point sell-off on SPX is nothing like a 100 point sell-off back in January of 2018 when it was trading 500 points lower. However the impact that it has on the portfolio is still incredible. Most of my long positions over the last two trading sessions where the SPX has dropped over 135 points, has been either stopped out or closed out by choice.

I closed out one of my longest positions back on Friday, Restoration Holdings (RH) for a +9% profit, only to be thwarted by a +12% profit in Etsy (ETSY). Additional positions include: Home Depot (HD) for +8%, Square (SQ) for +9%, Ulta Beauty (ULTA) for +5%, +4% in Switch (SWCH), covered a portion of my United Parcel Services (UPS) for +5%, +6% in Tesla (TSLA), and in Caterpillar (CAT) for a +3% profit.

So plenty of profits, but they were also some losses too, but but the winners won out in the end. The losses were manageable and small, except for Zuora (ZUO) which gapped a couple percent below my stop loss for a 7% loss. Others were small losses in Visa (V), Facebook (FB), Fastenal (FAST), and Uber Technologies (UBER).

Indicators

- Volatility Index (VIX) – Finished up 47% on the day. A wild day for the indicator, and not something you normally see. It was the highest reading since January 3rd of last year. The is a strong tendency for years now, for the VIX to see every spike higher quickly sold, and that could be the case again tomorrow.

- T2108 (% of stocks trading above their 40-day moving average): The lowest reading since October of last year. The reading on this indicator are not extreme until there is a breach below 20.

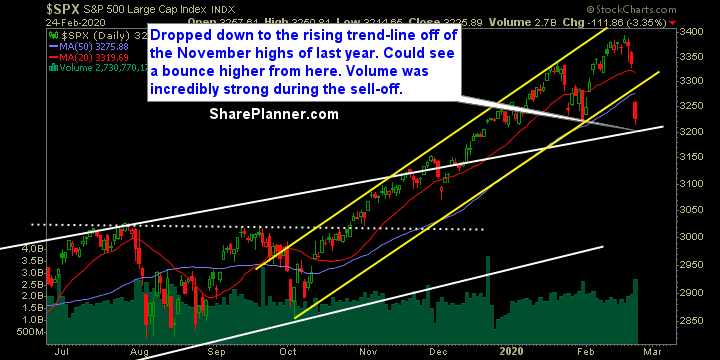

- Moving averages (SPX): Gapped and currently trading below the 20-day and 50-day moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

There wasn’t a single sector that was spared the wrath of today’s market sell-off. Utilities interest me quite a bit because it has found support at the January highs where it consolidated for a couple of weeks. Could certainly bounce higher from here. Triple top pattern confirmed on Staples. Double top in Inudstrials. Materials have almost pulled back to its rising trend-line off of the December lows. Financials broke below its January lows as did Discretionary. Most notable was Energy Breaking below its December lows, and it could get really ugly there.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

The percentage amount for your stop-losses and where to put them at when trading the stock market can be very difficult to determine. In this podcast episode, Ryan talks about times when it works using tight stop-losses versus very wide stop-losses and the tricks that you can use to narrow the stop-loss even further.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.