The Fed Up Rally Takes Price Back to Almost All-Time Highs

Of couse I am using a play on words as this Fed Up Trump Rally is hated and despised by most and defies the logic of investing in general. I mean, c’mon it has been since last October – almost a half of a year, since we last had a sell-off in excess of 1%. In my trading life time, I’ve never seen such a thing. Quite amazing really.

Do I think we’ll go this whole year without such a pullback? No. There will be a pullback and there will be a point at which this rally is completely called into question and doubted by the media and masses as a whole.

But for now, the play is to continue trading this Fed Up Trump Rally. Short plays are likely to lose you money (thought not on my recent American Airlines (AAL) trade), and the long positions are likely to be more forgiving than what you expect them to be. However, We are only working with knowledge and understanding up to the moment. At any point everything can change and that is when you’ll want to find yourself managing risk all along. It always happens and will happen again. Just always be one step ahead of the crowd.

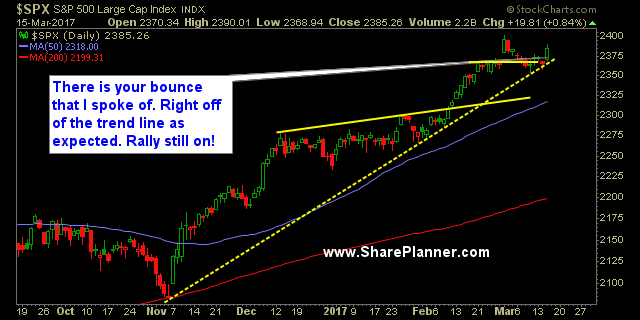

S&P 500 Chart

Current Stock Trading Portfolio Balance:

- 5 long positions

Recent Stock Trade Notables:

- American Airlines (AAL): Short at 44.76, Closed at 44.03 for a 1.6% profit.

- UPRO (Day-Tade): Long at 95.35, closed at 96.50 for a 1.2% profit.

- OZRK: Long at $56.12, closed at $54.69 for a 2.5% loss.

- FNSR: Long at $34.25, closed at 34.70 for a 1.3% profit.

- UPRO (Day-Tade): Long at 96.92, closed at 98.03 for a 1.2% profit.

- JP Morgan Chase (JPM): Long at 87.21, closed at 89.67 for a 2.8% profit.

- Chevron (CVX): Short at 110.03, covered at 111.85 for a 1.6% loss.

- Flex Technologies (FLEX): Long at $15.62, closed at $16.57 for a 6.1% profit.

- Baidu (BIDU): Long at $174.70, closed at $187.00 for a 7.0% profit.

- Ollie’s Bargain Outlet: Long at 33.20, closed at $32.50 for a 2.1% loss.

- Corning (GLW): Long at $26.98, closed at $27.45 for a 1.7% profit.

- Illinois Tool Works (ITW): Long at $127.74, closed at $129.86 for a 1.7% profit.

- Marriott Int’l (MAR): Long at $86.16, closed at $87.51 for a 1.6% profit.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.