Current Megaphone Price Pattern Starting to Favor Bulls The bears are letting yet another opportunity to correct this market slip through their hands. It is quite astounding really. I mean, you have a solid opportunity with last Friday's sell-off to put the bulls against the ropes, and they do, but along the way, they let

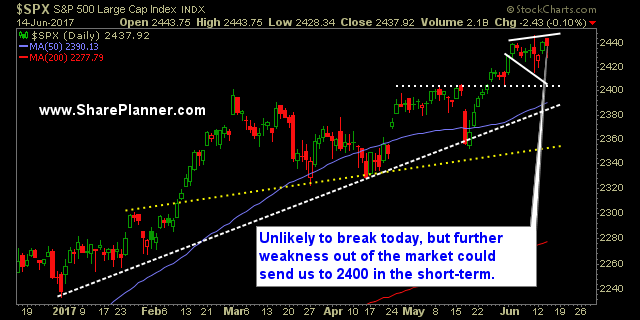

‘Hawkish Rate-Hike’ Gets the market in a tizzy But lets not kid ourselves, all this talk about a ‘hawkish rate hike’, whatever that means, probably gives the bulls another opportunity to by the dip. If the bears can pull it together today, it could be a very nice for their short positions. But it is

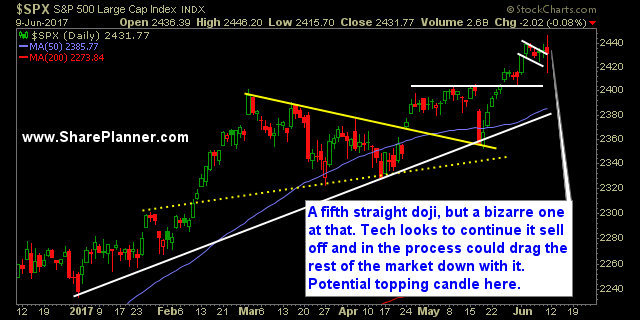

Inflection point: Let tech bust here or buy the dip once again. That is the choice the market has because what we saw on Friday with everything tech related being sold in a frenzy, made it seem like that suddenly, no one wanted to be in anything Nasdaq or tech related. Heck, did you

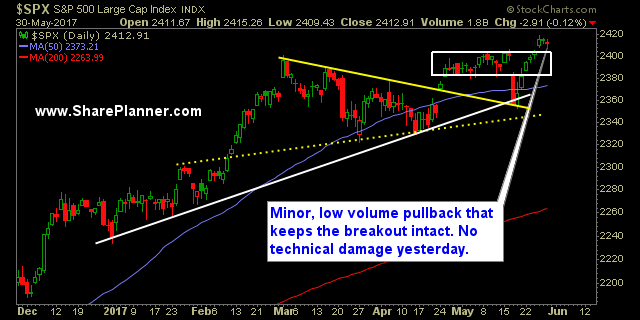

May was a good swing-trading month for me, but I’m ready for some volatility in June There was literally one day of trading in the month of May that showed the market still had a heartbeat to it still. Nonetheless, I managed to make it another profitable month of swing-trading as you can see the

Can the bears make something of this market… finally? I have been very quiet on the trading front today. I didn’t buy the dip, and so far it looks like that was the right play to make.

Instead of “Sell in May”, it is “Snooze in May” But more to the extent that the market is simply lacking the participants for big moves. There has only been one move so far this month that was in excess of 1%. But really, this market has been extremely flat since March. Nonetheless though, we

One last thought about bitcoin Okay, I want to go this whole week without mentioning bitcoin, crap I just mentioned it and even titled this post after it, so lets go ahead and throw that idea out the window, because it was over before it ever got started.

New All-Time Highs – Everything is fine…or should I worry? It is like the market is a sling-shot. Last Wednesday’s sell-off represents the moment where the sling gets pulled back, really hard, and the subsequent six days of buying in the market represents the market ‘letting go of the drawn sling and watching it propel

Bitcoins grow on trees Stocks rise for a fifth straight day. For sure though, the talk of the town is the metaphoric rise in crypto-currencies, i.e. Bitcoin. I’m literally sitting in a coffee shop yesterday going through my charts, and a random stranger starts asking me what I think about bitcoin. I tell him

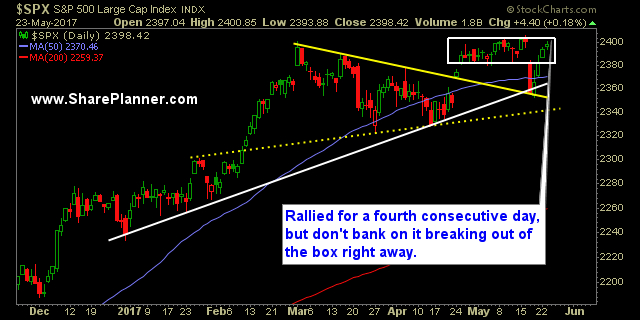

Back to the Dull Market Action Just as I was expecting, we are back to the market conditions that we saw prior to last Wednesday’s sell-off. The market has bounced hard off of those Wednesday’s lows and within four trading sessions, we are back inside of the box that price action has spent practically