Technical Outlook:

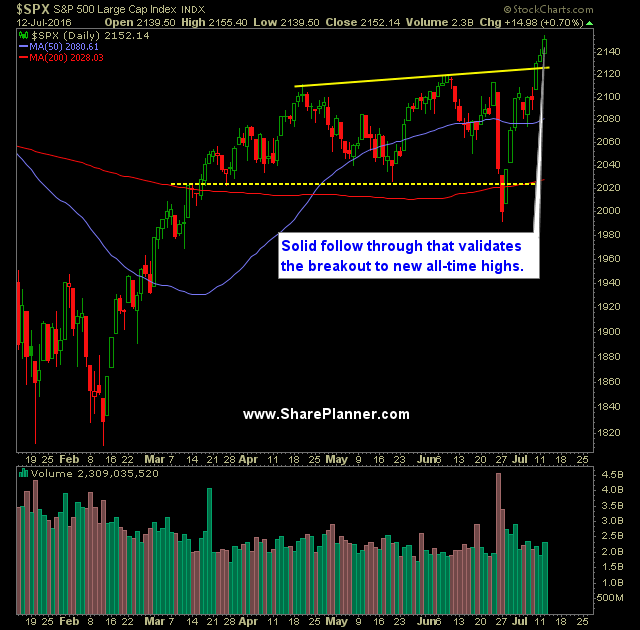

- SPX continues its epic rise yesterday, now up 160+ points in the last ten trading sessions.

- VIX prior to this week, had dropped 8 out of 9 trading sessions down to key support in the lower 13’s. Last two days the VIX has refused to drop lower despite the market rallying hard during these two days. See exactly how the VIX keeps managing to find key support here.

- T2108 (% of stocks trading above their 40-day moving average) finally established a higher-high, rising 13.5% to 78%.

- Strong increase in volume yesterday on SPY, and coming in at recent averages.

- SPX exhibited a great deal of follow through yesterday following Monday’s new higher-highs.

- There is a great deal of bullishness to this market right now despite the prevalent amount of worry. It has been over two years since the market has actually seen a legitimate rally and so it wouldn’t be surprising to see this market continue its current trend higher as shorts are forced to face the new reality of the market.

- In the very near term, the market is getting stretched, so some profit taking could be in store, though I don’t expect it to be enough to drag prices significantly lower.

- One catalyst that the bears could have in their favor is if Q2 earnings come up short.

- Dow Jones Industrial joined the record highs parade by closing at new record highs yesterday. The Russell and Nasdaq still have a significant way to go before doing so themselves.

- Oil bounced hard yesterday.

- At this point, I would track the market as it continues to make new highs against the 5-day moving average. There may be some short squeezing still as the shorts have their stops run above all-time highs and it will provide a good short-term reading on the strength of the market.

- Mondday marked the fourth consecutive year that SPX make a new all-time high, going back to 2013.

- At this point, it can be said that the market is climbing the “Wall-of-Worry”.

- Market is assuming that rate hikes are pretty much off the table for all of 2016.

My Trades:

- Added one new long swing position to the portfolio yesterday.

- Did not close out any swing-trades yesterday.

- Will look to add 1-2 new long positions today.

- Currently 40% Long / 60% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.