Buy the dip in semiconductor stock? Semiconductor stocks have plummeted over the past month. Is it now time to buy the dip in semiconductor stocks like Nvidia (NVDA) and Advanced Micro Devices (AMD), among others? In this video I discuss the potential for a bounce within semiconductor stocks and the SMH ETF as well as

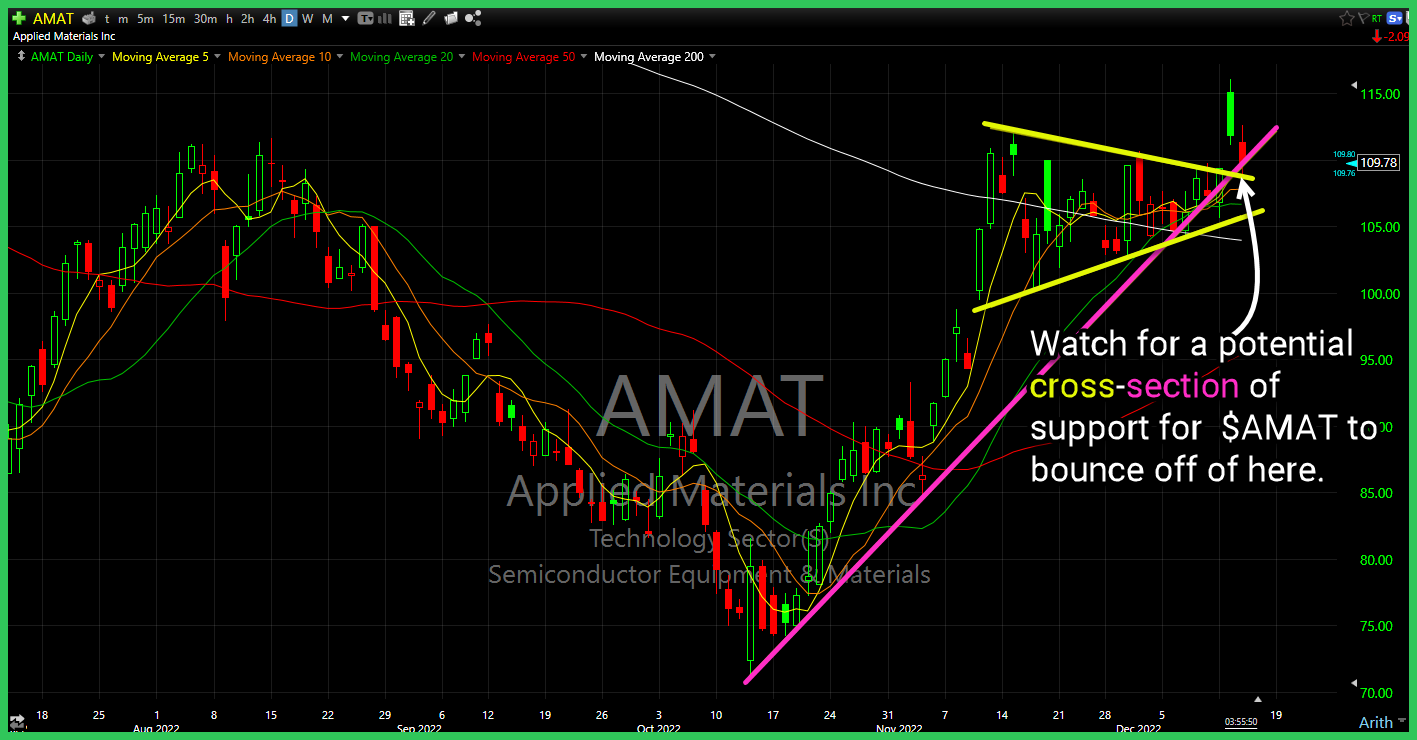

CBOE Market Volatility Index (VIX) Inverse head and shoulders basing pattern forming that is worth watching for a potential breakout next week. Applied Materials (AMAT) attempting to break out of the bull flag and re-confirm the inverse head and shoulders pattern. Semiconductor ETF (SMH) testing support that if broken would confirm a short-term

