Swing Trading Strategy:

One of the most helpful things that anybody can learn is to give up trying to catch the last eighth or the first. These are the most expensive eighths in the world. ~Jesse Livermore

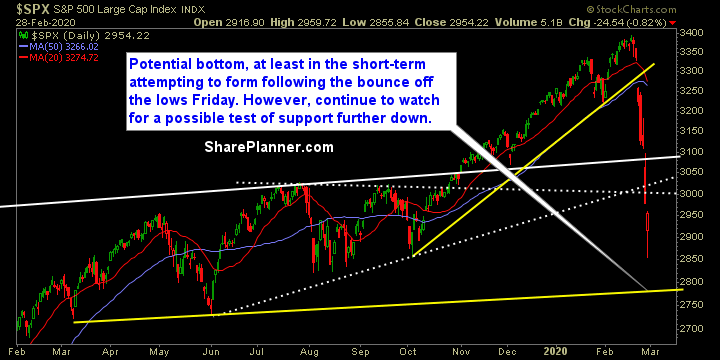

Perfectly timing bottoms or tops is insanely risky business and they usually come with a cost. I’m 100% cash right now, and yeah, it felt lonely missing out on that rally in the last 14 minutes of trading on Friday, but I don’t regret it one bit. After watching the Sunday night futures open up and the Banana Republic action that has ensued since, confirms that I made the right decision. Shorting at this juncture is incredibly risky business as the market is due for a bounce, and I have no intention being caught on the wrong side of that trade. For now, I will continue to focus my efforts on the long side of the trade, and to get long incrementally when the market conditions are more more favorable for doing so.

Indicators

- Volatility Index (VIX) – Most of the gains for the VIX on Friday were lost. It reached a high of 49.48, and came within a breath of taking out the highs of February 6, 2018 highs, which would have been all around amazing in its own right. However, it pulled off 20% off the highs, and creates a little bit of a shooting star pattern going forward.

- T2108 (% of stocks trading above their 40-day moving average): At massive extremes – hitting 5% at the lows and settled at 7%. Declined 25% over all, and a nice hammer candle has formed. Potential bottom candle, but still a very high risk trade for the broader market. December 2018 reached 3%.

- Moving averages (SPX): Still trading below all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy and Technology on Friday led the market higher. It was impressive reverses for the sectors, while the defensive sectors were the most bearish all day long, which indicates that investors may be warming up to the idea of taking on some new risk.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.