Swing Trading Strategy:

Are you living to trade another day?

I’ve shorted plenty, and I mean plenty of bear markets. Most of the time successfully. Look at my track record for Q4 in 2018 and I did quite well with that, and so far I’m doing pretty well with this one too. I’m profitable so far in February, and expect to be at the end of tomorrow, I was profitable in January, and both months the market finished lower (assuming we don’t have the mother of all rallies tomorrow to finish green for the month).

I’m not even looking at short setups right now – that’s totally foolish to be looking at short setups at this juncture – the risk reward is nuts. Now my focus has turned to the bounce plays. Not sure when it will happen, but it doesn’t hurt, when there is strong potential for one, to put a small amount of capital to work. I tried today, and quickly got out, when it was obvious this market wanted nothing to do with it. However, that doesn’t deter me from trying and at some point, there is going to be a snap-back rally as there always is, and the profit potential will be phenomenal. I have my doubts it will be tomorrow as people will be hesitant to get long ahead of a weekend with this corona virus, but on Monday, the first trading day of the month, I could totally see the market rallying then.

Indicators

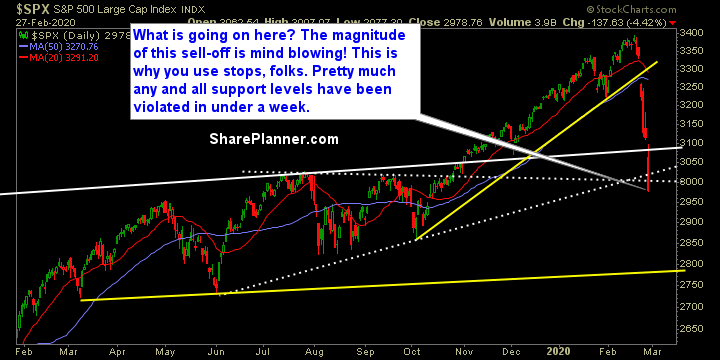

- Volatility Index (VIX) – VIX closed at its highest level since August 24, 2015. Today it went up 42% and up over 129% this week alone! at some point there is going to be a crush in volatility,

- T2108 (% of stocks trading above their 40-day moving average): A 50% drop in this indicator takes it all the way into the rare single digits where it settled at 9.35%. This is the area where you tend to see strong bounces at because the selling pressures become exasperated.

- Moving averages (SPX): Sliced below the 200-day moving average like butter and now trading below all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Real Estate, I kid you not was trading at all time highs at the end of last week. Now it is trading below all of its gains going back to September 3rd. You can’t make this stuff up. Energy is in complete free fall, and at levels that hasn’t been seen since early 2016. No sector has been spared, and they all look like a dumpster fire.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.