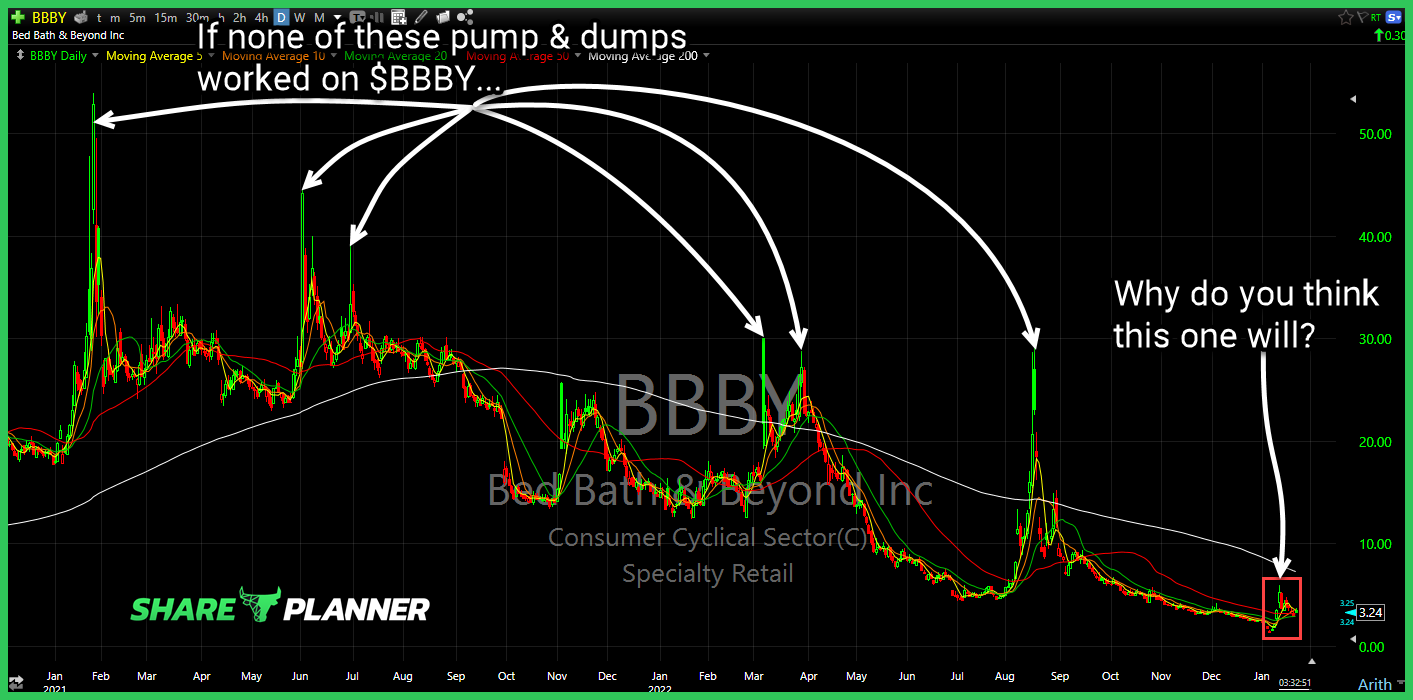

Bed Bath & Beyond (BBBY) its like they never learn their lesson... Alphabet (GOOGL) struggling some to break through the declining trend-line from last February. Petco Health and Wellness (WOOF) with a strong basing pattern brewing and nearing a break out here. High risk/high reward scenario. Some consolidation today following Nvidia (NVDA) breakout

Watch for a potential cross -section of support for Applied Materials (AMAT) to bounce off of here. Nice cross-section of support for Garmin (GRMN) if it can bounce off of it in the coming days. Moderna (MRNA) finally pushing through major resistance. Walt Disney (DIS) with five straight days of gains, but even

