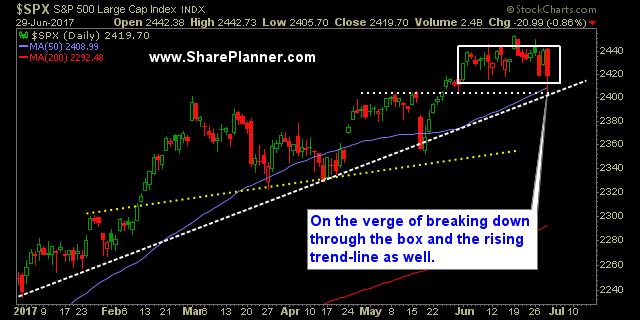

My Swing Trading Approach I closed out my one long position early on Tesla (TSLA) and added an additional short position before anything ran hard against. Yesterday proved to be a very profitable day, and will look to add more short positions today, if the market has more downside in the cards.

It’s August (already!) and historically that is a bearish month for the stock market. There tends to be more sudden and swift sell-offs then what traders are used to seeing, and the last legitimate pullback in this market was in 2011, during the month of….you got it, August!

Bears, man! WHERE DID YOU GO!? Actually had the S&P 500 down about about 8-9 points lower at one point today, but that ended with a sharp buying spree that took price back up to just below breakeven. There’s no one out there to really push stocks substantially higher, but count on the bulls to

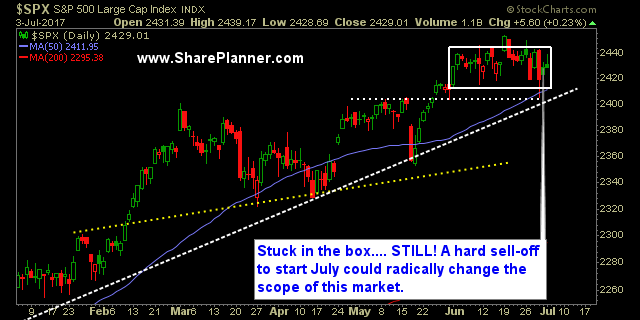

I suspect that the holiday volume will persist into the week. Anytime you have a week where there are only 3.5 trading sessions in total, you can expect that much of Wall Street will take the week off and enjoy an extended vacation.

Futures are surprisingly making a move in the premarket Whether it holds will be a whole other question. Gap highers tend to be shakey business of late. Even Friday, where the market was solid all day long, chose to sell off in the final 10 minutes of trading and wipe out about 80% of the

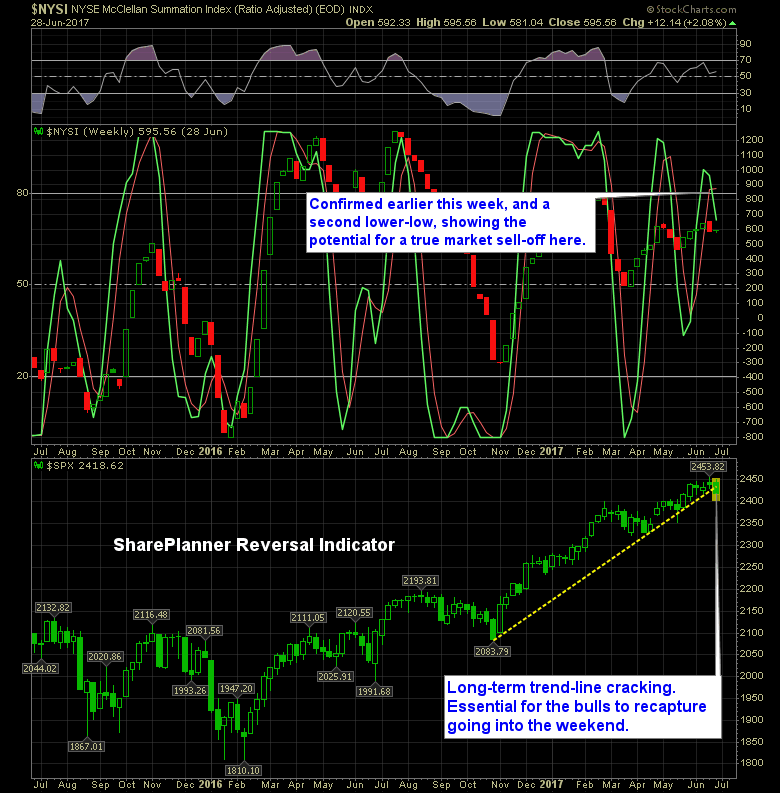

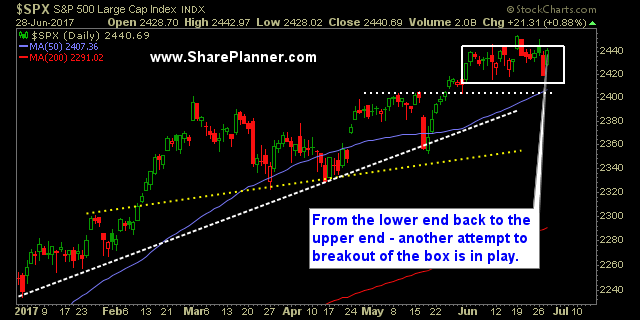

Stock market is on shaky ground That doesn't mean the market is simply going straight down from here - if it were only that easy. That's because, despite the sudden bearishness that has been prevalent throughout this week, there is still that pesky dip buying mentality of the stock market that won't let the 8

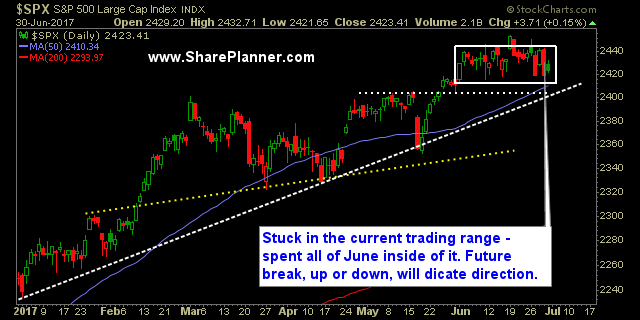

Forget the notion that the markets might be calm this week Or the idea that the markets might be engage in some friendly window dressing to close out the first half of the year. Because it has been anything but that. In fact, I would go on to say that it has been the most

Nasdaq selling off again, SPX flat The technology purge looks to resume again this morning, while most of the overnight gains have been lost by the large caps. This market is becoming a bit less predictable in the latter half of this month. yesterday's bounce looked reminiscent of the bounce following the May 17th sell-off,

I barely remember the sell-off that ‘alledgedly’ happened yesterday. People say that there was one, but I can’t take their word for certain. The buy-the-dip crowd would never allow such a thing. Don’t believe me? Take a look at the charts below – nothing ever happened yesterday. S&P 500 (SPY) Dip Buy Nasdaq (QQQ) Dip Buy

Buy Machines Continue to Bounce following One Day Sell-offs If the premarket is any sign of what looms for the market today, it will be yet another hard bounce following a one-day sell-off.