Swing Trading Strategy:

How am I now 100% cash!?!

My two remaining long positions were stopped out – that stunk. Both were contained with AbbieVie (ABBV) being the worst at -6% and the other, Northrop Grumman losing -3%. But Short positions were straight fire – I covered United Parcel Service (UPS) for +10%, Caterpillar for +5%, Walt Disney (DIS) +7%, Discover Financial (DFS) +5%, and CarGurus (CARG) for +3%.

That has me 100% cash. Here’s the thing when you are shorting the market you are fighting all the governments and market forces that are predisposed to drive it higher. 2000 points on the Dow and more than 200 points on SPX in just a couple of days, I’m not going to push my hand any further and will get completely out. If the market had only dropped 20 or 30 points instead, I’d still be in, but at this point, the market is priming for a hard bounce, even if the coronavirus remains on the forefront. When it does, play the bounce then short the next leg down.

That is what I’ll attempt to do.

Indicators

- Volatility Index (VIX) – I wasn’t too sure how much higher it could climb, but it managed to run 11% more today and even breach 30 at one point, to close at 27.85. I think the market is setting up for a bounce in equities, even if it is short-lived, so this index is prime to get knocked down again.

- T2108 (% of stocks trading above their 40-day moving average): A 38% move all the way down to 21%. That is the lowest closing reading since January 4th of last year. Starting to hit extreme levels, but could even drift lower if need be.

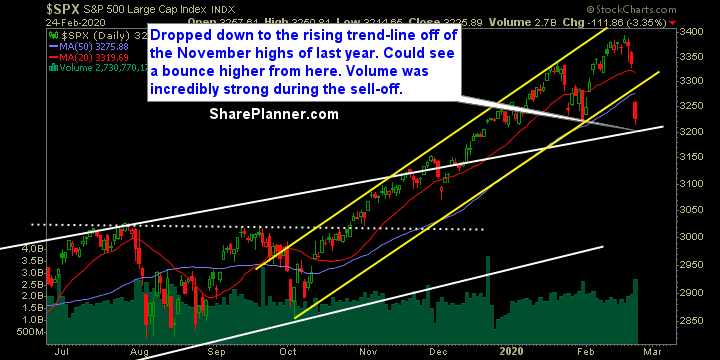

- Moving averages (SPX): Another sell-off like today, and you’ll have the market testing the 200-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Industrials unseated Energy as the worst sector today, and in the process broke through the 200-day moving average. This has been a huge bounce area the last six times it has been tested, so it could easily see a push back higher tomorrow. Energy sector as a whole is at its lowest levels since April of 2015. Financials haven given up all of its gains since November, while Real Estate finally buckled and broke the rising uptrend from the December lows. Discretionary testing key support going back to the May highs of last year.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.