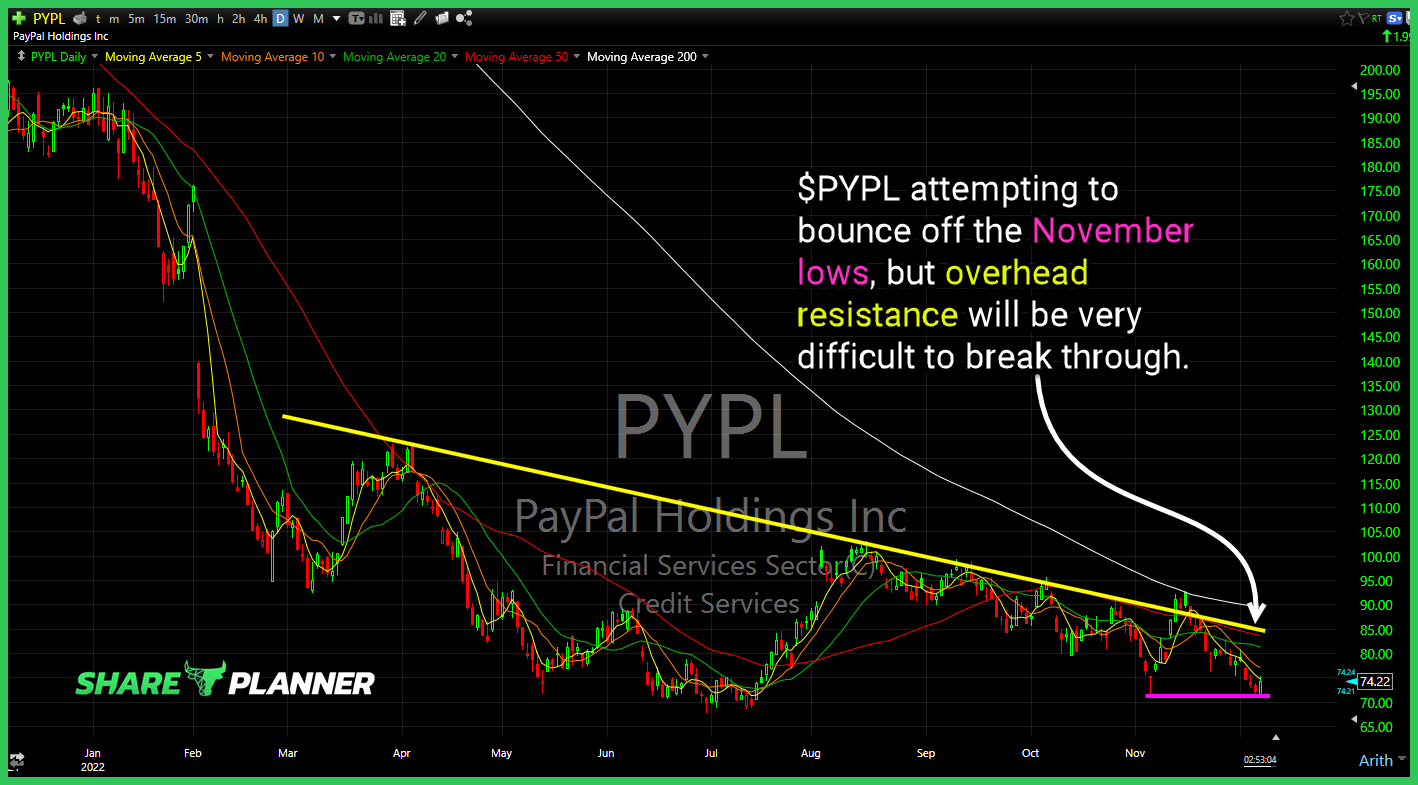

PayPal (PYPL) attempting to bounce off the November lows, but overhead resistance will be very difficult to break through. Applied Materials (AMAT) Watch the triangle pattern here for a potential breakout as it attempts to bounce off of the rising trend-line. Bear flag confirmed on Western Digital (WDC) Utilities (XLU) solid uptrend remains

TripAdvisor (TRIP) testing some major resistance, I'm watching to see whether or not it can break through this time. Herc (HRI) looks great, but the 50-day moving average could see a price rejection. Applied Materials (AMAT) testing resistance but seeing some pushback. Builders FirstSource (BLDR) with a potential head and shoulders pattern that

