Technical Analysis:

- Another “sell-off” that was hardly a sell-off on Friday, where price basically stood still.

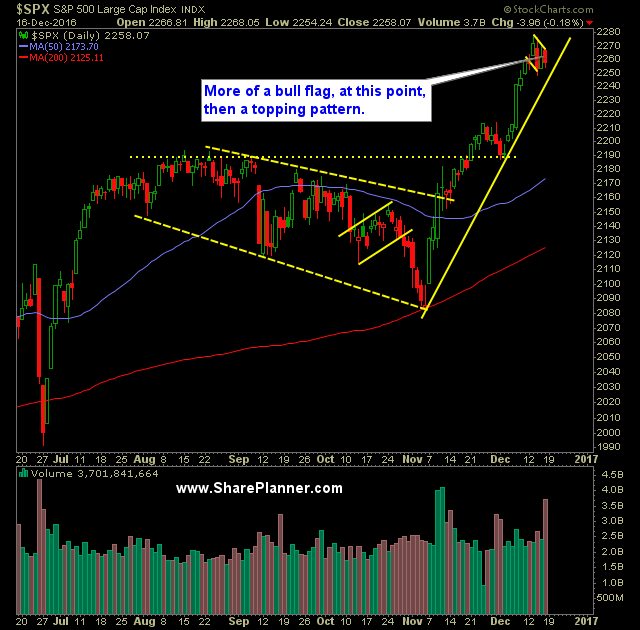

- Right now, it is more likely that the bulls are alleviating overbought conditions through “time” rather than “price”.

- The steep rising uptrend on S&P 500 (SPX) could possibly be tested today at 2252.

- The only rising uptrend that has been broken at this point is on the Russell 2000 (RUT). All other indices remain intact. Nasdaq (COMPQ) has the most sustainable trend-line as its slope is much “flatter”.

- CBOE Market Volatility Index (VIX) wiped out most of last week’s gains. The weekly chart of VIX shows just how much the bears continue to pounce on all the gains the VIX puts forth.

- SPDRs S&P 500 (SPY) saw an increase in volume, and the highest since the two days following the election results. Much of this is likely due to it being quadruple witching. Overall the volume was about double the recent averages.

- There is still 70% of stocks trading above their 40-day moving average according to the T2108.

- SPX closed below the 5-day moving average for the second time in the past three trading sessions.

- If the market is to continue rallying here, it wont’ be at the same clip it has been doing it at since the election results came in.

- Rounded top is forming on the SPX 30 minute chart.

- A lot of bullishness is forming on the oil plays, and many of the individual stocks could be in play for a nice breakout today.

- $53-4 price area continues to provide some degree of resistance for the bulls pertaining to Light Sweet Crude Oil (/CL).

- Very little in the way of ground breaking news that will hit the market between now and year end.

- This time of year, people start anticipating a “Santa Rally” from the market but if you recall last year, that rally never came, in fact, the entire rally was marked by a great deal of selling.

My Trades:

- I did not close any of my positions on Friday.

- I did not add any new positions to the portfolio on Friday.

- I will look to add 1-2 new swing-trades to the portfolio today.

- I am currently 10% Long / 20% Short / 70% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.