Swing Trading Strategy:

I took partial profits in a number of positions yesterday including +6% in Thor Industries (THO), +4% in Facebook (FB) and +5% in Coupa Software (COUP). I took a loss in my first foray into the crypto world by trading Grayscare Bitcoin Trust (GBTC). I think it could bounce here, but the overnight gaps and how close it was to my stop-loss didn’t make it worth me holding. I did add another long position to the portfolio and I have

Indicators

- Volatility Index (VIX) – VIX managed to pop a good deal, over 8% yesterday, but well off the overall highs of the day when it gave up about 2/3’s of its overall gains on the day before the close. Downtrend off of the December 2018 highs were in play and the rejected price.

- T2108 (% of stocks trading above their 40-day moving average): Such an odd divergence and reason why I actually added a long position yesterday was the fact that T2108 rose 4%, despite SPX being down 13 points. A bullish divergence there.

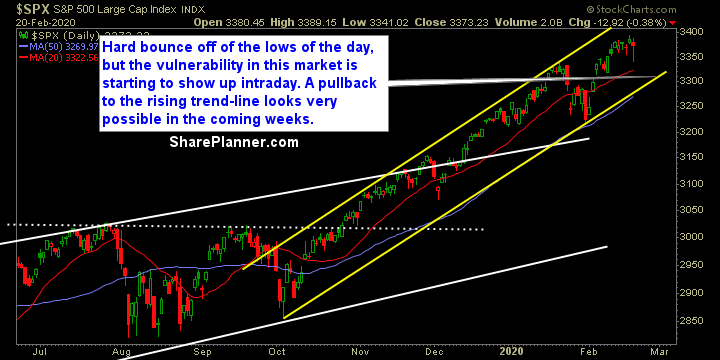

- Moving averages (SPX): Broke below the 5-day moving average and likely to open below the 10-day MA today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Real Estate, Utilities, and Financials were the big winners yesterday, while Technology took the lion’s share of the selling. Real Estate’s rebound was huge, while I would continue to remain clear of Energy and Materials.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode, Ryan examines one swing trader's disaster of a trade in Robinhood (HOOD) and the problems that come with not managing the trade and managing the risk in every swing trade that one takes.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.