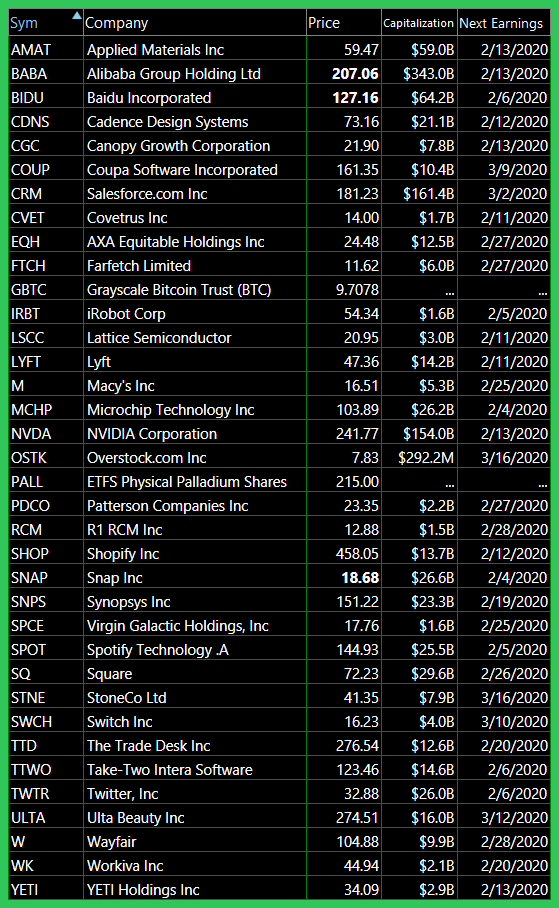

The Bulls Are Finding Solace in China’s Market Manipulating Tactics I can’t say that I am, though I have been rather quiet on the trading front today, I did manage to take a flier on a few trades like I am certainly benefiting from today’s action with Sqaure (SQ) rally +6%, and Smartsheet (SMAR) rallying +4%,

With SPX gaping down over 50 points this morning, there was no way the bulls wouldn’t buy the dip. To not do so, meant they would have to throw the towel in on this rally that has pushed higher incessantly since October. To not buy the dip means they would have to raise cash, and

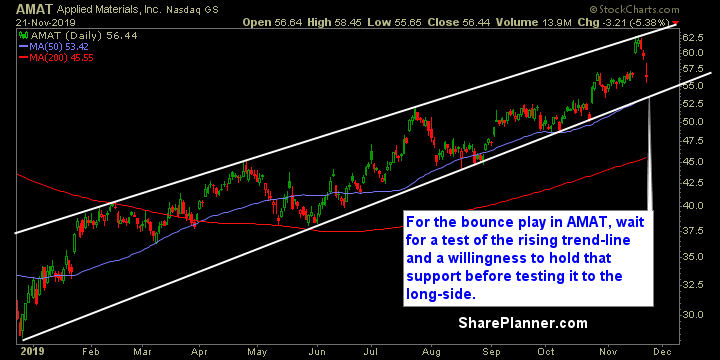

Friday’s Swing-Trades: AMAT, COP and ULTA Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Applied Materials (AMAT)

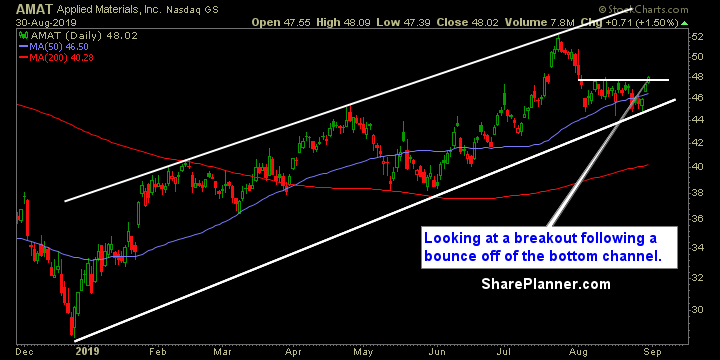

Monday’s Swing-Trades: AMAT, WDC and SEE Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Applied Materials (AMAT)