Energy already getting railroaded, while the only industry that really matters is semiconductors.

Energy not to shabby here. Showing a lot of momentum and it's still building.

Semis and Energy are holding firm to this market. Healthcare and real estate trying to make a play here, but I'm not sure it lasts.

Energy showing some life, perhaps new leadership from Real Estate?

SMH already starting to weaken again, and nothing at all to like about energy right now.

Episode Overview What should you look for when examining your past swing trades and what should you consider when looking into whether the trade was a well managed swing trade or not. Plus Ryan talks about some of the key signals for getting out of a profitable trade. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube

Episode Overview Ryan goes over one listener's swing trading journey, analyzes the trading strategy being employed, and answers questions on everything from short squeezes and short floats to insider and institutional buying and sector rotations. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by explaining why he

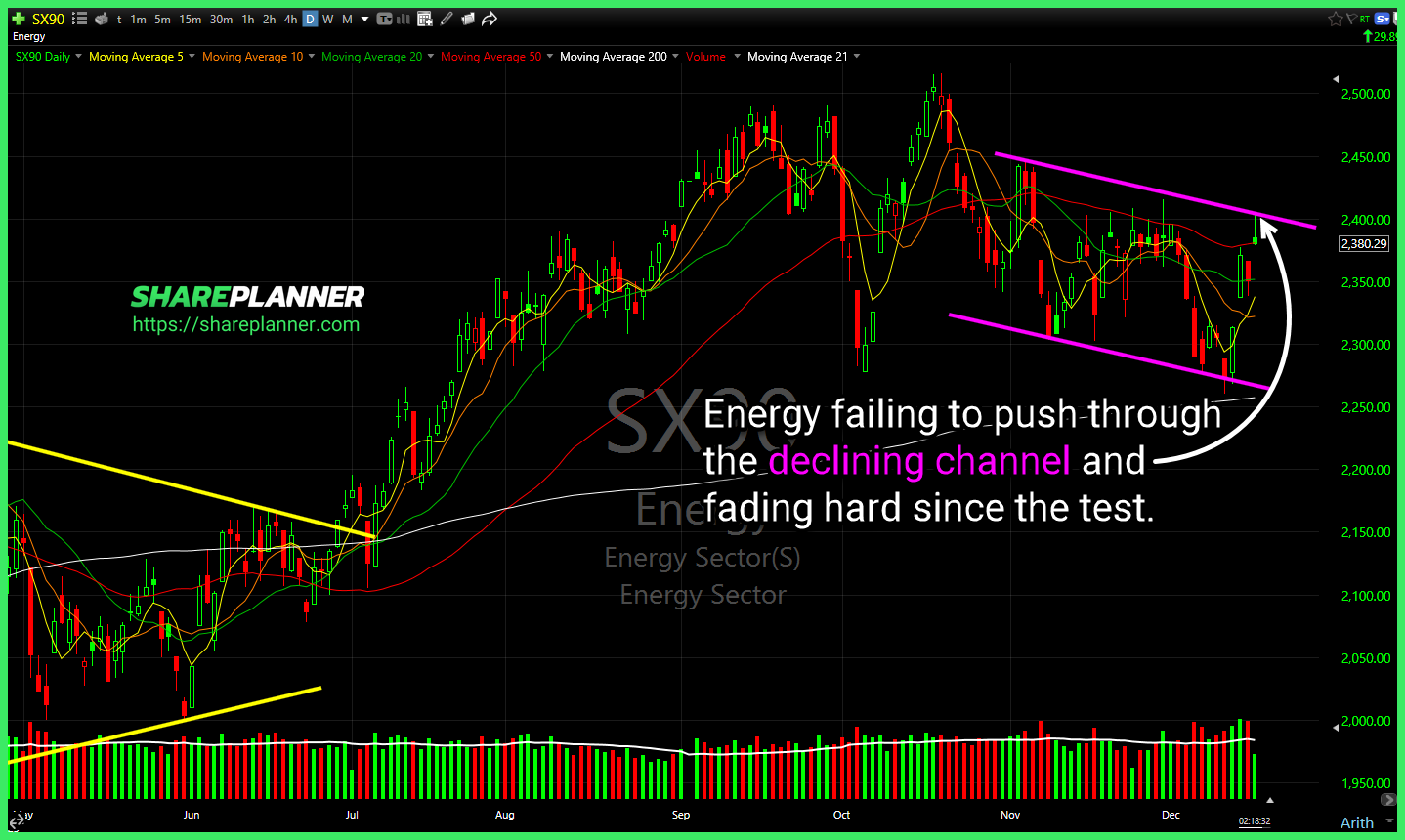

Energy $XLE has the potential to shine here if it can break out of this declining channel. Some much needed consolidation this week. . $XLB tight and well constructed bear flag in the materials sector and toying with a confirmation over the past couple of weeks. $ALB huge support going back to November, with bounces

Energy sector failing to push through the declining channel. $XLE $GPCR these days there's no limits to what the bulls won't go to, to buy the dip. This time off of a -50% push lower & bounce off the rising trend-line. Gap and crap on $NIO following the gap higher. Watch to see here whether